Deed Of Trust Modification With Lien In Hillsborough

Description

Form popularity

FAQ

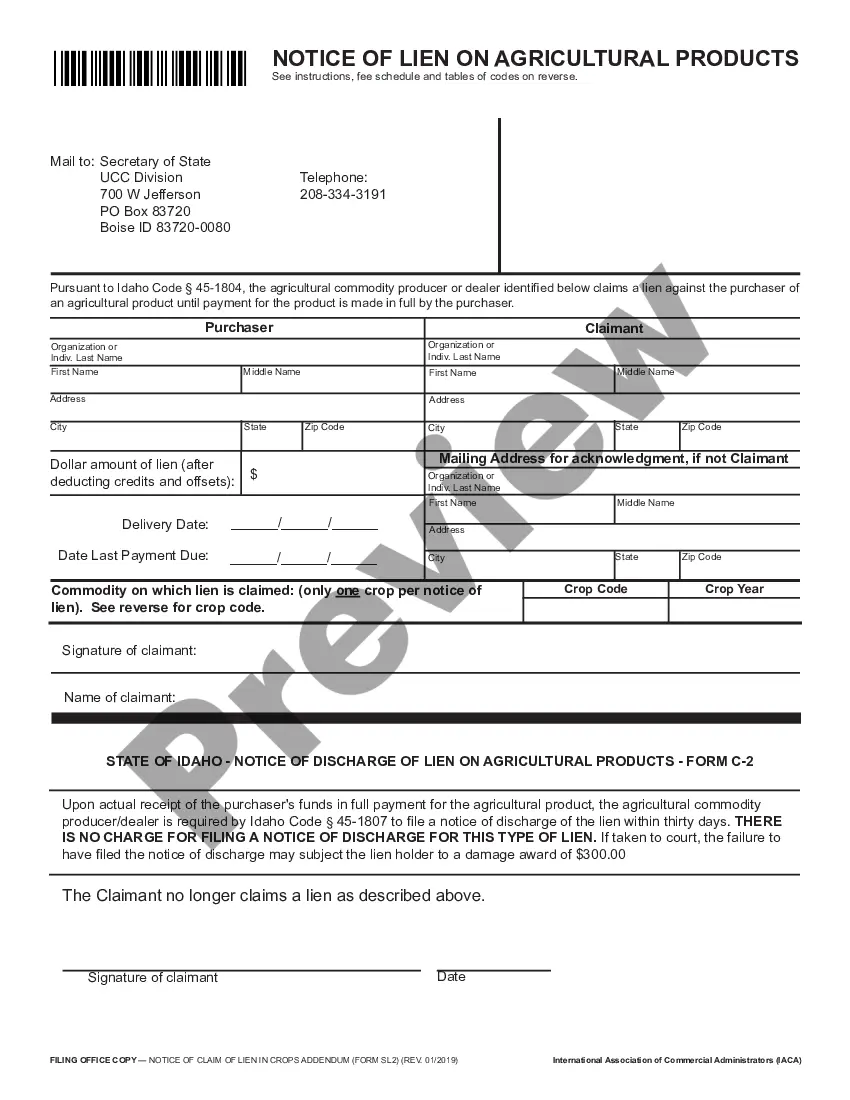

Deed of Trust Modification means, with respect to any Deed of Trust, a modification agreement entered into between the Borrower or the Project Owner, as applicable, and the Lender, modifying the terms and conditions of the Deed of Trust in order to (i) add to the lien of the Deed of Trust Additional Lots, or (ii) make ...

Tampa, Florida 33619-0917 Submit paper title or a completed HSMV 82101 if unable to locate paper title. Your customer should sign a completed form HSMV 82139 Notice of Lien. Submit the completed form HSMV 82139 and a check (see fees) to the Tax Collector's office. The lien will be added to show you as lienholder.

A deed of trust creates a lien on the purchased property when it is executed and delivered by the trustor/borrower to the beneficiary (usually the lender). Once executed and delivered, the deed of trust takes priority as a security against the property in relation to any other liens previously recorded.

The terms of a trust can only be validly amended when the amendment complies with the existing trust deed and rules. We assist by reviewing the existing trust rules and providing amendment documentation that ensure that the variation of trust terms remain compliant and effective. What's included: letter of advice.

What is a discretionary trust by deed of variation? A deed of variation is a legal document that 'redirects' a beneficiary's interest in an estate. It is then possible to set up a discretionary trust to receive the interest, providing further flexibility.

Deed of Trust Modification means, with respect to any Deed of Trust, a modification agreement entered into between the Borrower or the Project Owner, as applicable, and the Lender, modifying the terms and conditions of the Deed of Trust in order to (i) add to the lien of the Deed of Trust Additional Lots, or (ii) make ...

Tampa, Florida 33619-0917 Submit paper title or a completed HSMV 82101 if unable to locate paper title. Your customer should sign a completed form HSMV 82139 Notice of Lien. Submit the completed form HSMV 82139 and a check (see fees) to the Tax Collector's office. The lien will be added to show you as lienholder.

How Do I Add or Change a Name on my Deed? The only way to change or add a name to a deed is by having a new deed prepared.

To change the name on a deed, you must record a new deed with Official Records to replace the deed currently on file. You can obtain a blank deed form from an office supply store. The staff in the Recording Department cannot assist you with filling out the form, as it is a legal document.

How Do I Add or Change a Name on my Deed? The only way to change or add a name to a deed is by having a new deed prepared.