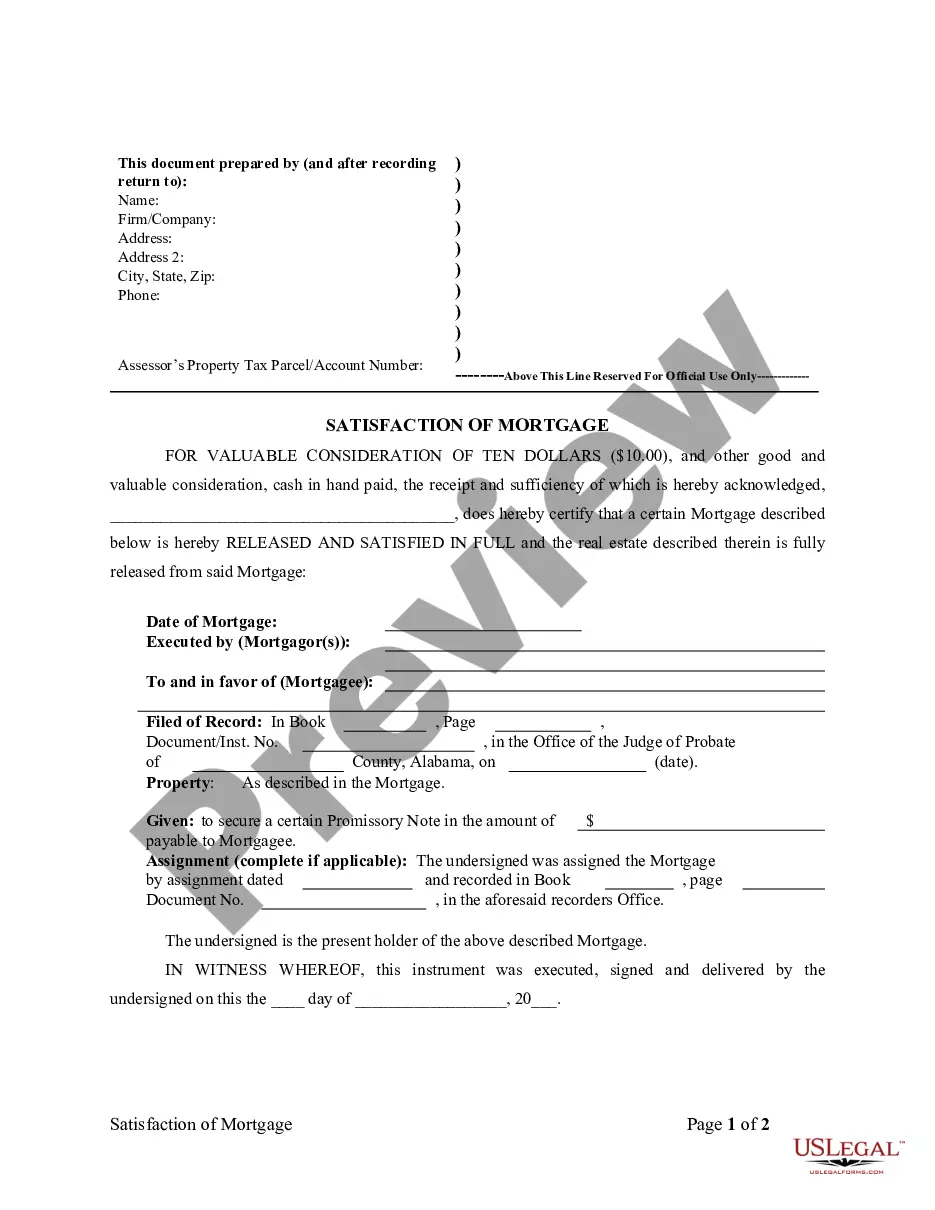

This form is a deed of trust modification. It is to be entered into by a borrower, co-grantor, and the lender. The agreement modifies the mortgage or deed of trust to secure a debt described within the agreement. Other provisions include: renewal and extension of the lien, co-grantor liability, and note payment terms.

Deed Of Trust For Form 17 In Michigan

Description

Form popularity

FAQ

Sign and date your deed Sign and date the quitclaim deed in a notary's presence, then file it with the county Register of Deeds Office in the property's county, not the county where you live. Once the deed is filed and recorded, the transfer is deemed legal.

Affidavit must be filed by the new owner with the assessor for the city or township where the property is located within 45 days of the transfer. The information on this form is NOT CONFIDENTIAL.

The Michigan statute does not require the trust document to be filed as part of the registration. To register the trust, the trustee files a statement that includes the trustee's name and address and acknowledges the trusteeship.

Only three states "require" trust registration, but even in those states, there are no legal consequences or penalties if you don't.

Use the following steps to set it up. Step 1: Choose between individual or joint trust. Step 2: Decide what property to include in the trust. Step 3: Choose a trustee. Step 4: Decide who will be the trust's beneficiaries. Step 5: Create a living trust document. Step 6: Sign the trust document in front of a notary public.

The trustee of a trust with its principal location of administration in Michigan may register the trust with the probate court in the location specified in the trust document.

The forms must be filed in the probate court. See also indexes for general, general civil, and general probate forms for other forms which are used in probate estate and trust proceedings as appropriate.

A Michigan deed of trust is a real estate document used in conjunction with a promissory note to place a property title in a trust until the borrower has repaid the lender in full. The arrangement involves three (3) parties: the borrower, the lender, and a trustee.

Michigan is a Mortgage state and Deed of Trust state.

Michigan doesn't allow real estate to be transferred with transfer-on-death deeds. There is a type of deed available in Michigan known as an enhanced life estate deed, or "Lady Bird" deed, that functions like a transfer-on-death deed. This type of deed isn't common. For more information, see Lady Bird Deeds.