Payoff Mortgage Form Sample For Single In Ohio

Description

Form popularity

FAQ

A payoff request allows a third party to receive the current balance due to release a lien or facilitate a business transfer (bulk sale transfer or liquor license). To release a lien or facilitate a bulk sale transfer, businesses must be in good standing to receive a payoff request.

Under federal law, the servicer must generally send you a payoff statement within seven business days of your request, subject to a few exceptions. (12 C.F.R. § 1026.36.)

CRN or DRL (This can be found on your letter from the Ohio Attorney General's office.)

CRN or DRL (This can be found on your letter from the Ohio Attorney General's office.)

Taxpayers with additional questions on this subject may contact ODT by logging into OH|TAX eServices and selecting "Send a Message" under "Additional Services" or by calling 1-800-282-1780 (1-800-750-0750 for persons who use text telephones (TTYs) or adaptive telephone equipment).

Ohio Employer Account Number You can find this on any previous Contribution Rate Determination from the Ohio Department of Job and Family Services. If you're unsure, contact the agency at 614-466-2319.

The statement is provided by the mortgage servicer and can be requested at any time. Accurate payoff information is crucial for managing financial decisions related to property ownership.

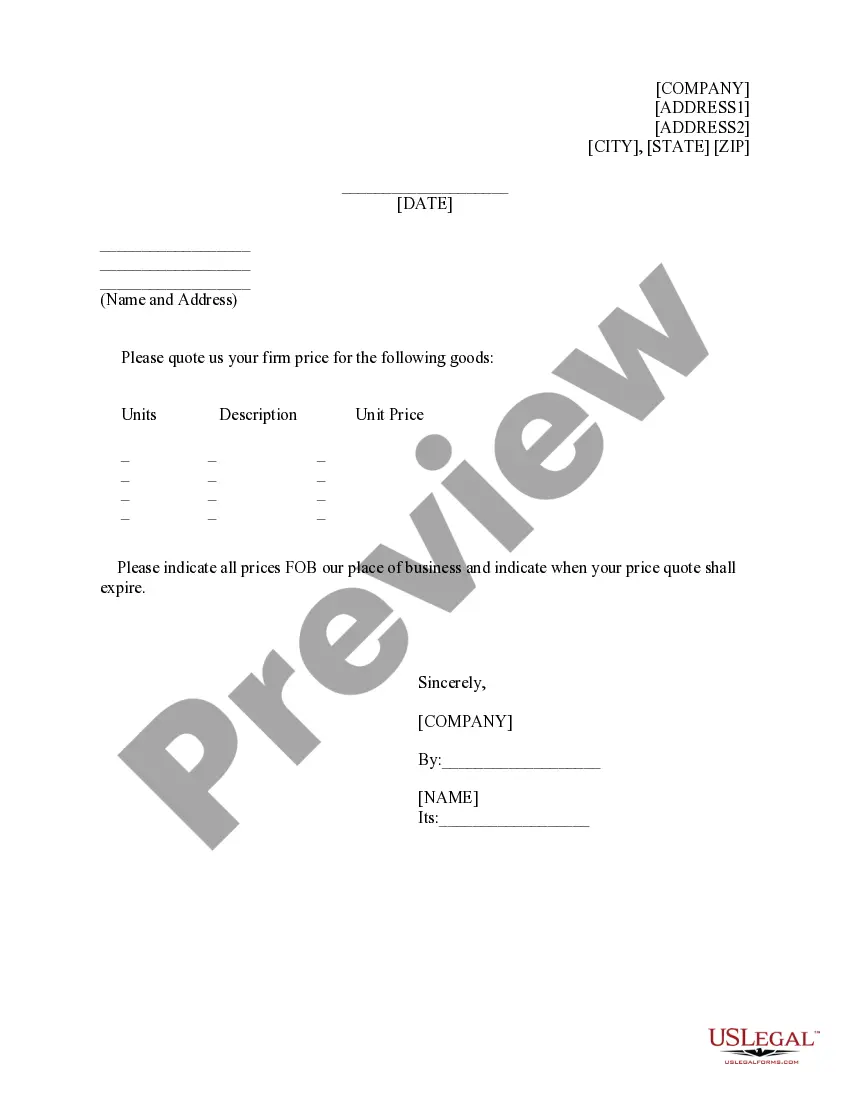

There's a process to getting the mortgage payoff statement. First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.