Trust Deed Format For Ngo In San Jose

Description

Form popularity

FAQ

This Deed of Trust (the “Trust Deed”) sets out the terms and conditions upon which: Settlor Name (the “Settlor”), of Settlor Address, settles that property set out in Schedule A (the “Property”) upon Trustee Name (the “Trustee”), being a Company duly registered under the laws of state with registered number ...

You'll find most California property deeds at the County Clerk's office, also called the Registrar/Recorder office. Some of them provide online searches. Others require visiting their offices. For example, the San Diego County Clerk's Office provides online searches.

Some of the most common reasons trusts are invalid include: Legal formalities were not followed when executing the trust instrument. The trust was created or modified through forgery or another type of fraud. The trust maker was not mentally competent when they created or modified the trust.

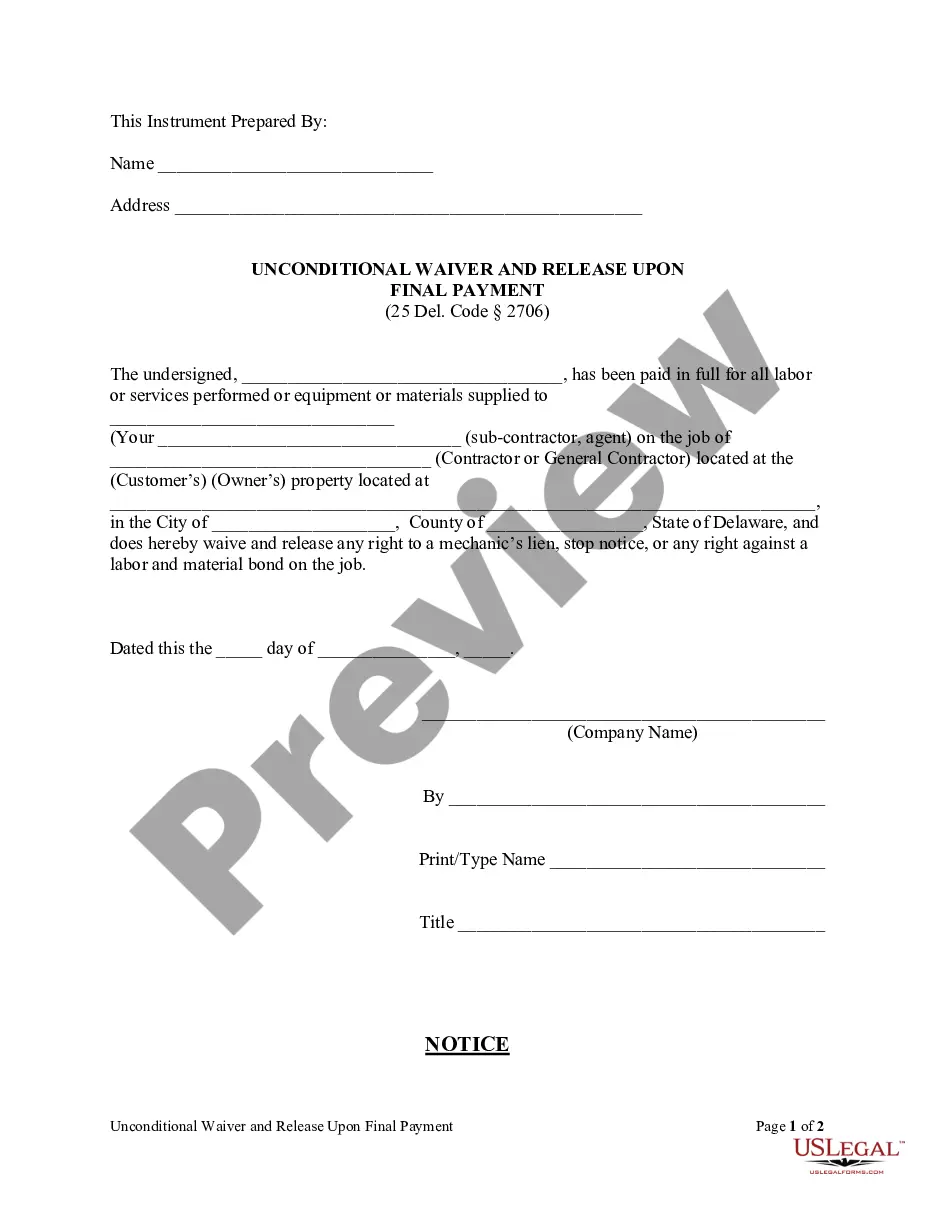

In California, a deed of trust must come with security, typically a promissory note. To be valid, a deed of trust must be (1) in writing, (2) with a description of the property, and (3) signed by the trustor of the deed of trust.

In California, a deed of trust must come with security, typically a promissory note. To be valid, a deed of trust must be (1) in writing, (2) with a description of the property, and (3) signed by the trustor of the deed of trust.

The following elements are essential for the formation of a Charitable Trust: An Author or Settlor of the Trust. The Trustee. The Beneficiary. The Trust Property or the Subject Matter of the Trust. The objects of the Trust.

Where to Get a Deed of Trust? To get a Deed of Trust, you must file the proper paperwork with the proper court as generally outlined above. These documents must be filed with the county clerk or recorder, and the lender typically sends them to the recording office after the property closing.

The Long Form, which could be 20-30 pages long, is the one used by institutional lenders.

Here is the rough outline: Select the trust that is best suited to your needs, such as a revocable living trust. Draft a trust deed and have it notarized so that it is legally binding. Record the deed at the county recorder's office. Notify the relevant parties, such as your mortgage lender and insurance provider.