Independent Contractor Contract Example In Minnesota

Description

Form popularity

FAQ

California Law states that a worker may be considered an independent contractor if (1) the worker has the right to control the performance of services, (2) the result of the work is the primary factor bargained for, and not the means by which it is accomplished, (3) the worker has an independently established business, ...

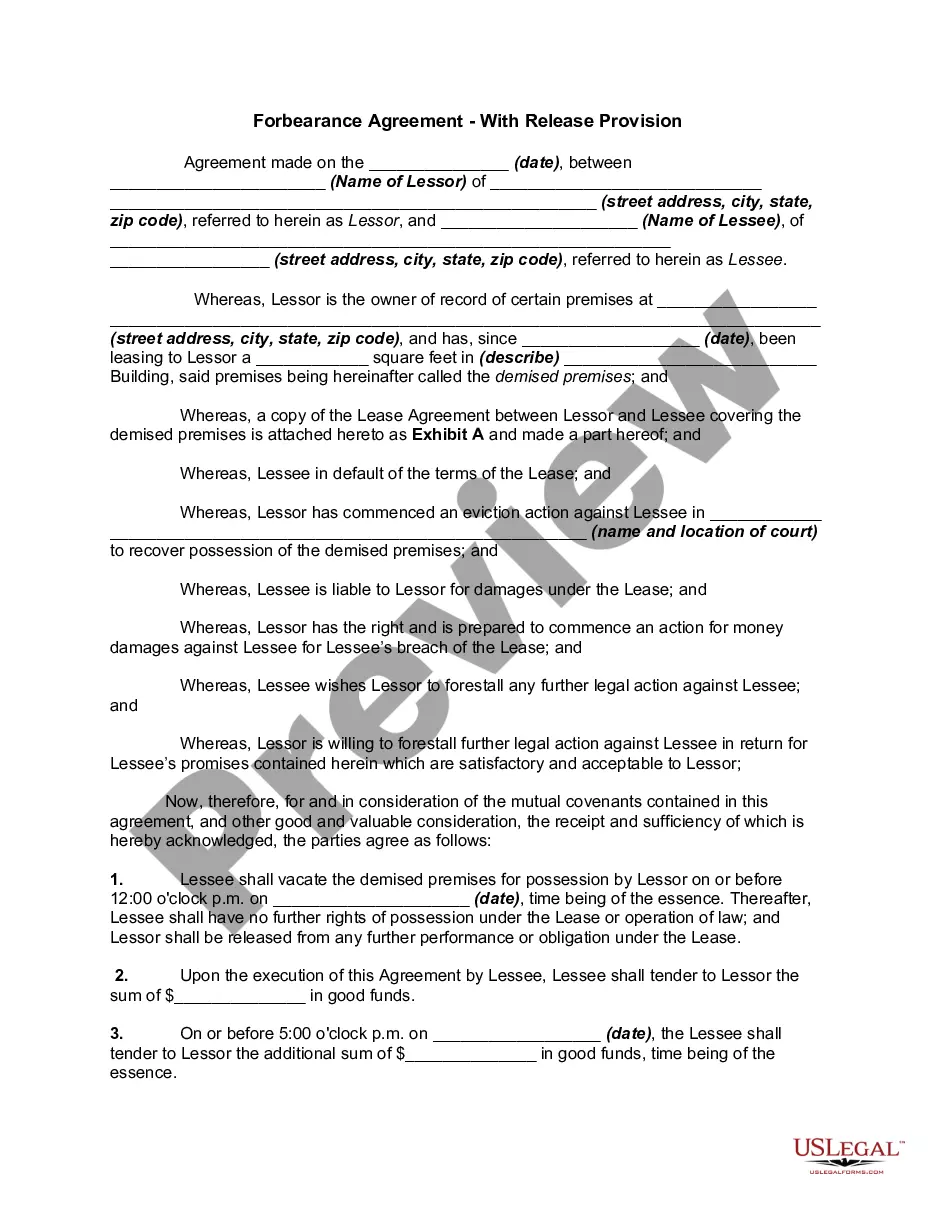

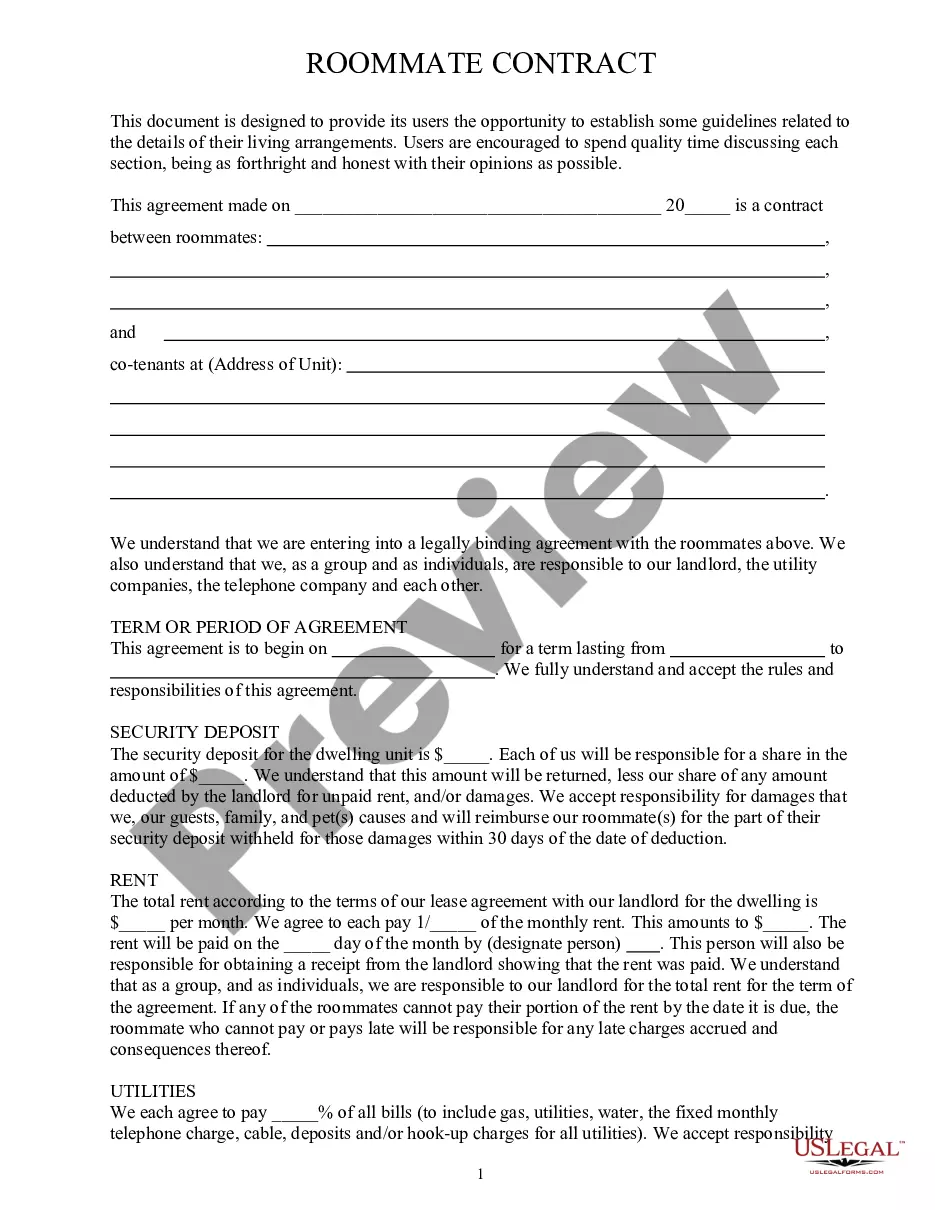

The agreement should have an introductory paragraph outlining who is the client and who is the service provider. It should contain the legal names of both parties, the date, and the physical addresses of each party.

The new rule, which becomes effective March 11, 2024, rescinds the 2021 independent contractor rule issued under former President Donald Trump and replaces it with a six-factor test that considers: 1) opportunity for profit or loss depending on managerial skill; 2) investments by the worker and the potential employer; ...

Submit a paper Report of Independent Contractor(s) (DE 542) using one of the following options: Downloading a fill-in DE 542 (PDF). Ordering the form to be mailed to you through our Online Forms and Publications. Printing your data directly from your computer to the DE 542 by following the Print Specifications (PDF).

Generally, a worker is a legitimate independent contractor if: The worker determines when, where, and how to performs the work. The worker's work is not essential to the employer's business.

These financial aspects indicate the worker is an independent contractor: The worker has an opportunity for profit or risk of loss. The worker has a significant investment in the work. The worker offers services to the general public.

You should consider all evidence of the degree of control and independence in this relationship. The facts that provide this evidence fall into three categories – behavioral control, financial control, and relationship of the parties.

Independent contractors generally report their income on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship). Also file Schedule SE (Form 1040), Self-Employment Tax if your net earnings from self-employment are $400 or more.

A contractor agreement should describe the scope of work, contract terms, contract duration, and the confidentiality agreement. It should also include a section for the two parties to sign and make the agreement official. If the contract doesn't meet these requirements, it may be inadmissible in a court of law.