Judgment Against Property With No In Kings

Description

Form popularity

FAQ

Most creditors will file the release of judgment within 30-60 after you finish paying them. What if I need the judgment released immediately (“I'm supposed to close next week!”)? You can ask them to give you the release sooner. They might do it; they might not.

The concept of “nonexempt property” appears in the context of Chapter 7 bankruptcy proceedings and refers to property of the debtor's estate that does not qualify for a statutory exemption .

In a debt collection lawsuit, a judgment is a court order that allows the debt collector to use stronger tools, like garnishment, to collect the debt. A judgment is an official result of a lawsuit in court.

After a default has been taken, a judgment can be taken by either submitting documentation with a declaration as to the truth of the documents, or by having a prove-up hearing, where testimony is taken and documents are submitted. So the answer is yes. They can't execute the judgment without finding you, though.

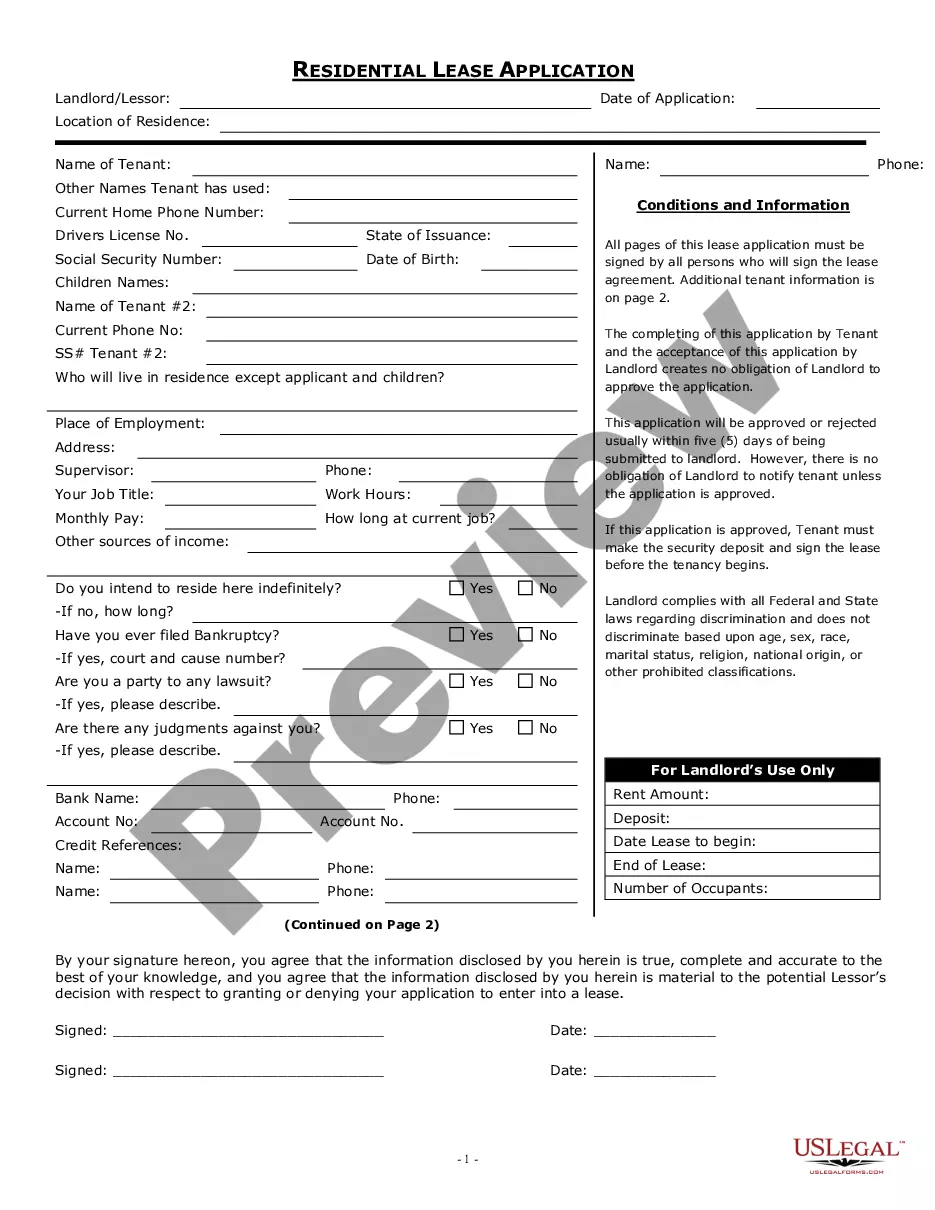

All judgments and court records are filed in the County Clerk Office in the County where the lawsuit was filed. You can go in person to the County Clerk Office in the County where you live to ask if a judgment has been entered against you. Most counties also allow you to search online.

How Long Are Judgments Valid in New York? Judgments are valid for 20 years and may be extended once for an additional period of 10 years. To extend a judgment for an extra ten (10) years, the Judgment Creditor must make written application to the court that issued the original judgment.

Judgments may be classified as in personam, in rem, or quasi in rem. An in personam, or personal, judgment, the type most commonly rendered by courts, imposes a personal liability or obligation upon a person or group to some other person or group.

All judgments and court records are filed in the County Clerk Office in the County where the lawsuit was filed. You can go in person to the County Clerk Office in the County where you live to ask if a judgment has been entered against you. Most counties also allow you to search online.

Judgements can become a first lien against a property. Lenders generally want to be first lien when it comes to mortgages. So yes, it will be deal breaker for most mortgage companies. I've seen mortgages get denied because of a $6000 judgement.