Payment With Due Date In Fairfax

Category:

State:

Multi-State

County:

Fairfax

Control #:

US-00422

Format:

Word;

Rich Text

Instant download

Description

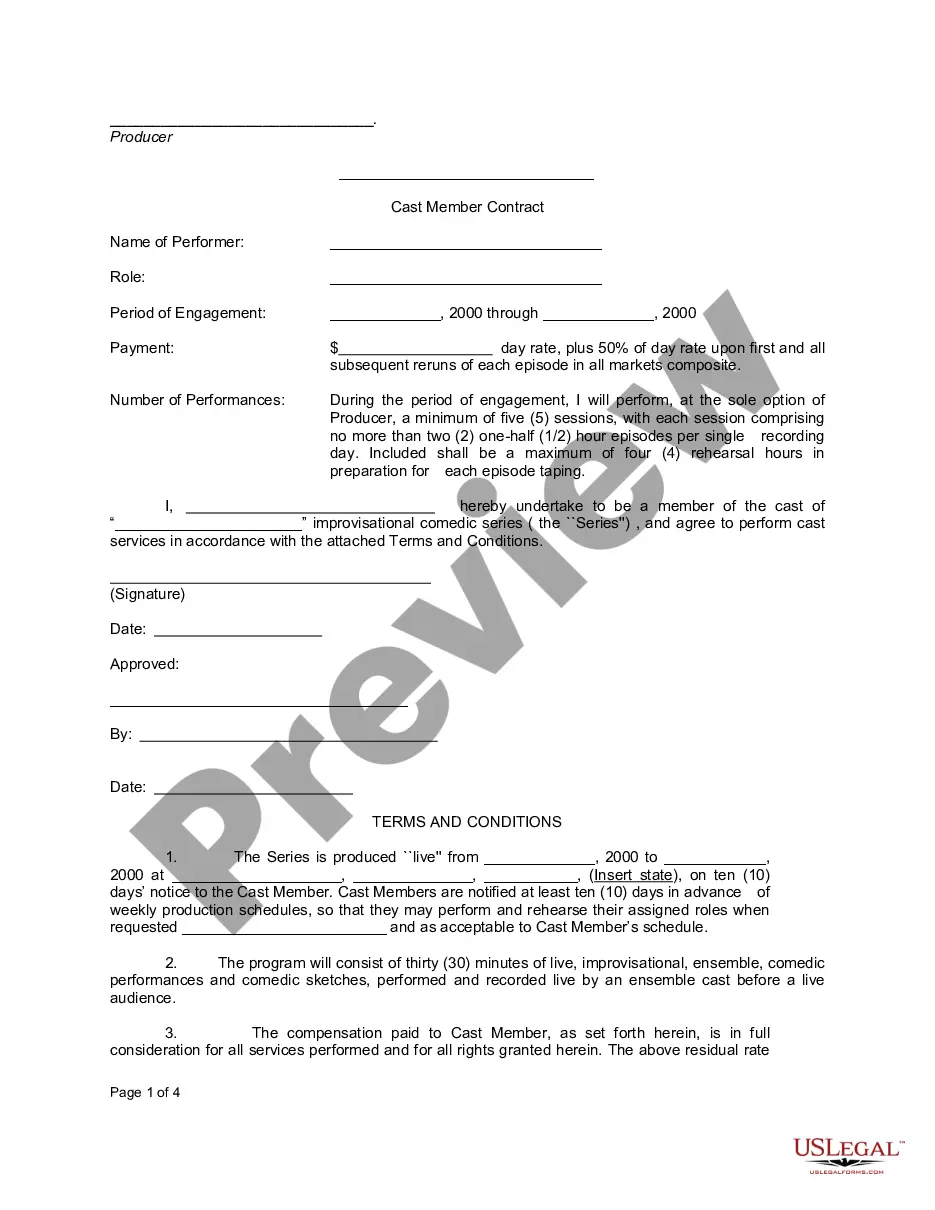

The Assignment of Money Due is a legal form utilized in Fairfax for the transfer of rights associated with a specific debt from one party, the 'Assignor', to another, the 'Assignee'. This form requires clear descriptions of the debt being assigned, including details about the amount due and the due date. The form is particularly useful for legal professionals such as attorneys, paralegals, and legal assistants to formalize a non-recourse assignment of debts, ensuring that the Assignee is responsible for collection while the Assignor guarantees the validity of the debt. When filling out the form, users should provide accurate information regarding the debt and include the appropriate signatures to validate the transaction. The straightforward language and format facilitate comprehension and ensure that even those with limited legal experience can understand the document's purpose and obligations. It's recommended to keep copies of any attached documents that substantiate the debt for future reference. Overall, this form serves as a vital tool for business owners and associates looking to manage financial transactions effectively and legally in a supportive framework.