Partnership Selling Examples In Contra Costa

Description

Form popularity

FAQ

A seller's permit is a state license that allows you to sell items at the wholesale or retail level and to issue resale certificates to suppliers. Issuing a resale certificate allows you to buy items you will sell in your business operations without paying amounts for tax to your suppliers.

How Long Is a Seller's Permit Valid in California? A California seller's permit remains valid as long as your business is actively engaged in selling or leasing taxable goods or services. There is no expiration date on the permit itself, and you are not required to renew it annually.

You must provide the following to receive a seller's permit: Your social security number (corporate officers excluded) Your date of birth. Your driver's license number, state ID number, or other ID (e.g., passport, military ID) Names and location of banks where you have an account. Names and addresses of suppliers.

If you fall into the category of businesses that plan to sell goods or products within the State of California, you will need to obtain a California Sales Tax Certificate Number (also called a Seller's Permit).

Where You're Based. Certain states, counties and localities have stricter regulations regarding who can sell online. For example, California requires you to register and have a seller's permit to sell on Etsy even before you make the first sale.

Is a seller's permit the same as an EIN? No, the IRS issues an EIN or (federal tax ID number), whereas a seller's permit is a tax ID that your state issues for local tax.

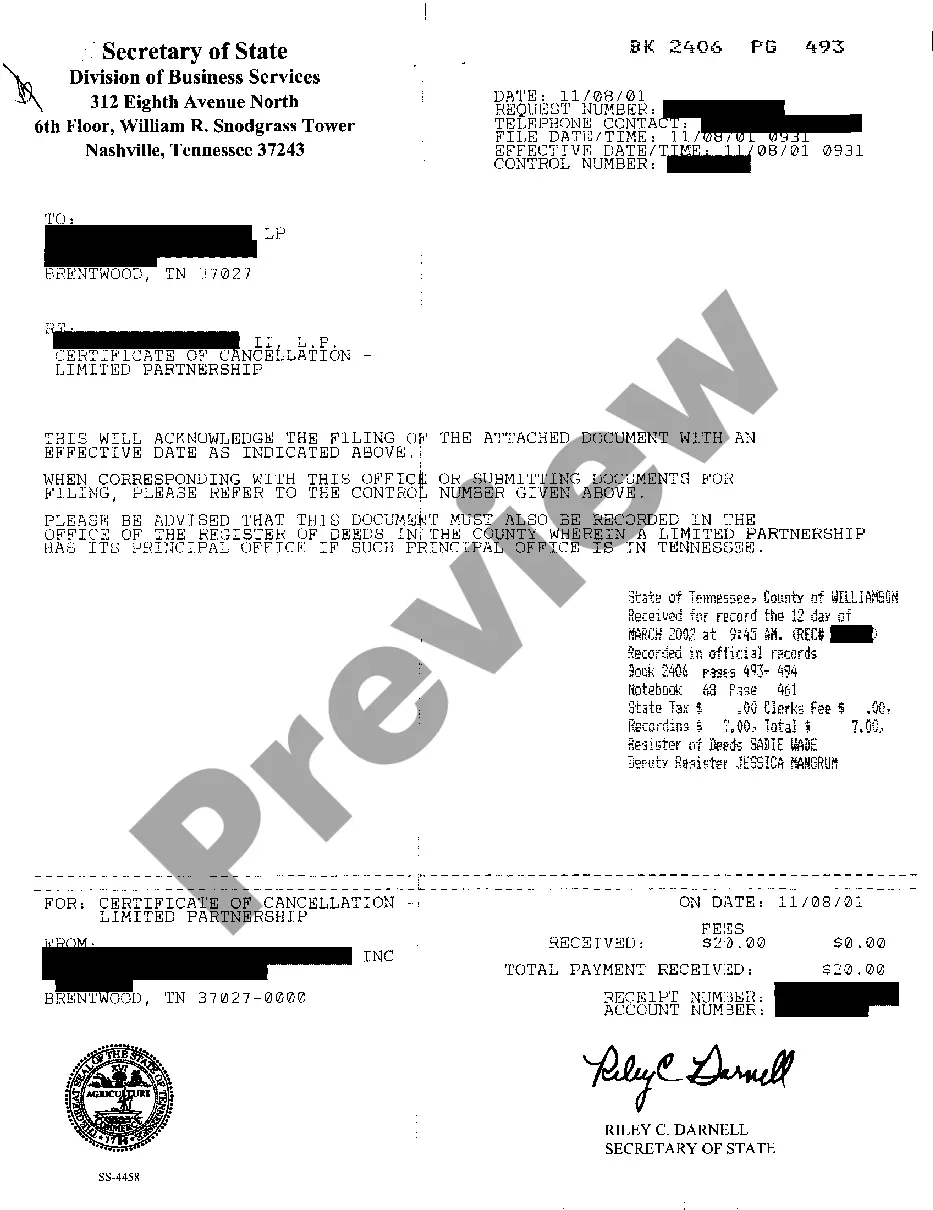

Kickstart your new business in minutes There are three relatively common partnership types: general partnership (GP), limited partnership (LP) and limited liability partnership (LLP). A fourth, the limited liability limited partnership (LLLP), is not recognized in all states.

There are four main types of business partnerships: Strategic alliances. Coopetition. Joint ventures. Buyer-supplier relationships.

4, there are 4 essential elements of partnership: That it is the result of an agreement, between two or more persons. That it is formed to carry on a business. That the persons concerned agree to share the profits of the business. That the business is to be carried on by all or any of them acting for all.

The Partnership Buyout Agreement Your path to an ownership sale will be simpler if you created a clear and thorough partnership buyout agreement when you started your company. The agreement should discuss what might lead to one of the partners wanting to sell her share and state the terms and timing that would apply.