Deed Of Trust Modification With Wells Fargo In Houston

Description

Form popularity

FAQ

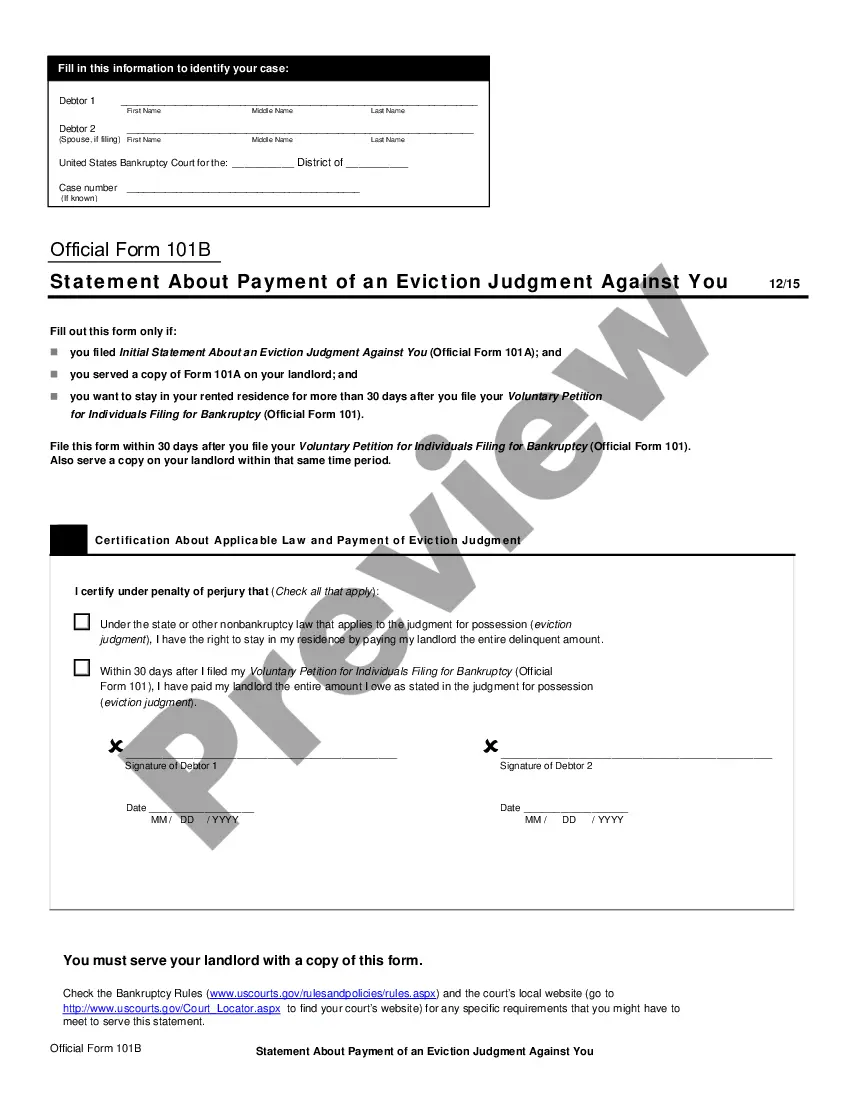

WHERE DO I RECORD THE DEED? After the deed has been signed and notarized, the original needs to be filed and recorded with the county clerk in the county where the property is located. You can mail the deed or take it to the county clerk's office in person. Only original documents may be recorded.

Transferring real estate to a living trust in Texas involves signing a deed that transfers the interest in the property to the trust and then recording this deed with the county to formalize the transfer. A wide range of financial accounts, including bank accounts, can also be transferred to a living trust.

The deed of trust must then be recorded with the county where the property is located, and each of the parties (the trustor, trustee, and lender) should keep a copy of the recorded document.

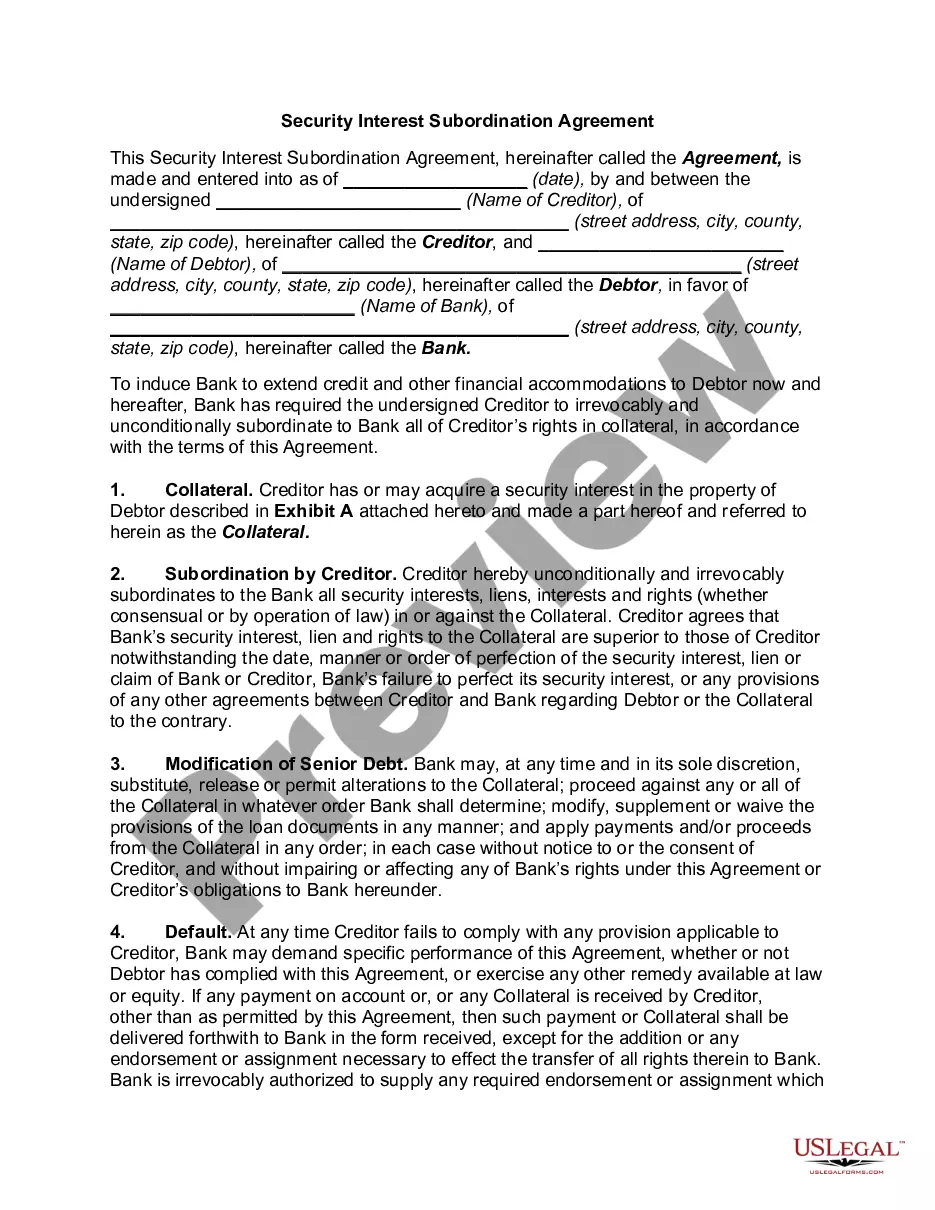

Deed of Trust Modification means, with respect to any Deed of Trust, a modification agreement entered into between the Borrower or the Project Owner, as applicable, and the Lender, modifying the terms and conditions of the Deed of Trust in order to (i) add to the lien of the Deed of Trust Additional Lots, or (ii) make ...

If you want to add your new spouse to your property deed, you can usually do this through a quitclaim deed. Depending on where you live, you may be able to create a new deed yourself, but in some locations you may need to get it notarized, file it with your county clerk, and/or utilize an attorney.

A modification is a change or alteration, usually to make something work better. If you want to change something — in other words, modify it — you need to make a modification. Lots of things require modification, because they get older or just because they can be improved.

Deed of Trust Modification means, with respect to any Deed of Trust, a modification agreement entered into between the Borrower or the Project Owner, as applicable, and the Lender, modifying the terms and conditions of the Deed of Trust in order to (i) add to the lien of the Deed of Trust Additional Lots, or (ii) make ...

To reform or change a deed, the parties to the deed must bring a legal action before a circuit court requesting that the court “fix” the deed by issuing a judgment or order stating the original intent of the parties, and what needs to be legally changed.

Where to Get a Deed of Trust? To get a Deed of Trust, you must file the proper paperwork with the proper court as generally outlined above. These documents must be filed with the county clerk or recorder, and the lender typically sends them to the recording office after the property closing.