Loan Modification Agreement Example In Santa Clara

State:

Multi-State

County:

Santa Clara

Control #:

US-00183

Format:

Word;

Rich Text

Instant download

Description

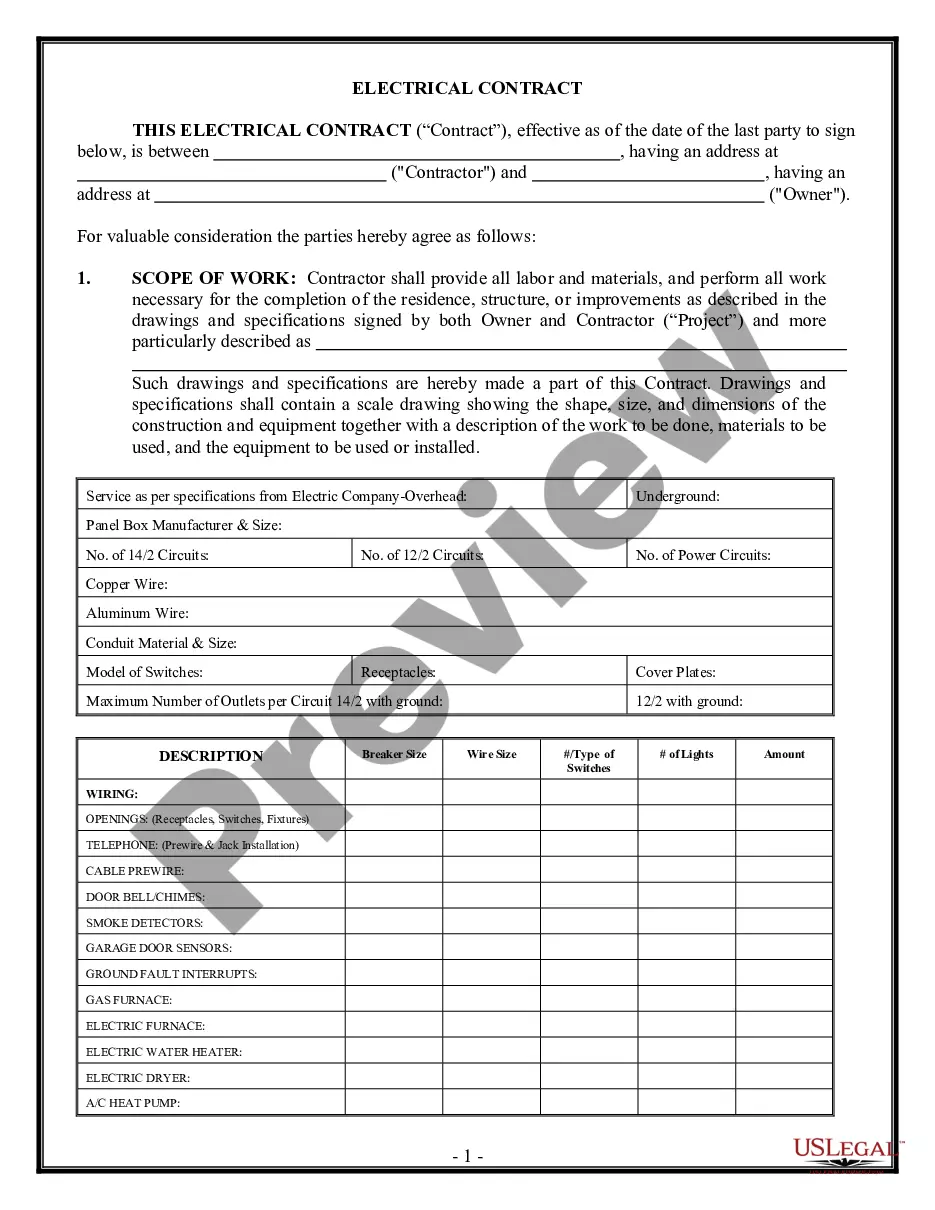

The Loan Modification Agreement example in Santa Clara is a legal document designed to modify existing mortgage or deed of trust obligations between a borrower and lender. Key features include the renewal and extension of the lien on the property, amendments to the security instrument, and co-grantor liability terms. Users are instructed to fill in specific dates, names, and financial figures that pertain to their agreement, ensuring clarity on payment obligations, interest rates, and potential penalties for late payments. This form serves as a valuable resource for various legal professionals, including attorneys, partners, owners, associates, paralegals, and legal assistants. They can utilize it to assist clients in modifying loan terms and securing better payment conditions. Additionally, the form outlines rights and responsibilities relating to the executed agreement, making it a comprehensive reference for managing borrower-lender relationships effectively. Overall, it ensures users have a structured method for negotiating changes to loan terms while adhering to legal requirements.

Free preview

Form popularity

FAQ

How to write a letter of agreement Title the document. Add the title at the top of the document. List your personal information. Include the date. Add the recipient's personal information. Address the recipient. Write an introduction paragraph. Write your body. Conclude the letter.

Yes you can, and changing your term won't affect your monthly payments. However, the term can be changed to coincide with the maturity of your repayment plan.

A forbearance agreement can act as a support system for borrowers who need time to get their finances in order after a temporary hardship, like a job loss. It will not, however, keep you out of foreclosure if you can't make the agreed-upon payments after your forbearance period ends.