Homestead Act Example In Fulton

Description

Form popularity

FAQ

Alabama's homestead statute, like other state homestead laws, places a limit on acreage and value that can be designated as a homestead. However, the limits differ between Alabama's constitution (limiting homesteads to 80 acres and $2,000) and its statutory code (limiting homesteads to 160 acres and $5,000).

Homeowners may qualify for different homestead exemptions from the various taxing jurisdictions including school system, cities, and Fulton County. Once granted, exemptions are automatically renewed each year as long as the homeowner continually occupies the property under the same ownership.

For your convenience, Fulton County taxpayers may file application for homestead exemption through our online portal. For all property owners who occupy the property as of January 1 of the application year. No income or age limit. Includes $30,000 off the assessed value on County, $2,000 off school.

Homestead tax exemptions usually offer a fixed discount on taxes, such as exempting the first $50,000 of the assessed value with the remainder taxed at the normal rate. With a $50,000 homestead exemption, a home valued at $150,000 would be taxed on only $100,000 of assessed value.

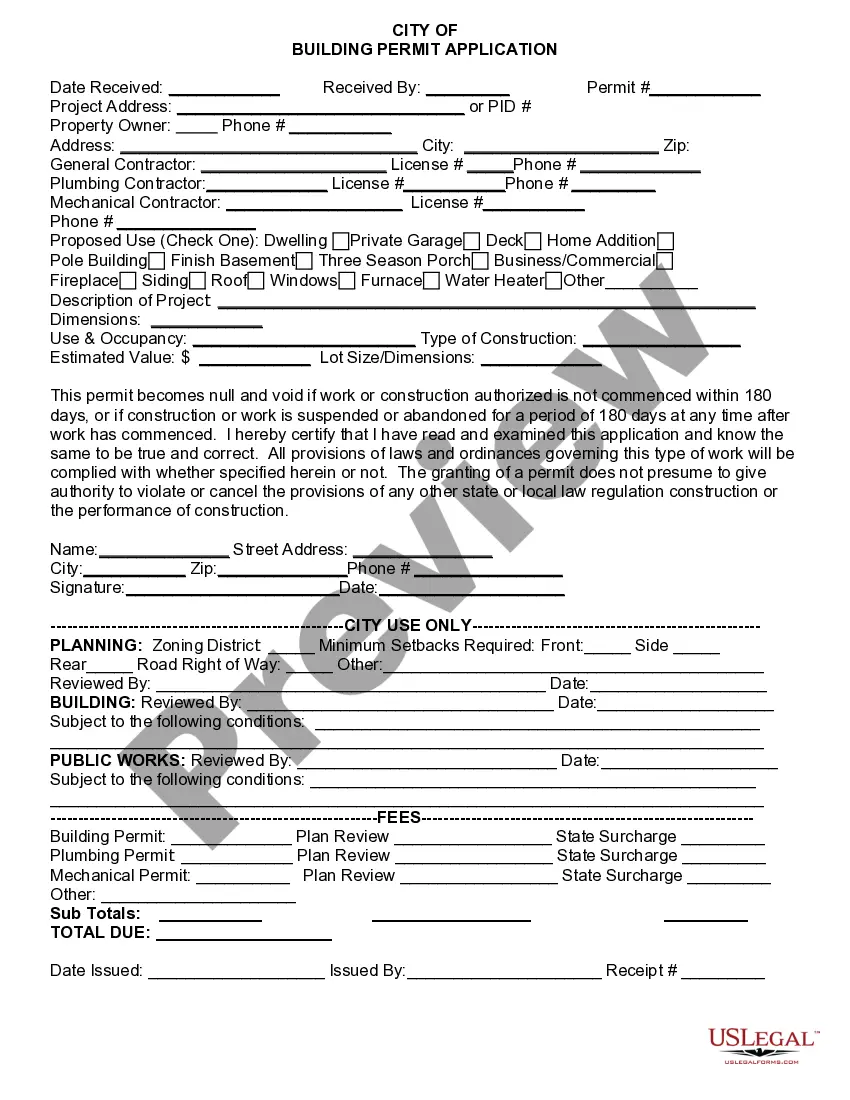

Gather What You'll Need Homeowner's name. Property address. Property's parcel ID. Proof of residency, such as a copy of valid Georgia driver's license and a copy of vehicle registration. Recorded deed for new owners, if county records have not been updated. Trust document and affidavit, if the property is in a trust.

FULTON. COUNTY. Homestead Exemption. Application Deadline: April 1. APPLY ONLINE. .fultonassessor. CALL US AT. 404-612-6440 x4. HOMESTEAD. EXEMPTION GUIDE. A Homestead Exemption is a legal provision, established by state law, that may reduce the assessed value on owner-occupied homes.

You may apply through the Fulton County Tax Assessors Office online portal or in any office of the Fulton County Tax Assessors Office. Homestead exemptions are a form of property tax relief for homeowners.