Payoff Statement Request With Per Diem In San Bernardino

Description

Form popularity

FAQ

Meals and incidental expenses (M&IE): the standard California per diem rate for M&IE is $68 per day, except for the first and last days of travel, which amount to $51. Be sure to check if the area of business travel is not covered by a specified rate.

Claim these expenses on Form 2106, Employee Business Expenses and report them on Form 1040, Form 1040-SR, or Form 1040-NR as an adjustment to income. Good records are essential.

A per diem job in California is a flexible work arrangement where employers employ individuals on an as-needed basis, often in temporary or part-time roles. Per diem employees do not have a regular schedule. Instead, they work the hours their employers assign them, which can fluctuate.

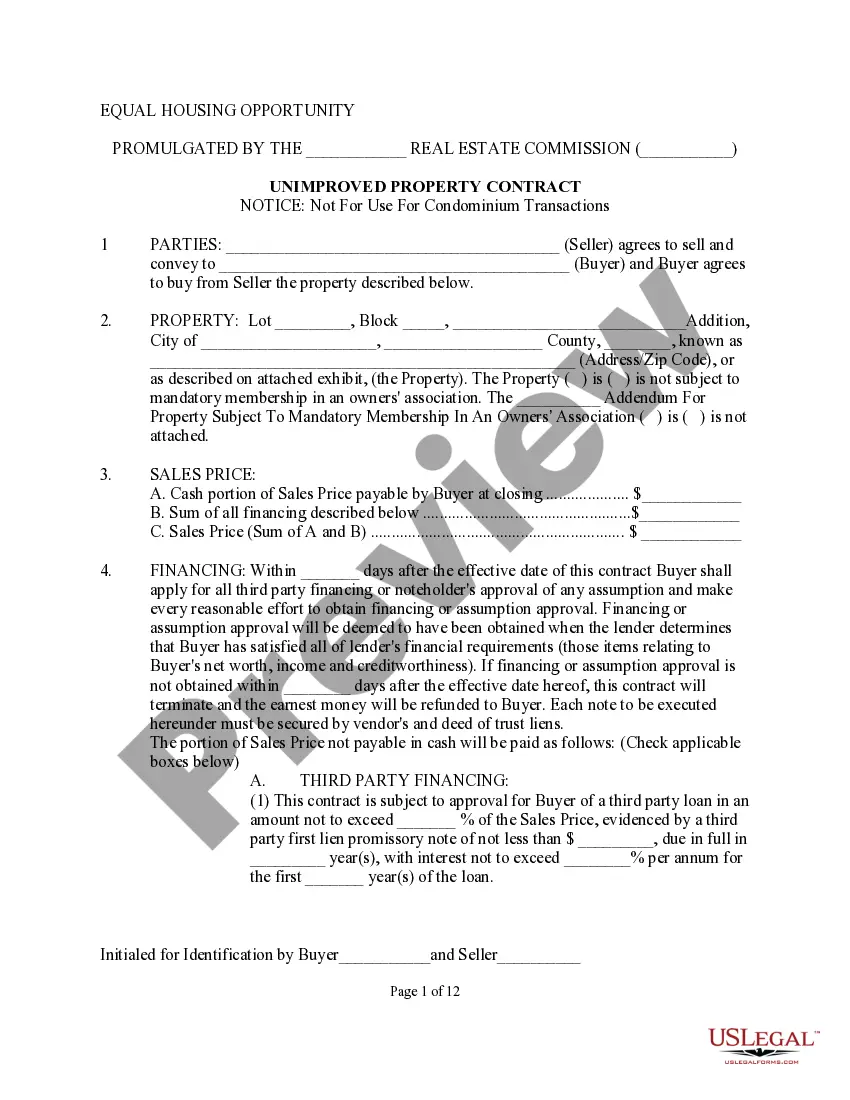

To get a payoff letter, ask your lender for an official payoff statement. Call or write to customer service or make the request online. While logged into your account, look for options to request or calculate a payoff amount, and provide details such as your desired payoff date.

A mortgage payoff request form is a document that is typically provided by the borrower to the mortgage lender or servicing company to request the full payoff amount for the remaining balance on their mortgage.

By including a per diem amount in the letter, the parties will not have to execute another payoff letter if the termination date is delayed.