Change Deed Trust With Future Advance Clause In Michigan

Description

Form popularity

FAQ

A deed of trust can benefit the lender because it allows for a faster and simpler way to foreclose on a home — typically months or even years faster.

Power of Sale Clause A power of sale provision is a significant element of a deed of trust, as it states the conditions when a trustee can sell the property on behalf of the beneficiary. Typically, this predicts when you will be delinquent on your mortgage.

So, the short version of this new law is that the taxable value of residential property WILL NOT be uncapped on the owner's death if: (a) the property is transferred to a close family member (this includes parents, children, adopted children, siblings, grandparents and grandchildren); and (b) the property is not “used ...

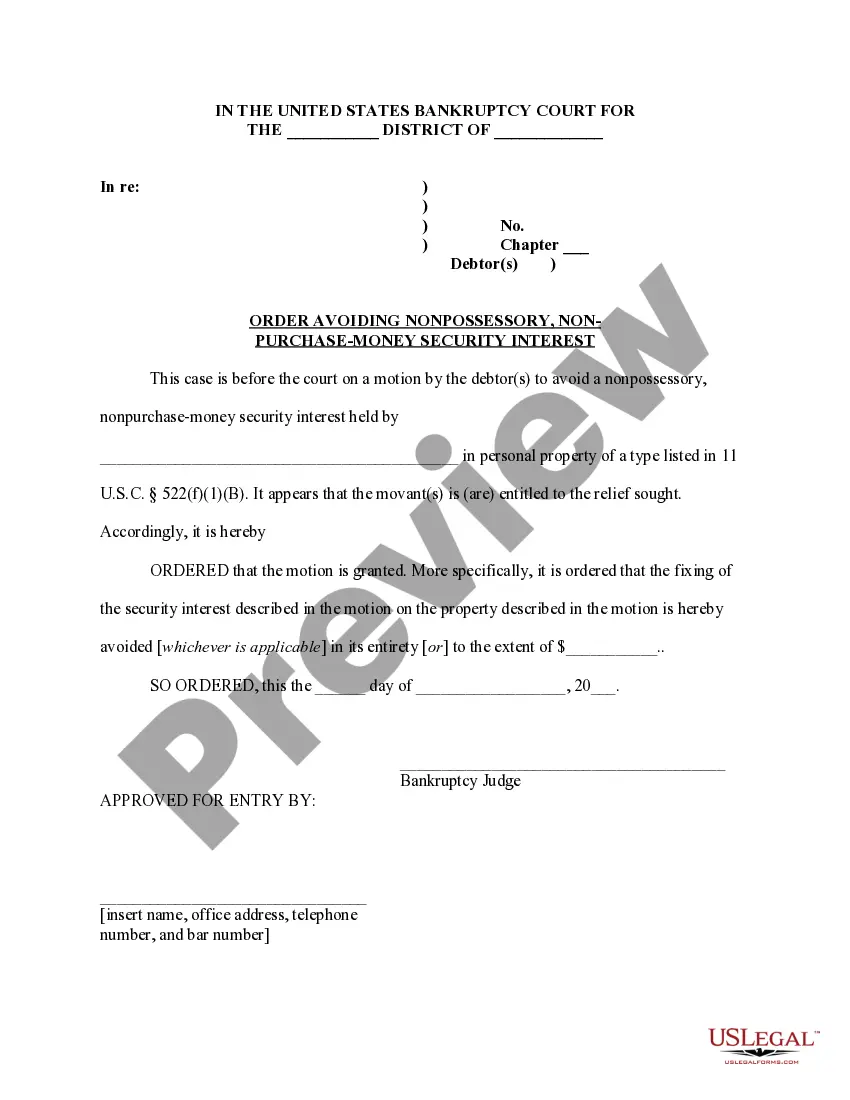

(a) "Future advance" means an indebtedness or other obligation that is secured by a mortgage and arises or is incurred after the mortgage has been recorded, whether or not the future advance was obligatory or optional on the part of the mortgagee.

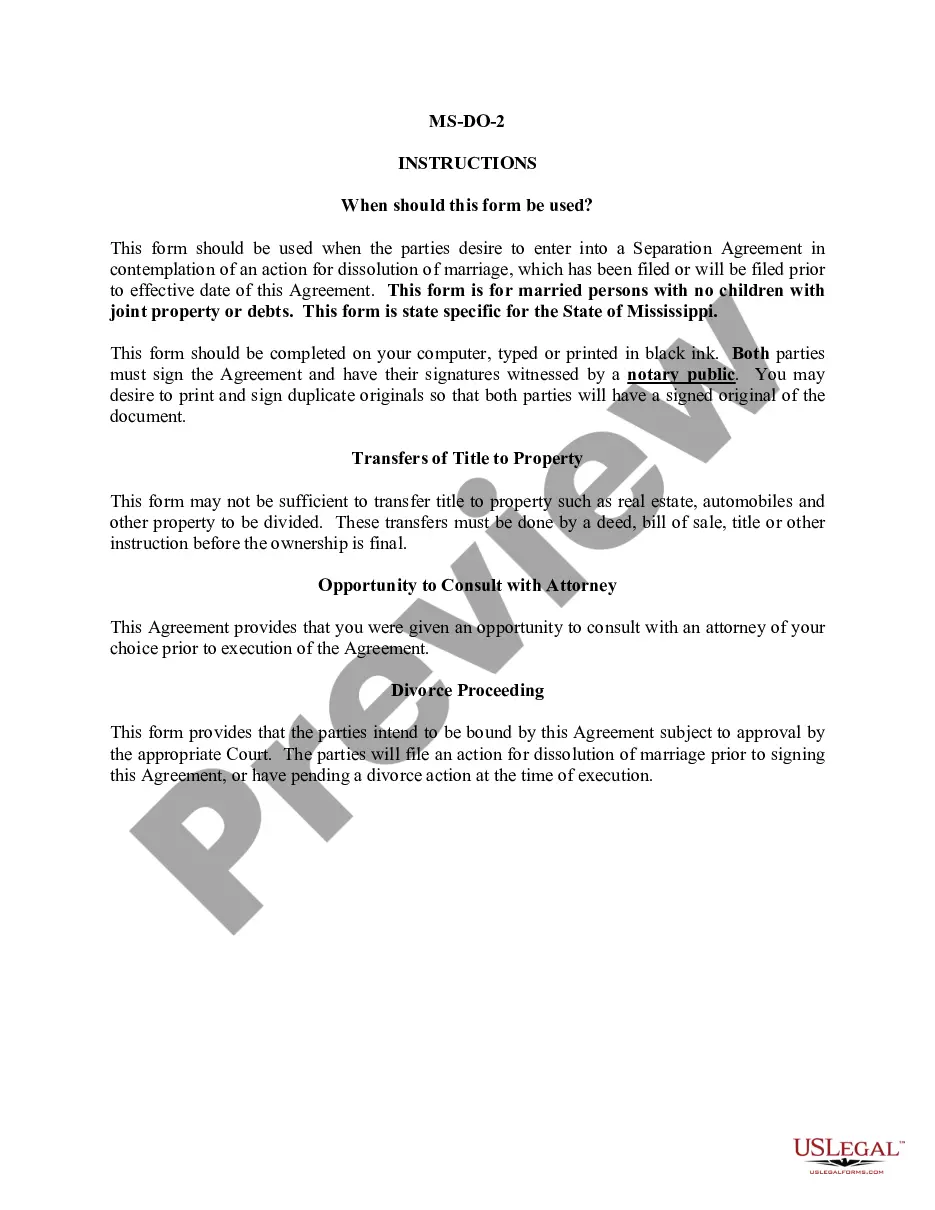

In most cases, if there is a conflict between a valid will and a valid lady bird deed, the deed will prevail. This is because the lady bird deed is a present transfer of a future interest that is subject to divestment at the discretion of the property owner.

Risk of Lenders' Claims: The lender may have claims to the property in the event the owner defaults on the mortgage. This could complicate the transfer of the property upon the owner's death. State Law Differences: Different states have varying laws that may affect how a Lady Bird Deed is treated.

Use of a Lady Bird deed is not a preferred method in some situations, such as when an owner is likely to die leaving a sizable unpaid lien on the property. It may be inadvisable where an owner wishes to leave the property to multiple (more than 2 or 3) default beneficiaries, particularly if they do not get along.

It is commonly found in an open-end mortgage or deed of trust, which allows the borrower to borrow additional sums in the future, secured under the same instrument and by the same security.

Sign and date your deed Sign and date the quitclaim deed in a notary's presence, then file it with the county Register of Deeds Office in the property's county, not the county where you live. Once the deed is filed and recorded, the transfer is deemed legal.