Lien Release Letter For Property In Riverside

Description

Form popularity

FAQ

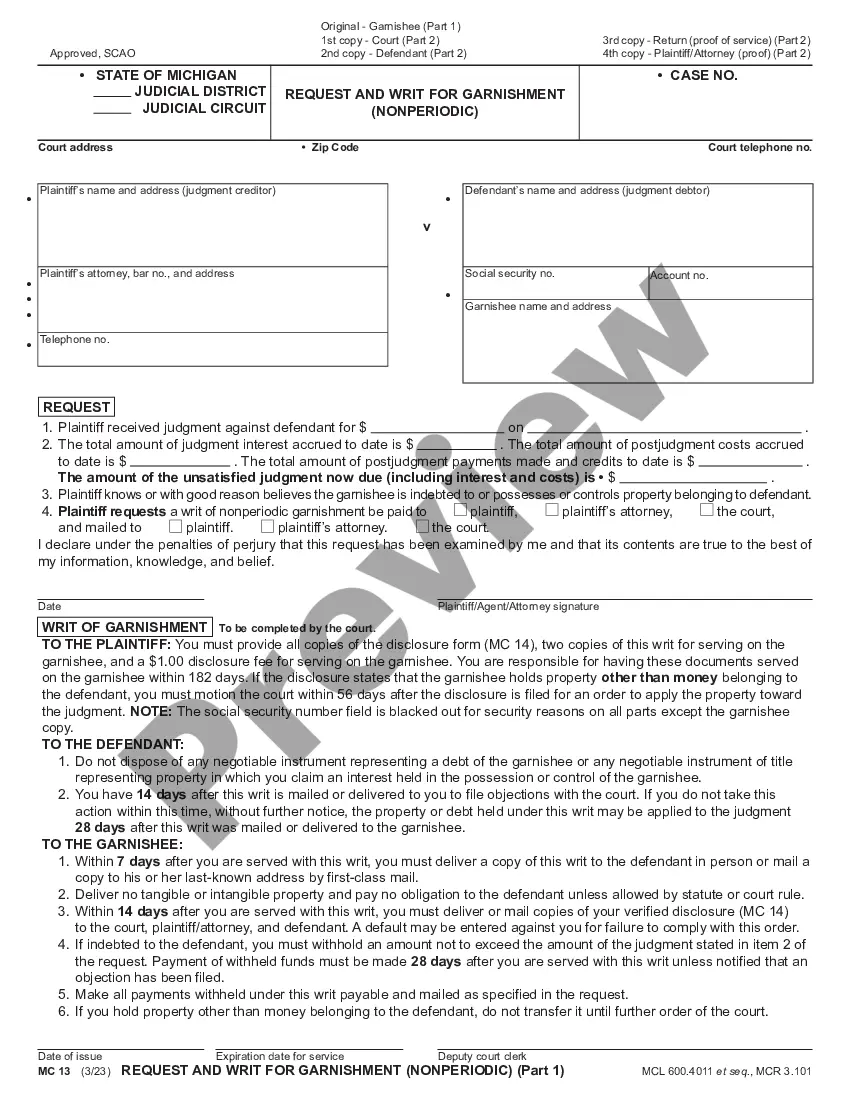

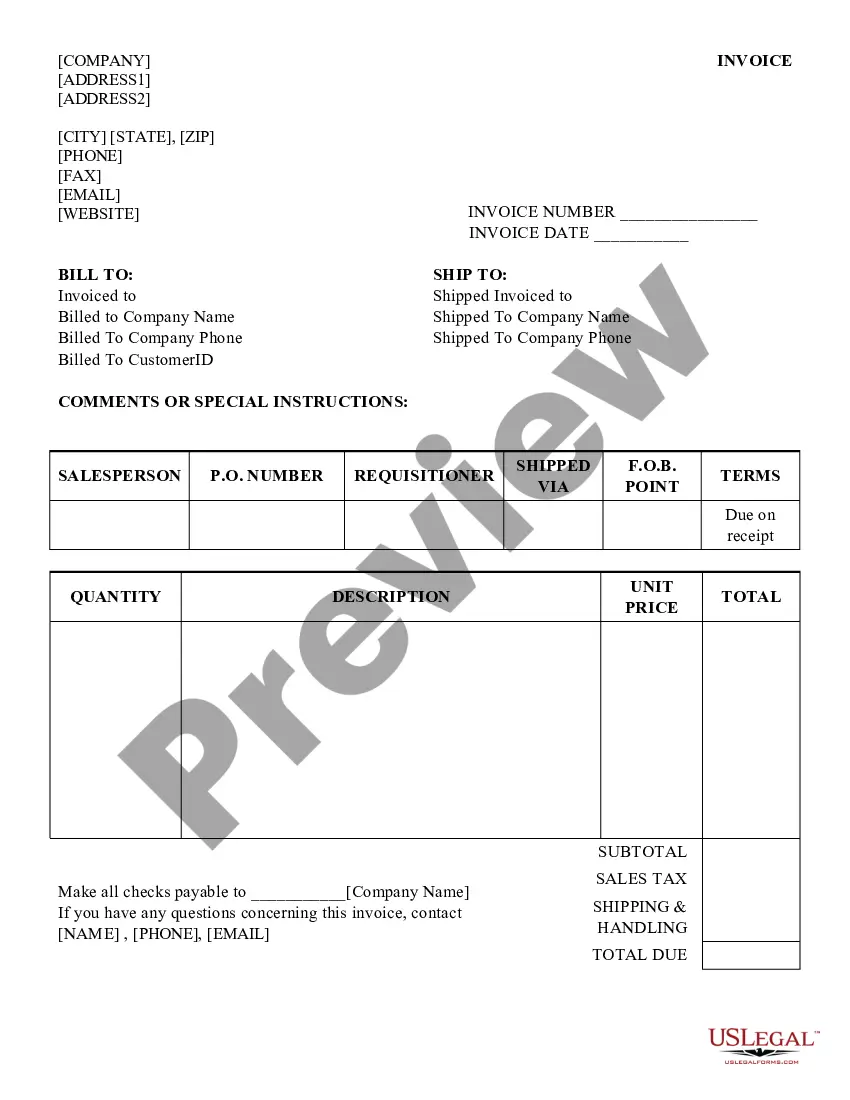

A payoff request allows a third party to receive the current balance due to release a lien or facilitate a business transfer (bulk sale transfer or liquor license). To release a lien or facilitate a bulk sale transfer, businesses must be in good standing to receive a payoff request.

A lien expires 10 years from the date of recording or filing, unless we extend it. If we extend the lien, we will send a new Notice of State Tax Lien and record or file it with the county recorder or California Secretary of State. We will not release expired liens.

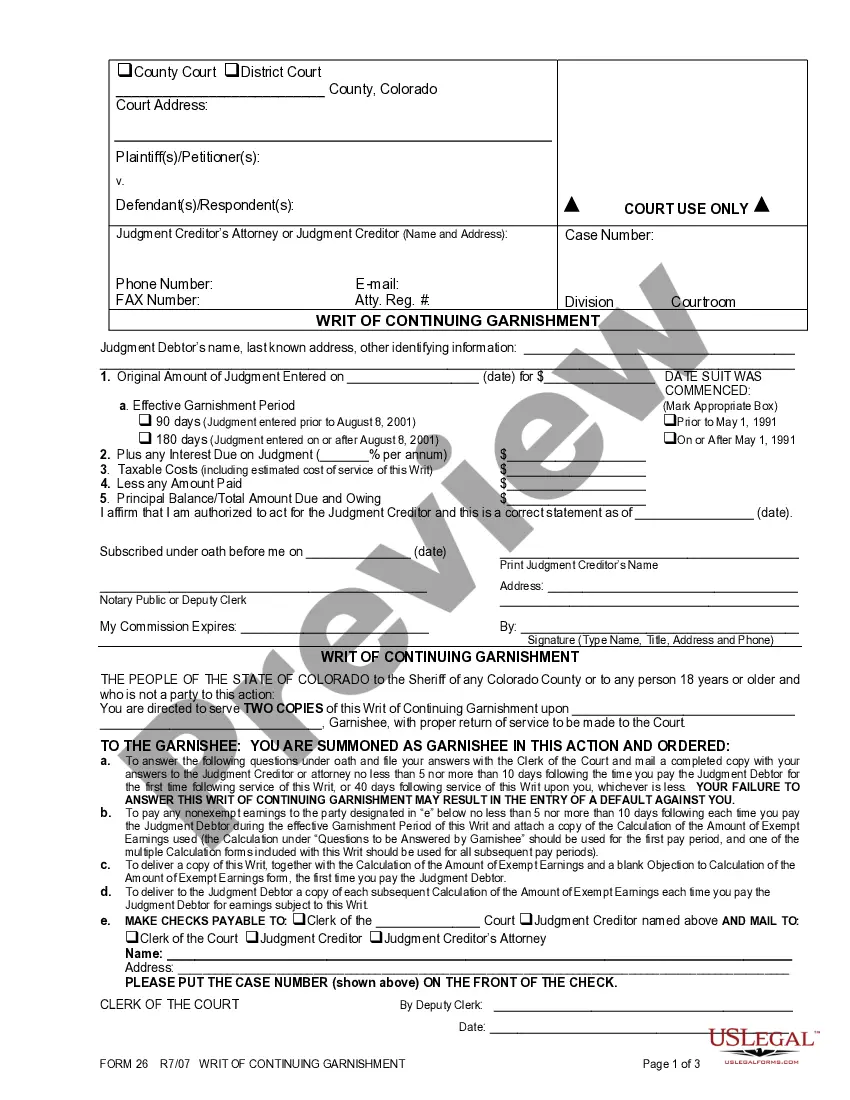

Here are a few ways to remove the lien: Invalidate the lien. If the lien is invalid or was obtained in a manner that doesn't follow the procedural requirements under the law, an attorney may be able to strip the lien from the property. Satisfy the debt. Negotiate a lower payoff. File for bankruptcy.

We would like to release the lien in respect of the below mentioned units pledged in our favour by the Investor, and we therefore, request you to kindly release the lien marked on the below mentioned units.

So the property can move into escrow how long does removing a lien take approximately five businessMoreSo the property can move into escrow how long does removing a lien take approximately five business days. That's it to get your own questions answered just visit the link in the description.

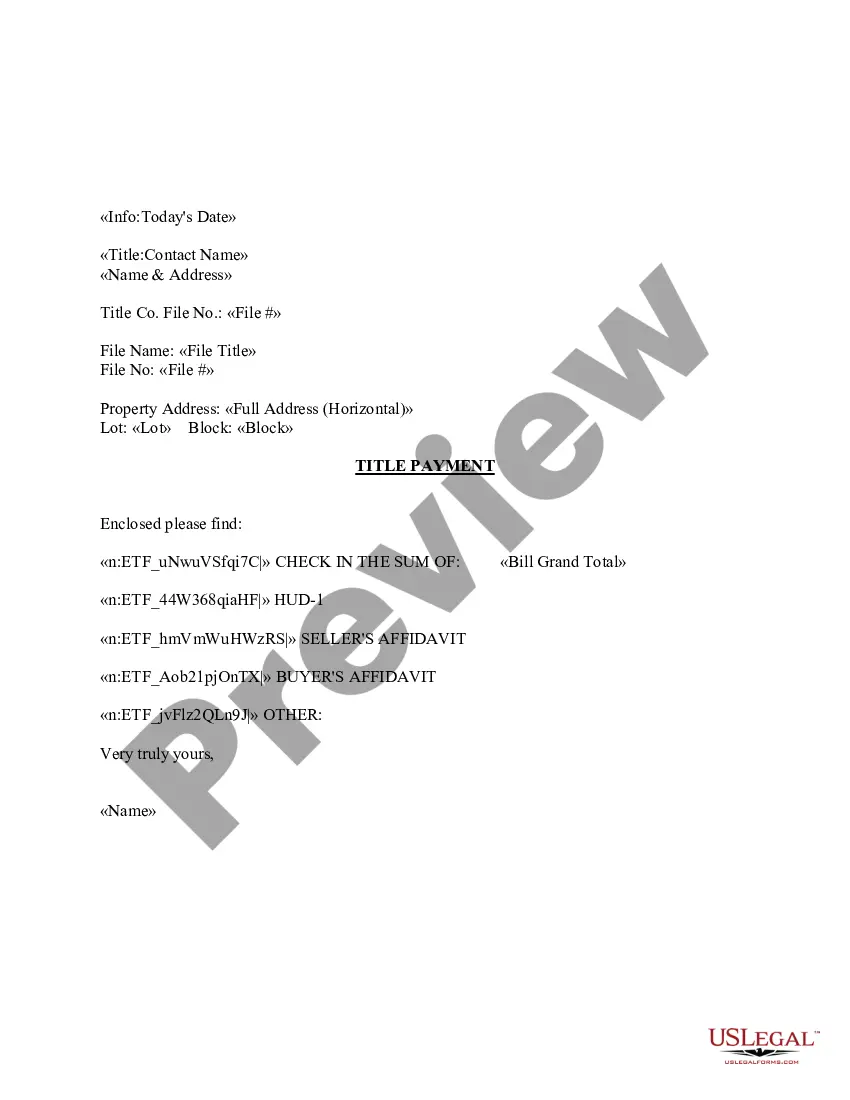

In most cases, the lien holder (the lender in this case) should send the release to be recorded within 30-90 days. If you aren't sure what the requirements are in your area, reach out to your real estate agent, title agent, or real estate attorney for guidance.

Lien Release: After a lien has been filed, the California claimant can release or cancel the lien by filing a Mechanics Lien Release form with the county recorder's office where the lien was originally recorded.