Installment Contract Agreement With Loan In Wake

Description

Form popularity

FAQ

Ing to Boundy (2012), typically, a written contract will include: Date of agreement. Names of parties to the agreement. Preliminary clauses. Defined terms. Main contract clauses. Schedules/appendices and signature provisions (para. 5).

To write a simple contract, title it clearly, identify all parties and specify terms (services or payments). Include an offer, acceptance, consideration, and intent. Add a signature and date for enforceability. Written contracts reduce disputes and offer better legal security than verbal ones.

The assignor must agree to assign their rights and duties under the contract to the assignee. The assignee must agree to accept, or "assume," those contractual rights and duties. The other party to the initial contract must consent to the transfer of rights and obligations to the assignee.

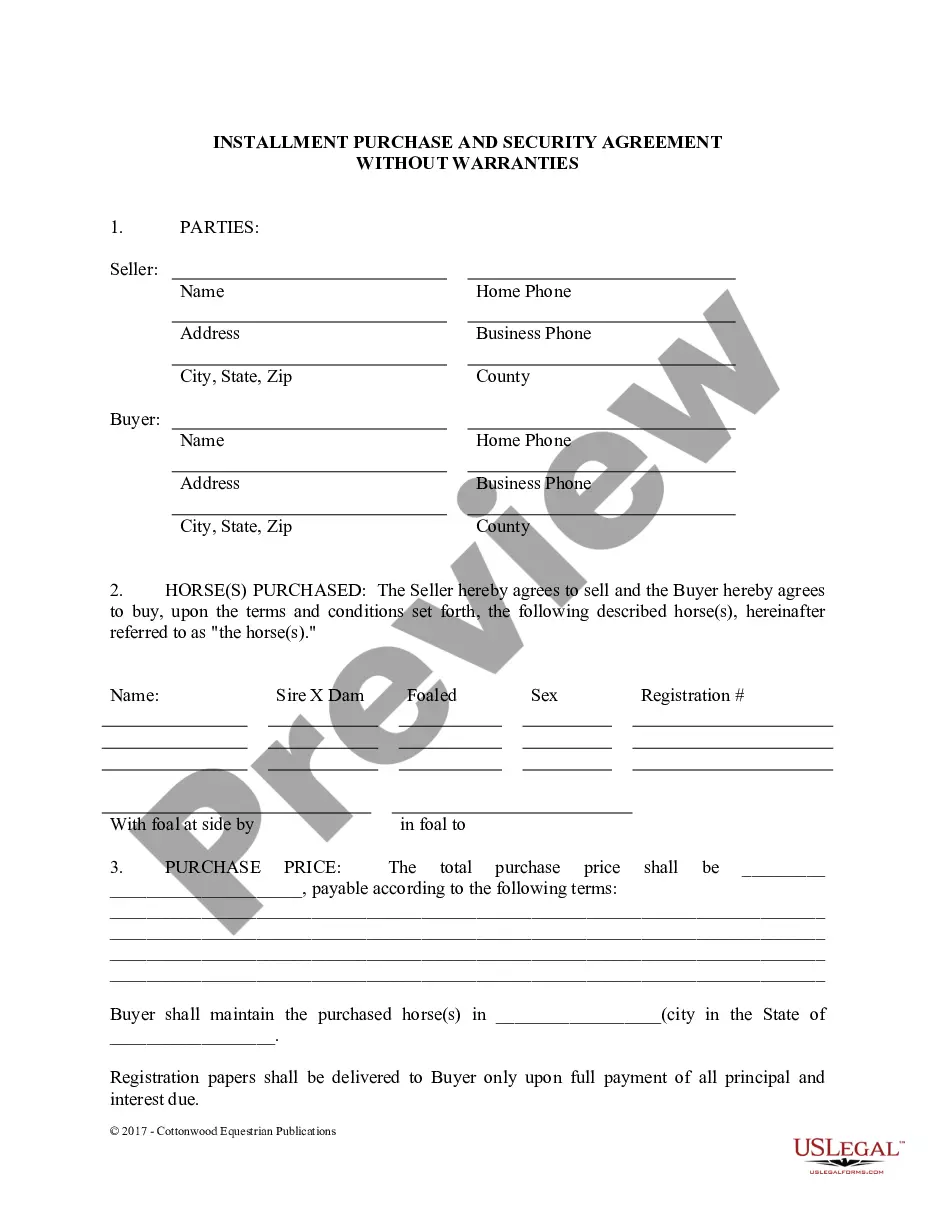

An installment contract is a single contract that is completed by a series of performances –such as payments, performances of a service, or delivery of goods–rather than being performed all at one time. Installment contracts can provide that installments are to be performed by either one or both parties .

The creditor should sign the Letter in the space provided before sending it to the debtor. If the debtor agrees to the repayment plan set out in the Letter Accepting Payments in Instalments, they should countersign the Letter in the space provided. This makes the Letter a binding agreement between the parties.

WHY THE IRS REJECTS INSTALLMENT AGREEMENT REQUESTS. The IRS typically rejects an installment agreement request for one of three reasons. If the IRS determines that your living expenses do not fall under the category of “necessary,” your agreement will more than likely be rejected.

Getting a Copy of the Contract Under TILA, the dealer is required to give the customer a copy of the contract to keep at the time the customer signs the retail installment sale contract whether you want to incur the debt on these terms.

Computer Service Contracts: Contracts for computer or technology services, such as software subscriptions, often involve installment payments being made over a set period of time; Agricultural Sales Contracts: In these contracts, the goods are subject to seasonal cycles, such as produce or agricultural goods.

Computer Service Contracts: Contracts for computer or technology services, such as software subscriptions, often involve installment payments being made over a set period of time; Agricultural Sales Contracts: In these contracts, the goods are subject to seasonal cycles, such as produce or agricultural goods.