Payment Plan Contract For Car In Utah

Description

Form popularity

FAQ

Although not legally required, the Utah DMV advises and provides private sellers with a bill of sale (form TC-843) to use when selling your car on your own. The bill of sale provides proof the seller has legally transferred ownership of the vehicle to the buyer.

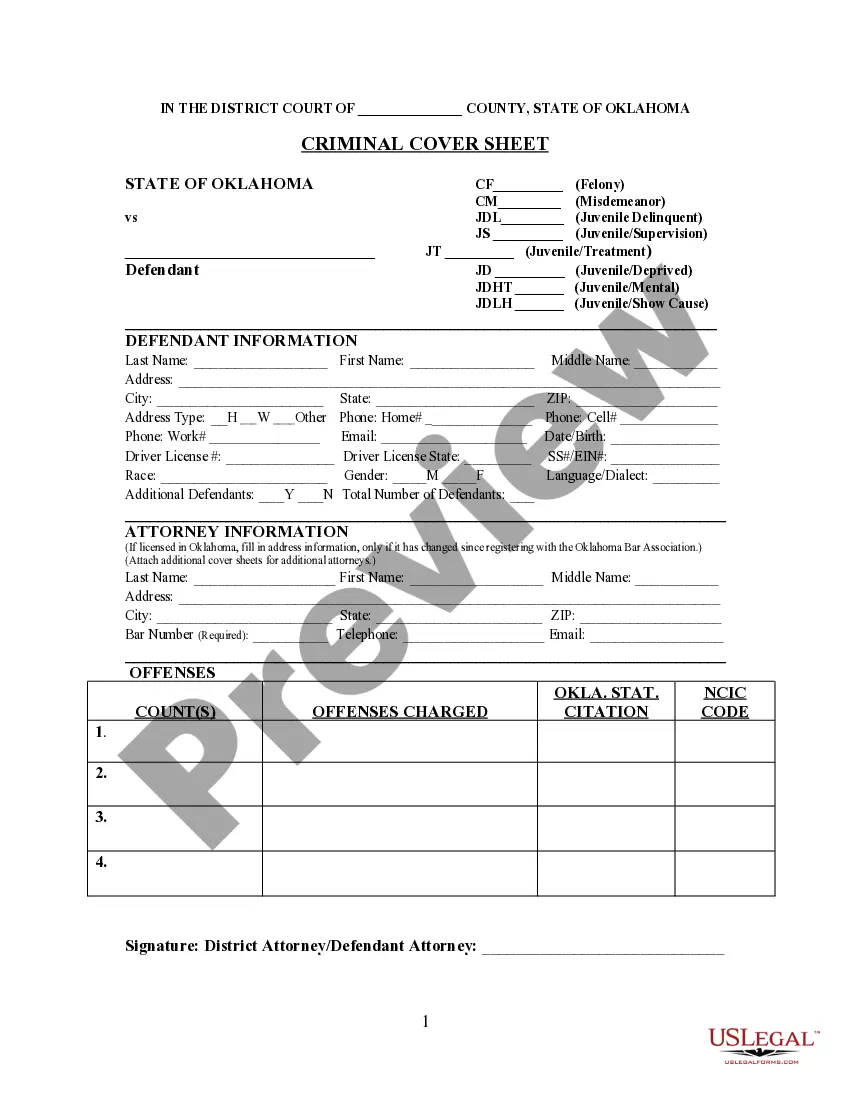

Disclosure of financing arrangements relating to the sale of motor vehicles. A dealer may not issue a temporary permit or release possession of a motor vehicle that the dealer has sold to someone other than another dealer unless the document of sale contains one of the disclosures listed in Subsection (2).

The bill of sale can be handwritten or typed/printed, but it should be in ink, not pencil. If desired, you can use the TC-843, Bill of Sale provided by the DMV.

Avoid white-out, scribbles, and strike-throughs. Back of the title top half in Section A - print name(s) in the box where it reads "Print Name of Seller." Back of the title right below where you printed name(s) - sign name(s) on the line where it reads "Signature of Seller (and Joint Seller)."

TO REPORT THE VEHICLE AS SOLD OR TRANSFERRED BY PHONE: Please call the DMV at 1.800. DMV. UTAH (800.368. 8824).

Utah's Lemon Law The law also requires the manufacturer or any future seller (dealer or individual) to disclose to a potential buyer, in writing, and in a “clear and conspicuous manner,” the fact that the vehicle is a manufacturer buyback.

Accident involving injury -- Stop at accident -- Penalty. "Reason to believe" means information from which a reasonable person would believe that the person may have been involved in an accident.

A vehicle payment plan agreement is a contract between a buyer and seller of a vehicle that agrees to installment payments. Since the seller is providing the financing, both parties must agree to the downpayment, interest rate, and the payment period.

Lemon laws also stipulate how many days your vehicle is in for repairs. In Utah, this is 30 days. In other words, if your car is at a repair shop for any warranty-covered defects for more than 30 days—which don't have to be consecutive—you can also get a refund or a new vehicle.