This form is a deed of trust modification. It is to be entered into by a borrower, co-grantor, and the lender. The agreement modifies the mortgage or deed of trust to secure a debt described within the agreement. Other provisions include: renewal and extension of the lien, co-grantor liability, and note payment terms.

Trust Of Deeds For Property In Santa Clara

Description

Form popularity

FAQ

The Grantee is the buyer, recipient, new owner, or lien holder. When "vs." appears on legal documents, the Grantor is on the bottom, the Grantee is on the top.

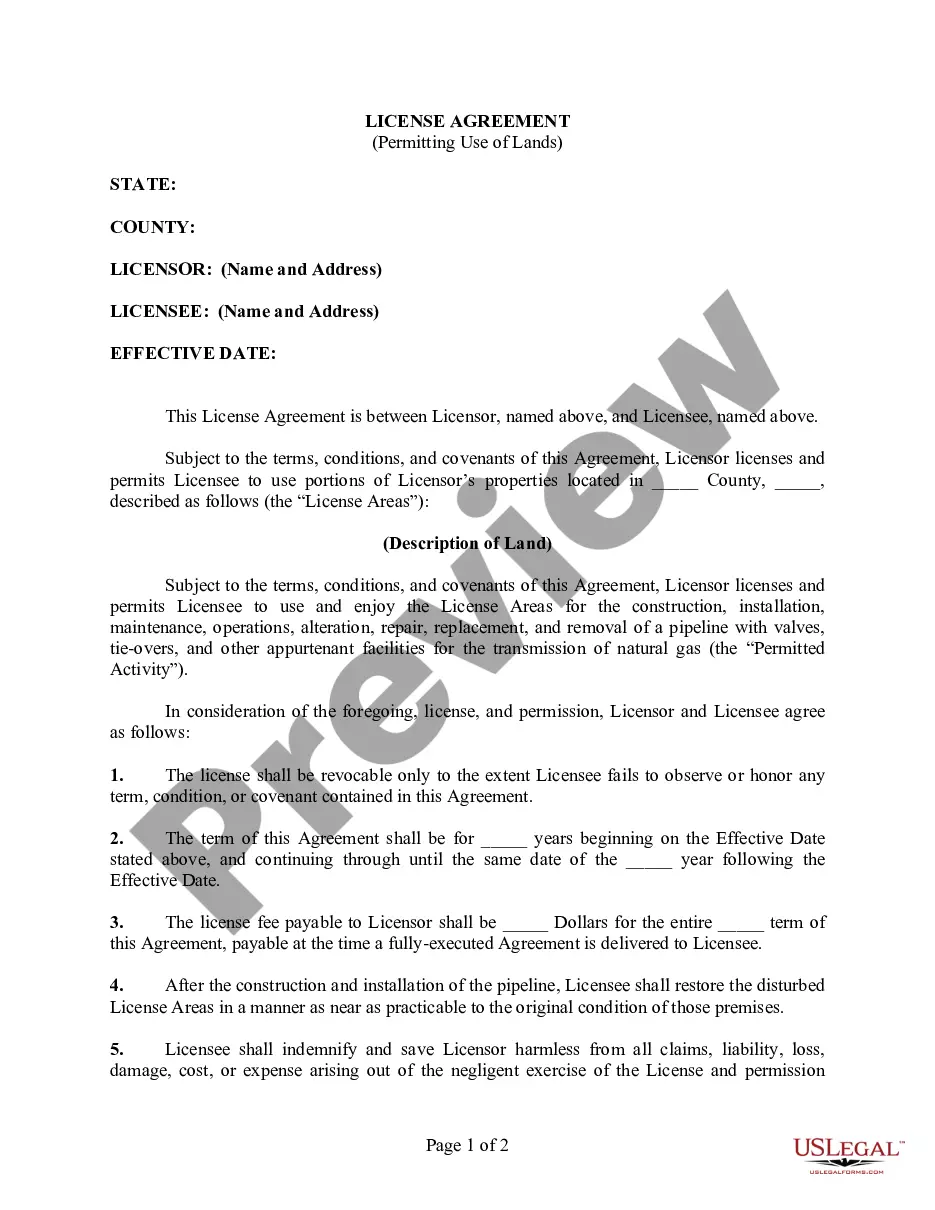

The assignment is typically from the originating lender, who purports to grant, assign, and transfer all beneficial interest in the deed of trust to the designated assignee.

It must: Be in writing. Have an amount which matches the amount on the Note(s) Have a date which matches the date on the Note(s) Have a complete legal description of the property(s) being encumbered (street address only is not sufficient)

Facilities for researching official records and maps are available at the Santa Clara County Clerk-Recorder's office main office. Note that document contents may only be viewed at the main office, not on-line.

You must choose the trust you want then draft and notarize a trust deed, record it and notify the relevant parties. The process is similar for all types of property.

The deed of trust must then be recorded with the county where the property is located, and each of the parties (the trustor, trustee, and lender) should keep a copy of the recorded document.

In California: “An unrecorded instrument is valid as between the parties thereto and those who have notice thereof.”

Disadvantages of a Trust Deed For borrowers, if financial circumstances change, default on repayment can result in property foreclosure.

Record the Signed Documents at the County Recorder's Office Take the original signed and notarized Deed of Trust and Promissory Note to the County Recorder's Office for the county where the property is located. In Sacramento, this is at 3636 American River Drive, Ste. 110, Sacramento CA 95864.

Ideally, an SMSF trust deed should be written in a way that doesn't require regular updating. However, the deed should be reviewed at least annually to ensure it's up to date.