Deed Of Trust Records For A Domain In New York

Description

Form popularity

FAQ

Is New York a Mortgage State or a Deed of Trust State? New York is a Mortgage state.

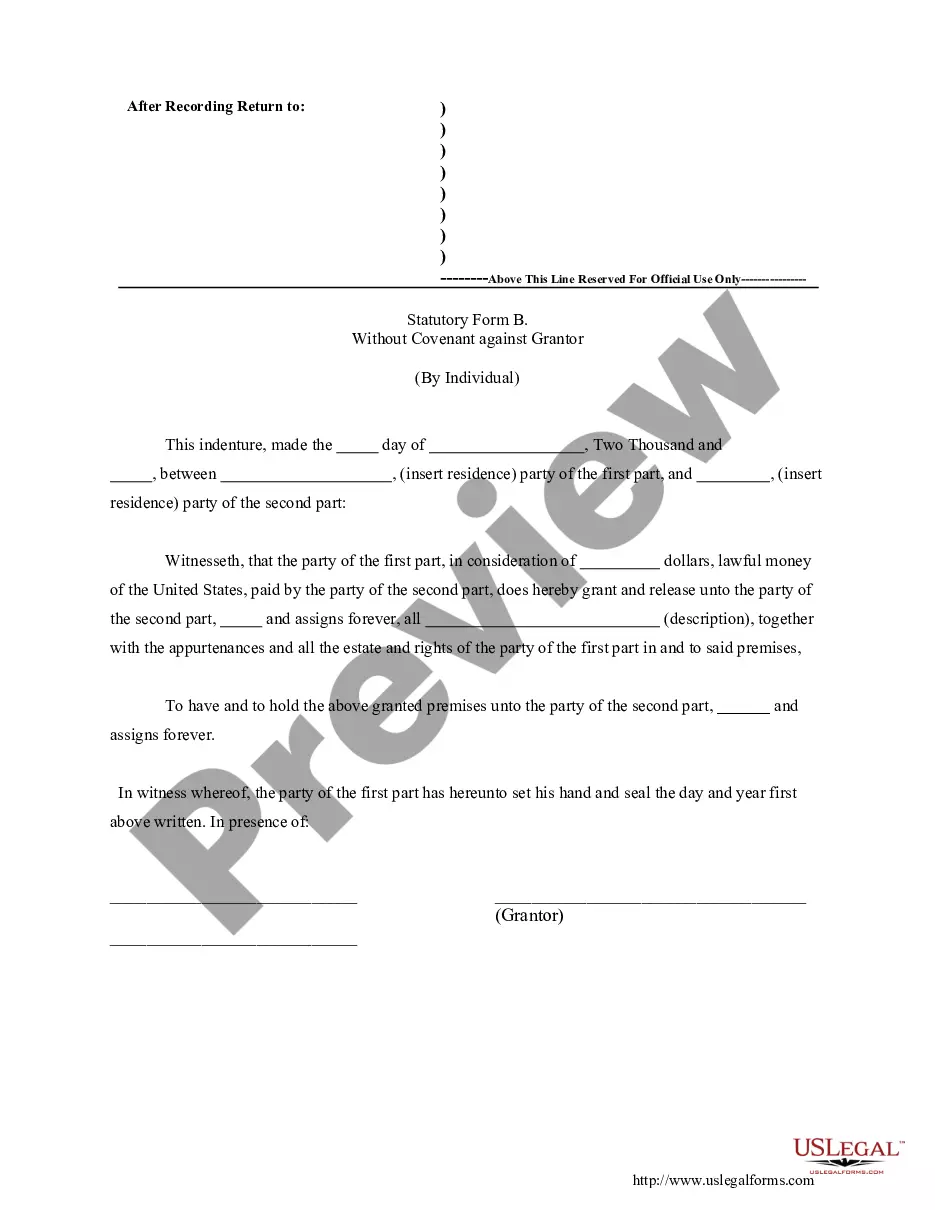

Check List for Recording Documents & Avoiding Rejections: Grantor/Transferor/Seller is the same. Grantee/Transferee/Buyer is the same. Deed must be completed with names and address of Grantor(s) & Grantee(s) Grantor(s) must be properly acknowledged by a notary public. All signatures must be original.

Deeds must be carefully drafted, delivered and recorded. The legal description of the property must be absolutely correct. Deficiencies in a deed can lead to a real estate dispute or even real estate litigation. Working with an experienced real estate attorney can help ensure the transaction is completed properly.

Disadvantages of a Trust Deed For borrowers, if financial circumstances change, default on repayment can result in property foreclosure.

A deed used to convey New York real property to a revocable trust. This Standard Document contains integrated notes and drafting tips.

You can search for property records and property ownership information online, in person, or over the phone with a 311 representative. Property owners of all boroughs except Staten Island can visit ACRIS. To search documents for Staten Island property, visit the Richmond County Clerk's website.

The seller's attorney will give the original deed to the buyer's attorney at closing. That original then gets recorded at the clerk's office of the local municipality. The clerk's office scans and records the document into the land records and then sends it to the buyer or their attorney.

So be sure to check with your county recorder's office for more. Information. Take a look at theMoreSo be sure to check with your county recorder's office for more. Information. Take a look at the links in the description below to learn more.