Buy Sell Agreement Purchase With Credit Card In Middlesex

Description

Form popularity

FAQ

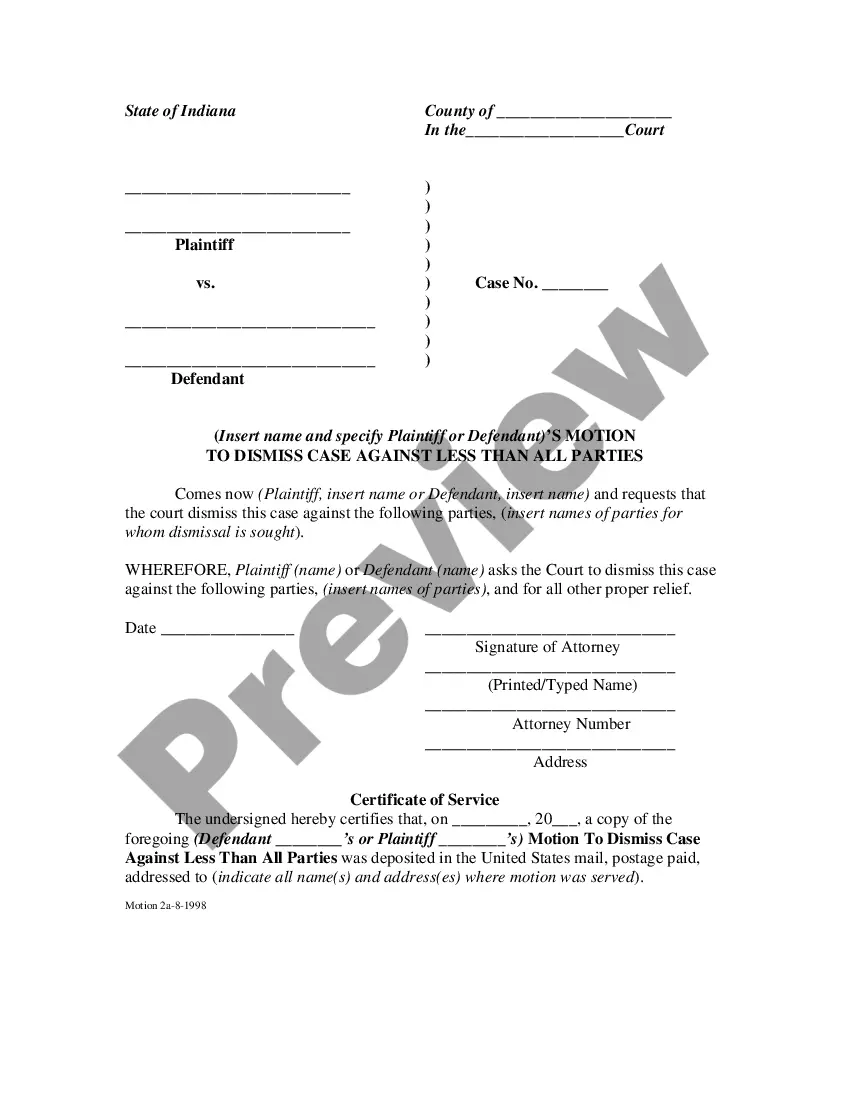

If you don't have a binding buy-sell agreement in place, your business is at risk. Without a clear succession plan, disputes can arise among partners—or their surviving spouses—that lead to loss of valuable time, increased expenses, and costly litigation.

While Shareholder Agreements might touch on provisions related to the transfer of shares or prohibiting transfers, a Buy-Sell Agreement is more specific and effective. It ensures that transitions are handled in a way that aligns with the owners' expectations and the business's financial stability.

Elements of a buy-sell agreement include: Any stakeholders, including partners or owners, and their current stake in the business' equity. Events that would trigger a buyout, such as death, disability, divorce, retirement, or bankruptcy. A recent business valuation.

sell agreement is a written contract between two or more owners of a business, or among owners of the business and the entity.

Trigger events will determine when your buy-sell agreement will come into play. Common circumstances include the death, disability, retirement or voluntary departure of a partner, but may extend to additional scenarios, such as divorce or individual bankruptcy.

In essence, a buy-sell agreement is a legally binding contract that stipulates how a partner's share of a business may be reassigned if that partner were to die or otherwise leave the business. Buy-sell agreements are commonly used by sole proprietors, closed corporations and partnerships.