Promissory Note Procedure In Palm Beach

Category:

State:

Multi-State

County:

Palm Beach

Control #:

US-00425BG

Format:

Word;

Rich Text

Instant download

Description

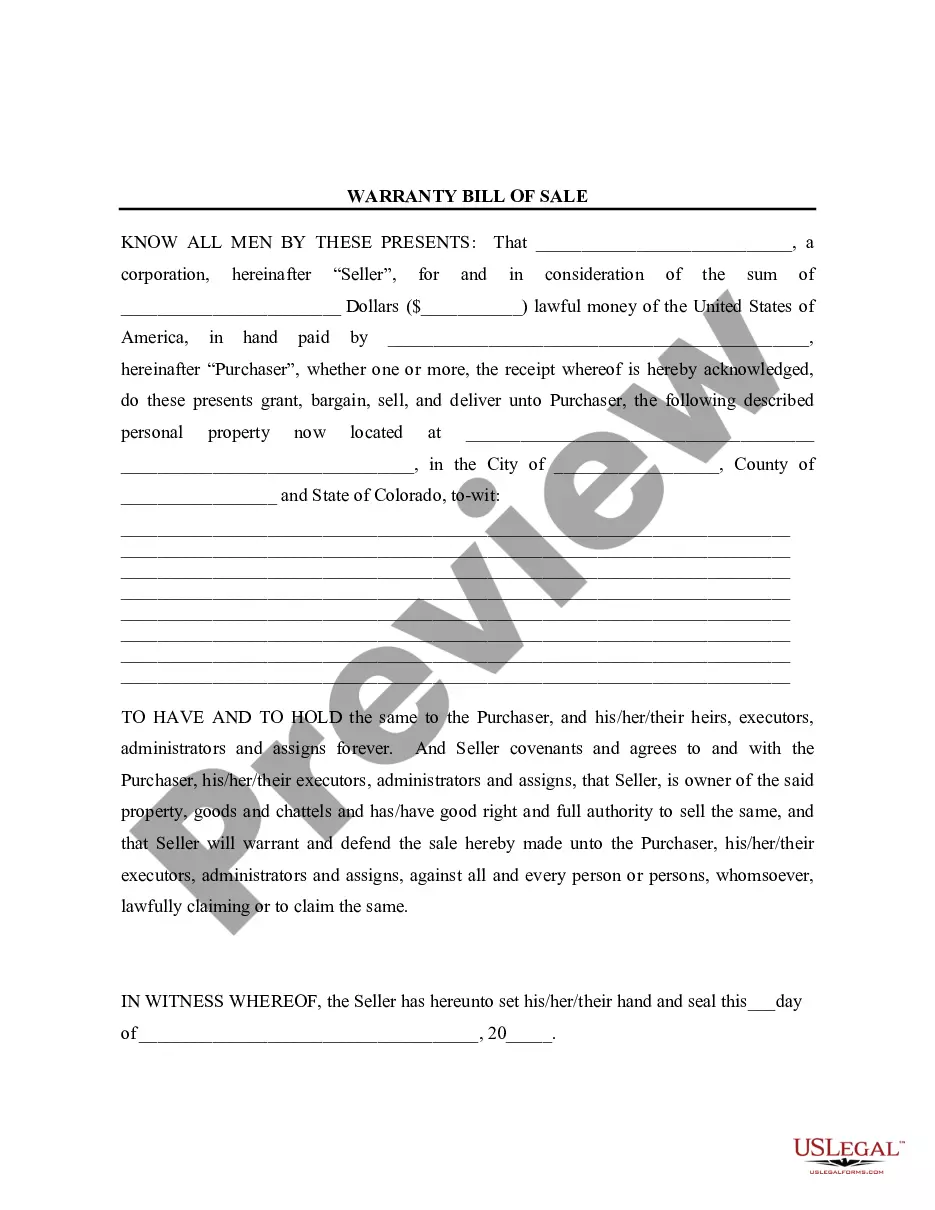

The Promissory Note procedure in Palm Beach outlines a legally binding agreement in which the borrower promises to pay a specified amount to the lender, with clear terms regarding repayment schedules, interest rates, and potential penalties for default. This document includes essential sections such as the loan amount, repayment details, consequence of default, and prepayment terms. Users can fill in their details, including lender information, date, loan amount, interest rate, and repayment structure, ensuring all required fields are completed accurately. It serves various purposes suitable for attorneys, partners, owners, associates, paralegals, and legal assistants, allowing them to facilitate loans securely between parties. Specifically, attorneys can utilize it for drafting and advising clients, while paralegals may assist in the filing process and ensuring compliance with relevant laws. Additionally, the structure accommodates different loan scenarios, offering flexibility that partners and owners may seek when securing funds. The form emphasizes user-friendly language and detailed instructions for filling and editing to assist those with limited legal background in navigating the document efficiently.

Free preview