Mobile Home Lien Release Form

Description

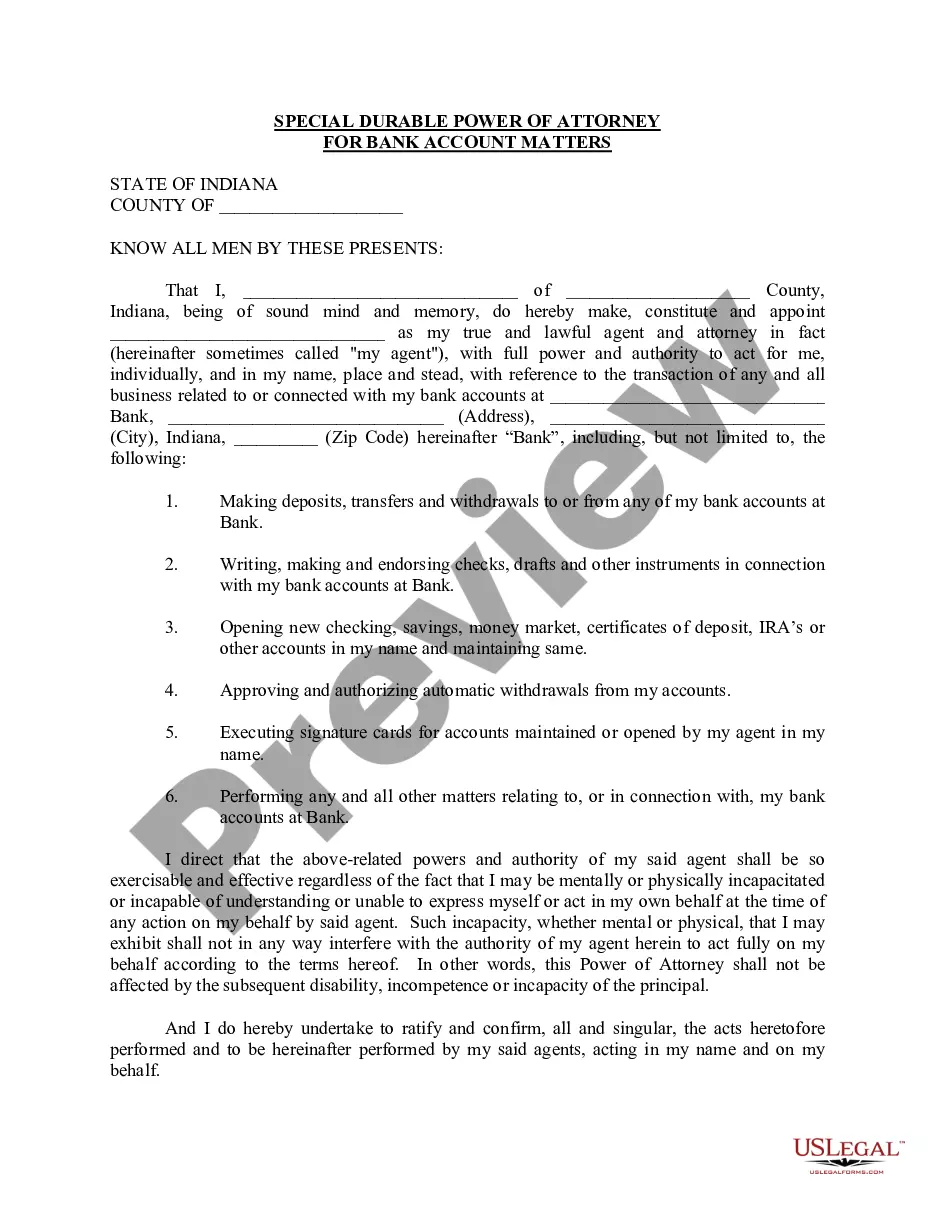

How to fill out Bill Of Sale Of Mobile Home With Or Without Existing Lien?

There's no longer any justification to squander hours searching for legal documents to satisfy your regional state requirements.

US Legal Forms has compiled all of them in one location and streamlined their accessibility.

Our platform offers over 85,000 templates for any business and individual legal circumstances classified by state and area of use.

Utilize the Search field above to find another sample if the previous one did not suit your needs.

- All forms are properly drafted and validated for legitimacy, so you can be confident in acquiring a current Mobile Home Lien Release Form.

- If you are acquainted with our service and already possess an account, you must verify your subscription is active before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all saved documents at any time by navigating to the My documents tab in your profile.

- If you've never used our service before, the process will require a few additional steps to complete.

- Here's how new users can locate the Mobile Home Lien Release Form in our library.

- Review the page content thoroughly to ensure it includes the sample you need.

- To assist with this, use the form description and preview options if available.

Form popularity

FAQ

A buyer cannot change their manufactured home from personal to real property unless they attach it to land they own or lease under a qualifying, long-term lease. They also need the approval of each lien holder and must place the lien holders' written consent on file with the TDHCA.

When applying, please have a copy of the Manufactured Home title certificate and a copy of the most recent real property tax receipt for the manufactured home. The fee for the detitle permit is $53. The home must also be affixed to the property.

To transfer the title, take your current Certificate of Title and a tax clearance form from the Treasurer of the county in which the mobile home was located which states that all the personal property mobile home taxes have been paid on the unit.

You fill out a T-234, submit it to the tax commissioner where the property is located, along with the title to the mobile home. The title gets retired with the State of Georgia, and now the mobile home is no longer separately titled or taxed, and is simply part of the real property, just like house would be.

If you're interested in de-titling your home, you must submit all of the following:Stamped Manufactured Home Affidavit or the Retirement of Title Certificate.Home's SC title.Lien release (if applicable)Current paid property tax receipt.$50 de-titling fee.