Escrow Seller Does Within 30 Days In Montgomery

Description

Form popularity

FAQ

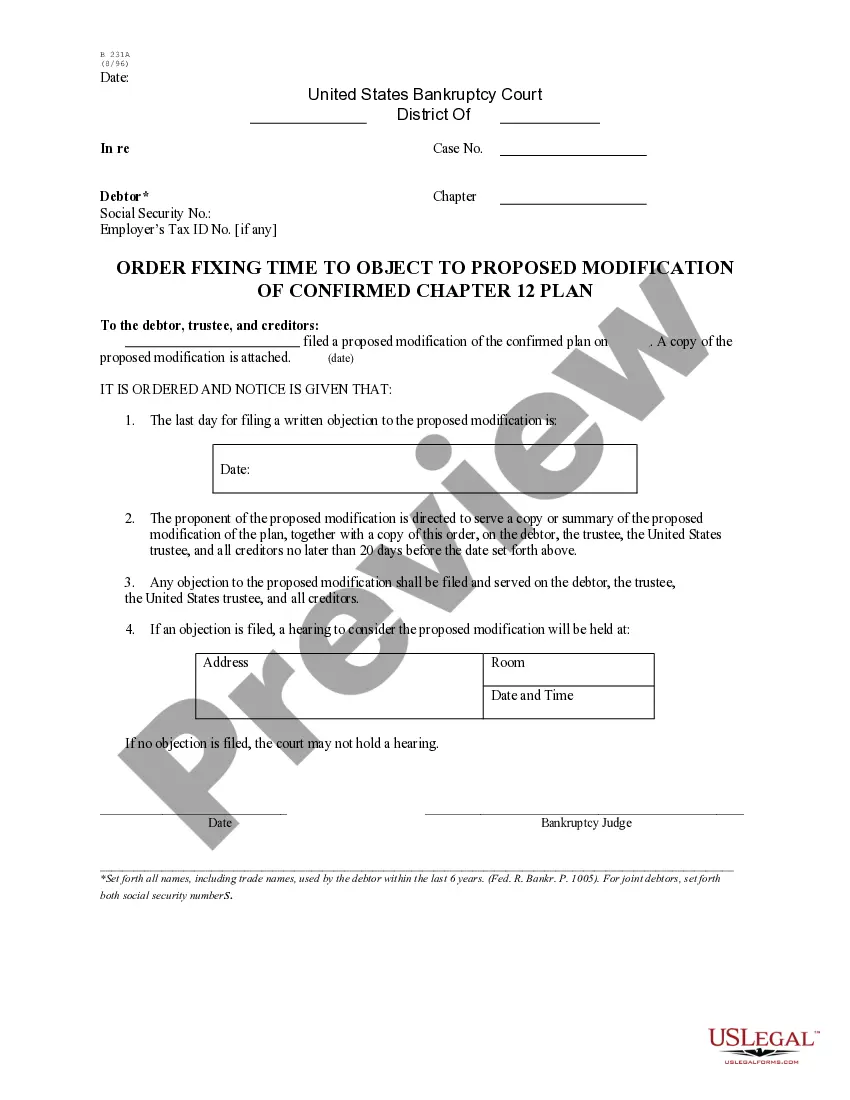

RULE No. Everyday must be counted regardless if it's a weekday, weekend, or holiday. There are two exceptions here. The escrow deposit is the first exception and allows for three “business” days. The second exception is when the last day falls on a Saturday, Sunday, or holiday.

It usually takes between 30 to 60 days for an escrow to close. Sometimes the escrow timeline can be shorter or longer. You and the Sellers agree to an escrow timeline during the contract negotiation.

Your lender will order a title report during the 30 day escrow period. Within a few days, the report will be prepared. The report will show the chain of ownership and if there are any outstanding liens against the property that need to be addressed.

A: A "typical" escrow is 30 days. That gives the title company time to pull up the title report and search for any liens, easements, lawsuits or other clouds on title.

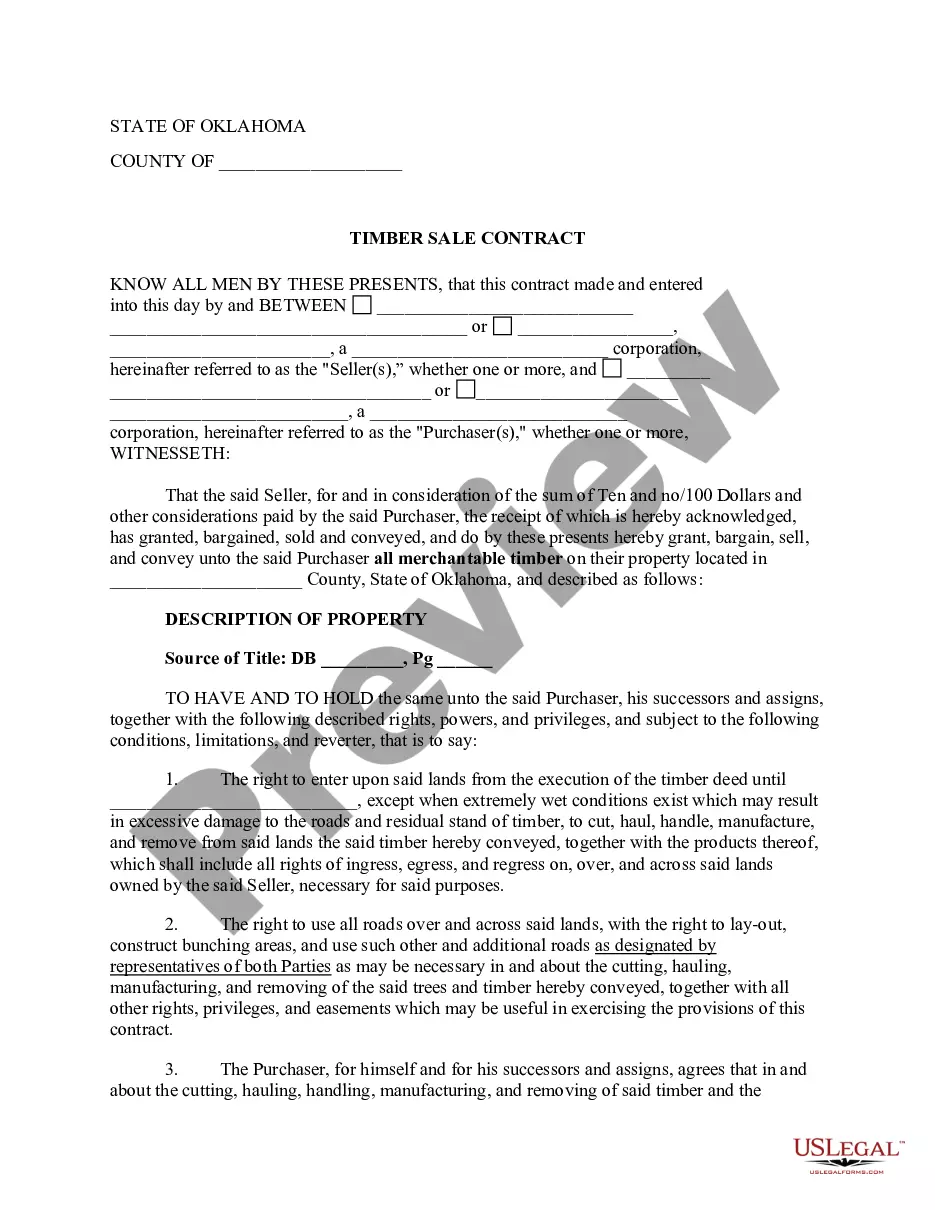

Common examples of delays at this stage include: – Building work – if building work has been carried out without the correct approvals this can cause a delay as it will need to be remedied, also if you are purchasing with a mortgage, your lender will have certain requirements with regards to this.

A house that's been on the market for 30 days, the sellers are probably getting desperate to sell. A house that's been on the market for 300 days hasn't sold because of the owners.

The amount of the tax bill is determined by two factors: (1) the assessment and (2) the property tax rate for each jurisdiction (state, county, & municipal). Assessments are based on the fair market value of the property and are issued by the Department of Assessments and Taxation, an agency of state government.

The amount of the tax bill is determined by two factors: (1) the assessment and (2) the property tax rate for each jurisdiction (state, county, & municipal). Assessments are based on the fair market value of the property and are issued by the Department of Assessments and Taxation, an agency of state government.

State Property Tax Exemption- Disabled Veterans and Surviving Spouses. Armed Services veterans with a permanent and total service connected disability rated 100% by the Veterans Administration may receive an exemption from real property taxes on the dwelling house and surrounding yard.

Real Estate Property tax levy increased from $0.70 to $0.75 per $100 of assessed value. Mobile Homes tax levy increased from $0.70 to $0.75 per $100 of assessed value. Personal Property tax levy remains at $2.55 per $100 of assessed value. Aircraft tax levy remains at $1.23 per $100 of assessed value.