Employment Work Form Withholding In Florida

Description

Form popularity

FAQ

Although Florida doesn't require Form W-2, the IRS mandates filing it to report wages and withheld taxes for your employees. The state of Florida does not require you to file Form W-2 as there is no state income tax.

Does Florida have employer payroll taxes? Yes, payroll taxes include employer contributions to Medicare tax, Social Security plus Florida's reemployment tax, which is deposited into the state Unemployment Compensation Trust fund.

Florida has no state, local, or municipal income tax withholding.

How to Fill Out the W-4 Form Step 1: Basic Information. This is where you fill out the basic information on the form all about you and your personal data. Step 2: Multiple Jobs or Spouse Works. Step 3: Claim Dependents. Step 4a: Other Income (Not from Jobs) ... Step 4b: Deductions. Step 4c: Extra Withholding. Step 5: Signature.

You won't see any Florida income tax withholding because there is no Florida state income tax. The same goes for local income taxes.

Florida has no state, local, or municipal income tax withholding. In general, workers are covered by the unemployment law of the state in which the work is performed.

Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming do not have state income tax. Most other states require employees to complete the W-4 for state taxes, unless the state imposes a flat income tax rate.

Form W-9. The IRS requires contractors to fill out a Form W-9, a request for a Taxpayer Identification Number and Certification, which you should keep on file for at least four years after the hiring. This form is used to request the correct name and Taxpayer Identification Number, or TIN, of the worker or their entity ...

Florida has no state, local, or municipal income tax withholding. In general, workers are covered by the unemployment law of the state in which the work is performed.

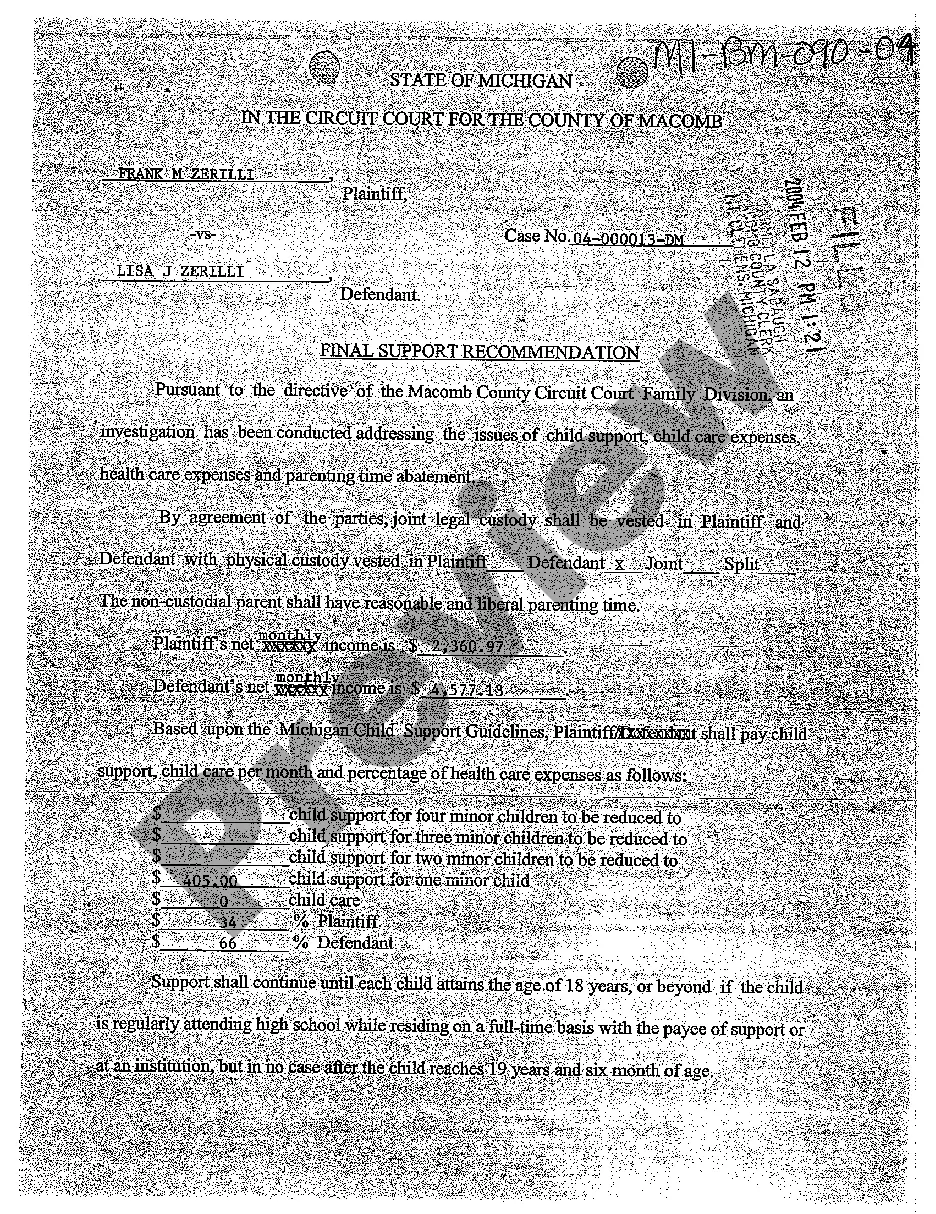

A court order that instructs the obligor's employer to withhold the child support payment from the obligor's income and send it to the Florida State Disbursement Unit ( SDU ).