Sale Business Asset With Revenue In Sap In Maricopa

Description

Form popularity

FAQ

In this posting transaction, you have to enter the revenue posting (debit A/R, credit revenue from asset sale) first, and then enter the asset retirement. An indicator in the posting transaction specifies that the system posts the asset retirement with the revenue posting.

A held for sale asset is shown on the Statement of Financial Position as a current asset. When the asset is reclassified, depreciation or amortization ceases because it is no longer being held as a productive asset with future benefit beyond its recoverable amount.

In an asset sale, the seller retains possession of the legal entity and the buyer purchases individual assets of the company, such as equipment, fixtures, leaseholds, licenses, goodwill, trade secrets, trade names, telephone numbers, and inventory.

How to record disposal of assets Calculate the asset's depreciation amount. The first step is to ensure you have the accurate value of the asset recorded at the time of its disposal. Record the sale amount of the asset. Credit the asset. Remove all instances of the asset from other books. Confirm the accuracy of your work.

To create a new asset, navigate to Accounting → Financial Accounting → Fixed Assets → Asset → Create → Asset or use Transaction code AS01.

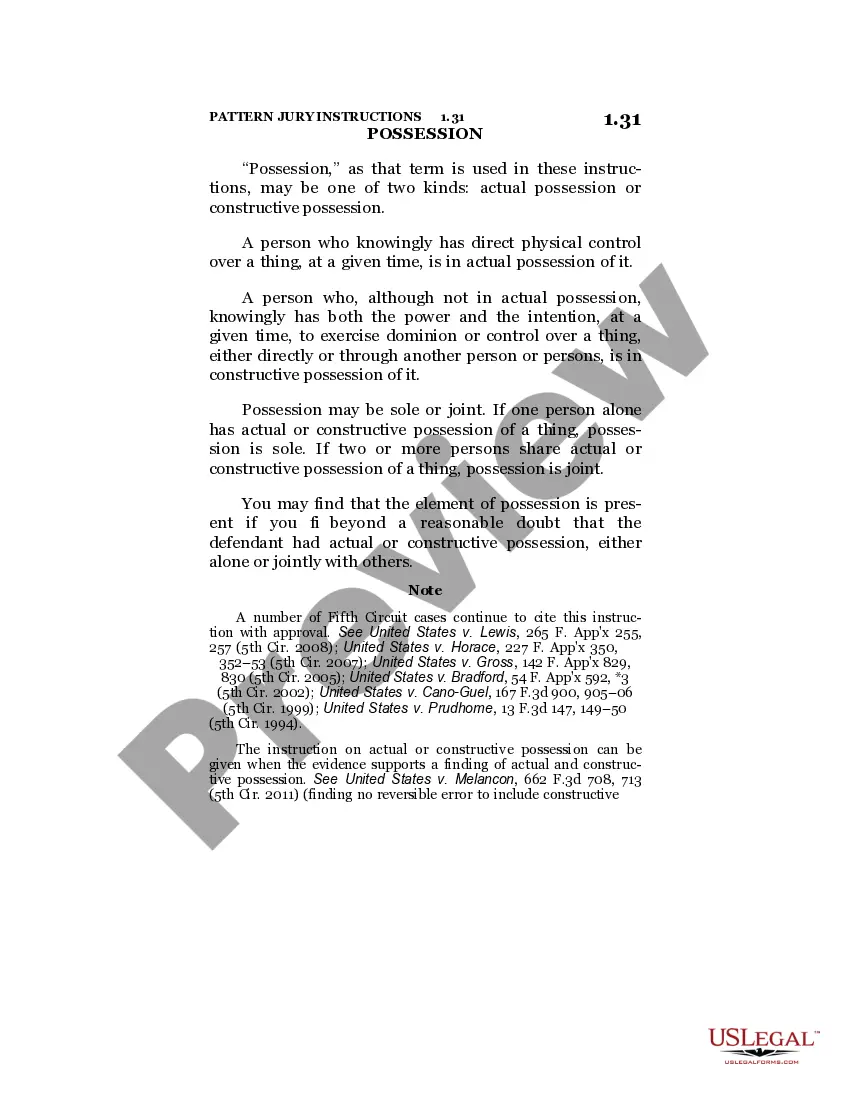

Graphic: Determining Proportional Value Adjustments. Posting Retirement with Revenue with Customer. Posting Retirement with Revenue to Clearing Account. Posting Retirement without Revenue (Scrapping)

About Retirements Retire an asset when it is no longer in service. For example, retire an asset that was stolen, lost, or damaged, or that you sold or returned.

Run Transaction code AJAB (Program RAJABS00) to close the Asset Accounting Fiscal Year. Execute in a Test run and if there are any errors then fix them. Otherwise, you can then uncheck the test run and run the program in the background.