Payment Plan Contract For Car In Texas

Description

Form popularity

FAQ

Generally, you can cancel a car contract in Texas without penalty in the following circumstances: If you have not taken delivery of the car. If the car is defective. If the dealer misrepresented the car.

A vehicle payment plan agreement is a contract between a buyer and seller of a vehicle that agrees to installment payments. Since the seller is providing the financing, both parties must agree to the downpayment, interest rate, and the payment period.

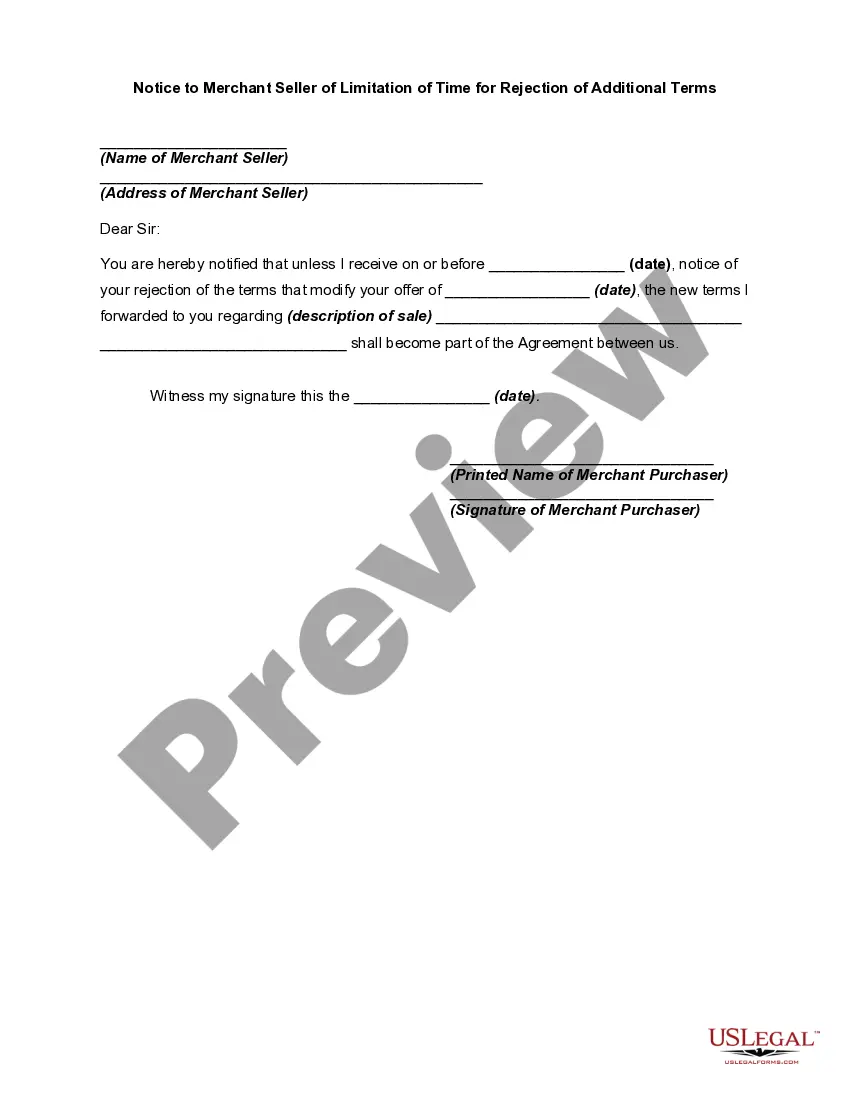

The creditor should sign the Letter in the space provided before sending it to the debtor. If the debtor agrees to the repayment plan set out in the Letter Accepting Payments in Instalments, they should countersign the Letter in the space provided. This makes the Letter a binding agreement between the parties.

Once a contract is signed by a buyer, a copy of the completed contract has been given to the buyer, and the buyer has accepted delivery of the vehicle, it is a legal binding contract between the buyer and dealer and which neither party may unilaterally rescind or cancel.

Either party can back out of a car deal until the sales contract is signed. Once the contract is signed it is final. A dealer would not likely be able to alter than contract as they are assumed, under law, to be professionals. As such they are not expected to make “mistakes.”

Once a contract is signed by a buyer, a copy of the completed contract has been given to the buyer, and the buyer has accepted delivery of the vehicle, it is a legal binding contract between the buyer and dealer and which neither party may unilaterally rescind or cancel.

The enforceability of a Texas contract relies on several factors. The first one being mutual agreement between the parties, where they both accept and understand the definite terms stated in an offer. If both parties do not completely agree on the terms, then the contract is considered invalid.

Payment plan set up Example: 20% of the invoice is due after the first work deliverable is done. After that, the remaining balance is split up equally into two installments.

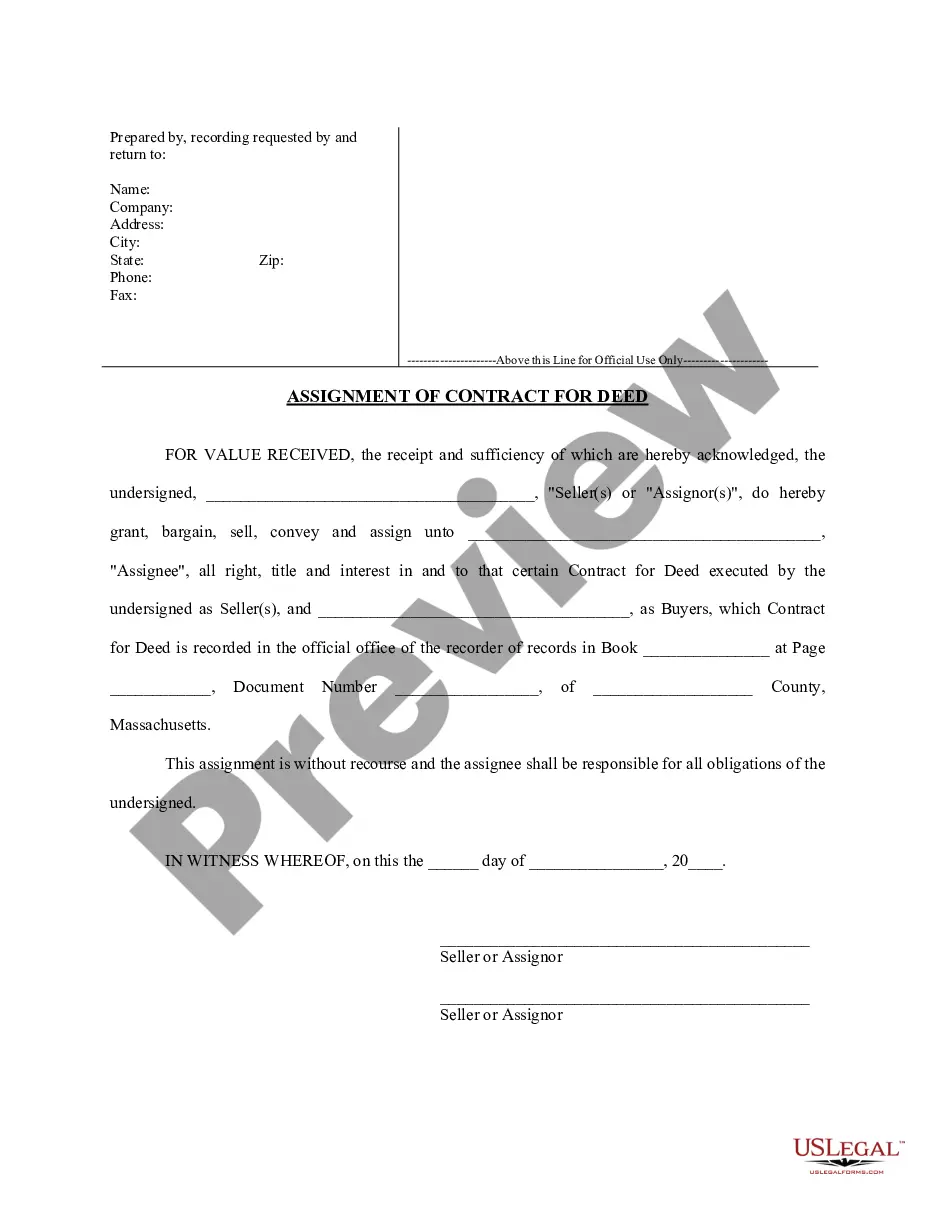

To write a simple contract, title it clearly, identify all parties and specify terms (services or payments). Include an offer, acceptance, consideration, and intent. Add a signature and date for enforceability. Written contracts reduce disputes and offer better legal security than verbal ones.