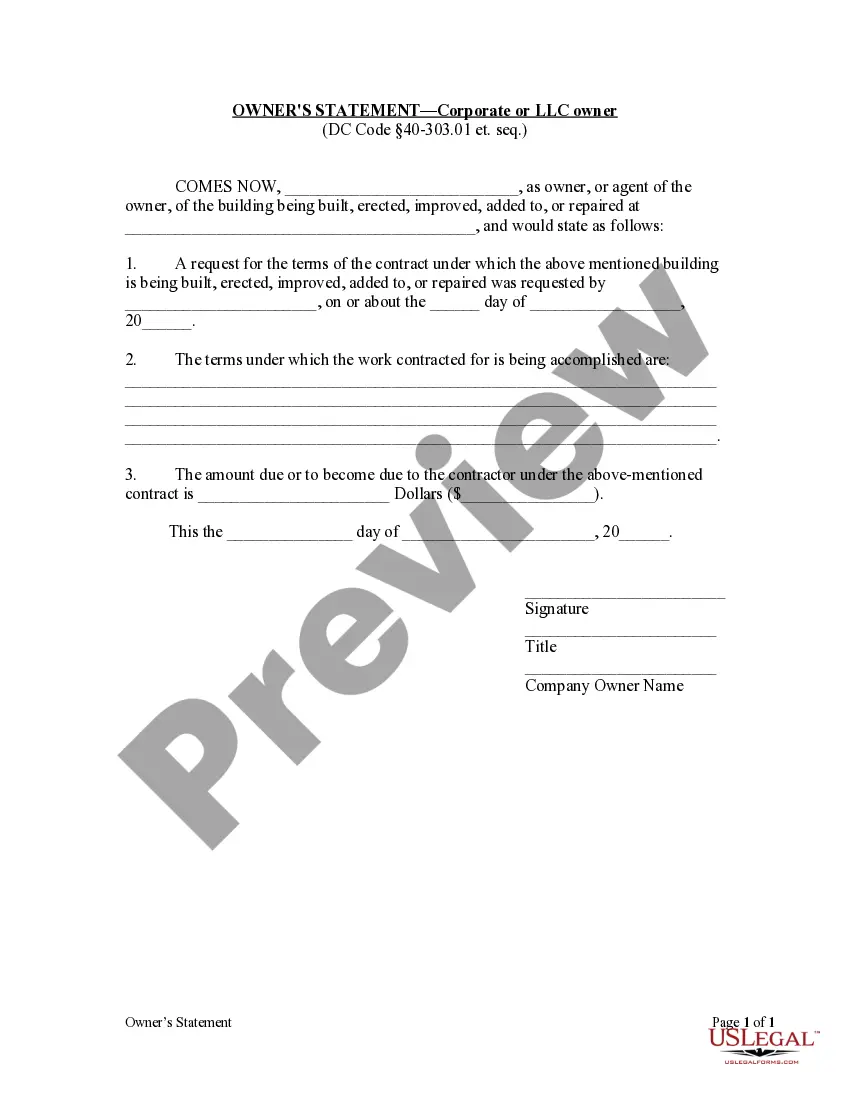

Arizona Uniform Corporate Resolution is a form used by corporations registered in the state of Arizona to formally document the adoption of corporate actions such as changing the name of the company, issuing additional shares of stock, changing the corporate address, and other corporate decisions. It is important to keep accurate records of corporate resolutions to ensure that the corporation's rights and obligations are properly documented. The Arizona Uniform Corporate Resolution is also known as the Arizona Corporate Resolution Form. It includes the names of the officers or directors of the corporation, the date of the resolution, and the specific action being taken by the corporation. The form must be signed by two officers or directors of the corporation, and a copy of the resolution must be filed with the Arizona Corporation Commission. The two types of Arizona Uniform Corporate Resolution are the Certificate of Resolution and the Articles of Amendment. A Certificate of Resolution is used to document the adoption of a corporate action, while the Articles of Amendment is used to amend the articles of incorporation of the company.

Arizona Uniform Corporate Resolution

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Arizona Uniform Corporate Resolution?

If you are searching for a method to accurately finalize the Arizona Uniform Corporate Resolution without engaging a legal expert, you have arrived at the ideal location.

US Legal Forms has established itself as the most comprehensive and dependable repository of official templates for every personal and commercial situation. Each piece of documentation available on our online platform is crafted in accordance with federal and state laws, ensuring that your paperwork is properly organized.

Another benefit of US Legal Forms is that you will never misplace the documents you acquired - you can retrieve any of your downloaded templates from the My documents tab in your profile whenever necessary.

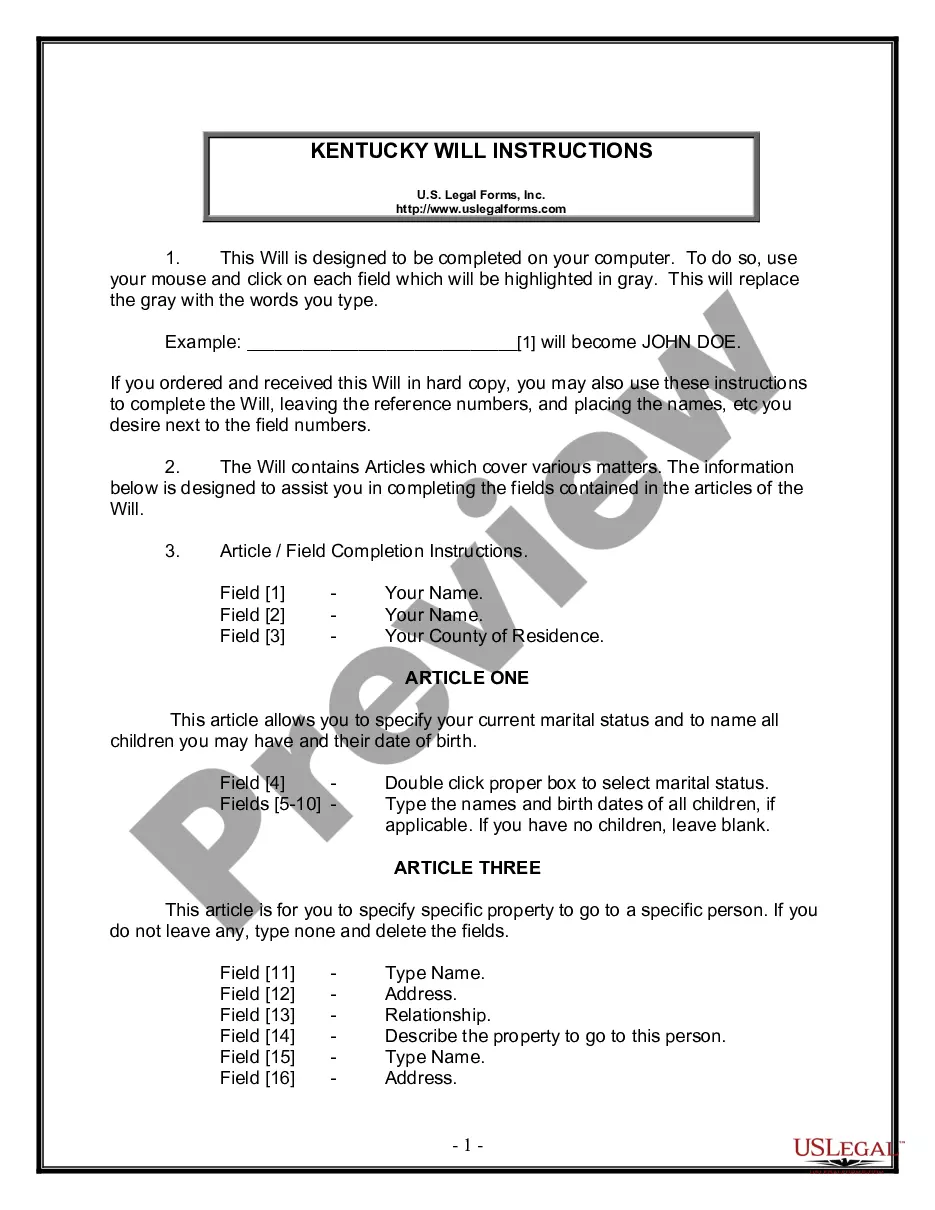

- Verify that the document displayed on the page aligns with your legal needs and state laws by reviewing its text description or exploring the Preview mode.

- Input the form title in the Search tab at the top of the page and select your state from the dropdown menu to find an alternate template if any discrepancies arise.

- Repeat the content verification process and click Buy now when you are assured that the paperwork meets all requirements.

- Log In to your account and click Download. If you do not have an account yet, register for the service and select a subscription plan.

- Utilize your credit card or the PayPal option to purchase your US Legal Forms subscription. The blank will be accessible for download immediately afterward.

- Select the format you prefer for your Arizona Uniform Corporate Resolution and download it by clicking the corresponding button.

- Upload your template to an online editor to quickly fill out and sign it or print it to prepare your hard copy manually.

Form popularity

FAQ

Yes, in Arizona, you can serve as your own statutory agent if you are a resident of the state. As a statutory agent, you will be responsible for receiving legal documents and official correspondence on behalf of your business. Just remember to include your role as a statutory agent when filing your Arizona Uniform Corporate Resolution, ensuring that all your responsibilities are clearly outlined.

Yes, Arizona recognizes S Corporations as a valid business structure. This allows qualifying businesses to enjoy pass-through taxation, where income is taxed only at the shareholder level. By filing the appropriate documentation such as the Arizona Uniform Corporate Resolution, you can officially register your S Corp status in Arizona and benefit from this tax treatment.

To establish an S Corporation in Arizona, begin by forming a regular corporation by filing Articles of Incorporation with the Arizona Corporation Commission. After that, you must file Form 2553 with the IRS to elect S Corporation status. To ensure compliance, create an Arizona Uniform Corporate Resolution that documents your election and meets necessary state requirements.

In Arizona, S Corporations are subject to a state income tax rate of 4.9% on their taxable income. However, individual shareholders report their S Corporation income on their personal tax returns, so it's essential to consider both federal and state implications. Utilizing the Arizona Uniform Corporate Resolution can help streamline tax matters, making sure your entity adheres to regulations.

To convert your LLC to an S Corporation in Arizona, you'll need to prepare and file the Arizona Uniform Corporate Resolution to elect S Corporation status. This process involves submitting Form 2553 to the IRS and completing the necessary paperwork with the Arizona Corporation Commission. Additionally, ensure your LLC meets the eligibility criteria for S Corporation status, such as limiting the number of shareholders.

Filing an annual report with the Arizona Corporation Commission is an essential step for your corporation. You can complete the filing online through their official portal. Preparing in advance with the Arizona Uniform Corporate Resolution can help you organize necessary approvals and information, making the filing process more efficient.

To file your annual report with the Arizona Corporation Commission, you must complete the online filing process available on their site. It is important to prepare the required information beforehand to expedite your submission. Using the Arizona Uniform Corporate Resolution ensures that all corporate decisions are properly documented before filing, streamlining your filing experience.

Arizona mandates that corporations file annual reports to maintain compliance. This report helps keep your corporation’s records up-to-date with the Arizona Corporation Commission. The Arizona Uniform Corporate Resolution provides a solid framework for gathering and submitting the necessary information for this annual report.

Yes, Arizona permits corporations to restate their articles of incorporation. This action is vital for updating or correcting your corporate information without forming a new entity. By utilizing the Arizona Uniform Corporate Resolution, you can ensure that all necessary decisions and approvals are properly documented.

Filing a complaint with the Arizona Corporation Commission is straightforward. You will need to fill out a specific complaint form available on their website. Make sure to provide all relevant details and documents related to the issue, as this will aid in the complaint process related to the Arizona Uniform Corporate Resolution.