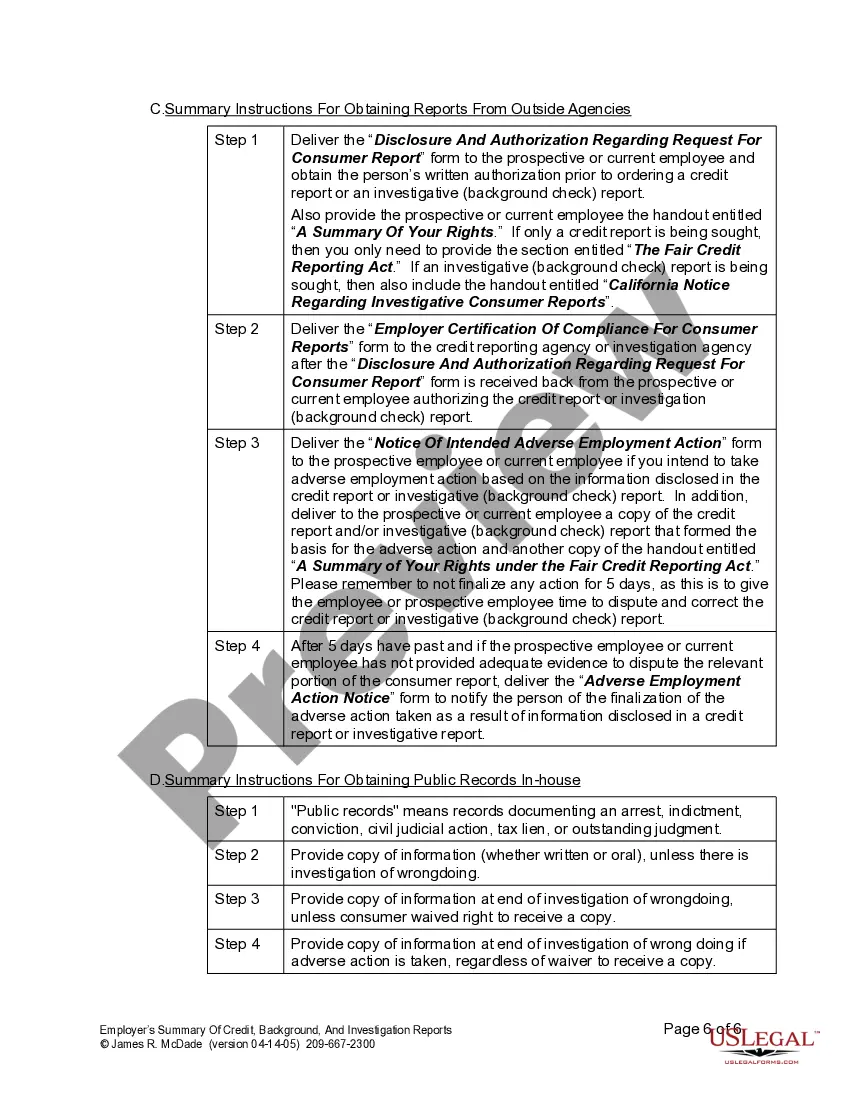

This document outlines the federal and state legal standards an employer must follow when requesting a consumer credit report or a background investigation on an employee or potential employee.

California Employer's Summary of FCRA Investigation Reports

Description

How to fill out California Employer's Summary Of FCRA Investigation Reports?

If you are looking for accurate California Employer's Summary of FCRA Investigation Reports samples, US Legal Forms is what you require; locate documents created and verified by state-certified legal professionals.

Utilizing US Legal Forms not only spares you from troubles regarding legal paperwork; you also conserve effort, time, and money! Downloading, printing, and completing a professional document is considerably cheaper than hiring a lawyer to do it for you.

And that’s it. In just a few simple clicks, you have an editable California Employer's Summary of FCRA Investigation Reports. After you register, all future orders will be processed even more efficiently. Once you have a US Legal Forms subscription, just Log In to your profile and click the Download button you see on the form's page. Then, when you need to use this template again, you'll always be able to locate it in the My documents section. Don't waste your time and energy comparing numerous forms across different online sources. Purchase reliable templates from one trusted platform!

- To start, finish your registration process by providing your email and setting up a password.

- Follow the steps outlined below to set up your account and find the California Employer's Summary of FCRA Investigation Reports template to address your needs.

- Utilize the Preview option or review the document details (if available) to confirm that the sample is the one you need.

- Verify its relevance in your state.

- Click on Buy Now to place your order.

- Select a suitable pricing plan.

- Create an account and pay using your credit card or PayPal.

Form popularity

FAQ

2022 You have the right to know what is in your file.report; 2022 you are the victim of identity theft and place a fraud alert in your file; 2022 your file contains inaccurate information as a result of fraud; 2022 you are on public assistance; 2022 you are unemployed but expect to apply for employment within 60 days.

Nearly all background checks include a criminal-history check, based on information supplied by the candidate, including their Social Security number. Criminal background checks will reveal felony and misdemeanor criminal convictions, any pending criminal cases, and any history of incarceration as an adult.

The FCRA defines a consumer report as any written or oral communication that meets all of the following conditions:220e It bears on a consumer's creditworthiness, credit standing, credit capacity, character, general reputation, personal characteristics, or mode of living.

(e) The term "investigative consumer report" means a consumer report or portion thereof in which information on a consumer's character, general reputation, personal characteristics, or mode of living is obtained through personal interviews with neighbors, friends, or associates of the consumer reported on or with

The FCRA gives you the right to be told if information in your credit file is used against you to deny your application for credit, employment or insurance. The FCRA also gives you the right to request and access all the information a consumer reporting agency has about you (this is called "file disclosure").

A credit report is a specific type of consumer report used for lending, while the broader term "consumer report" could be used to describe things like your driving history or criminal record.

Employers should be aware that California law generally limits an investigative consumer report inquiry regarding public records to the past seven years (10 years for bankruptcy filings).

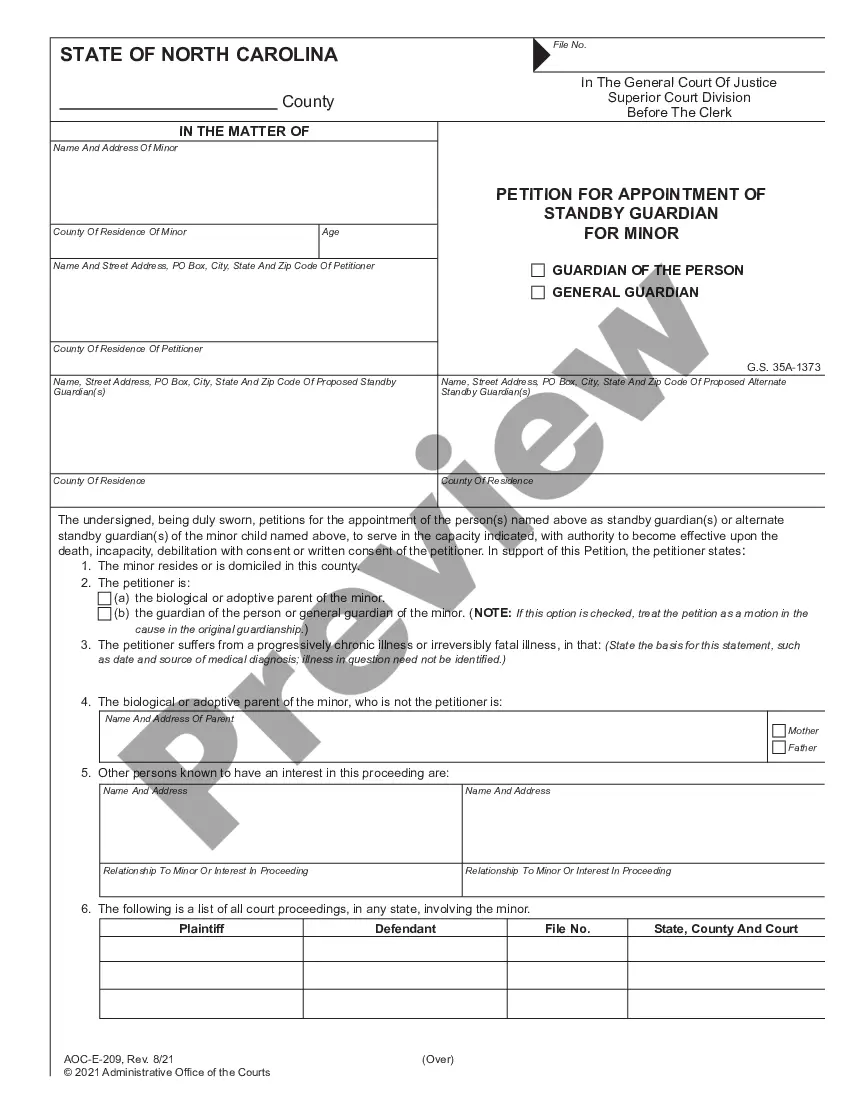

When you apply for a job, your prospective employer may use a consumer report to evaluate you as a potential employee. A consumer report is a collection of documents that may include credit reports, criminal and other public records such as bankruptcy filings, and records of civil court procedures and judgments.

Finally, if the furnisher determines that the disputed information is inaccurate or incomplete or cannot be verified, the furnisher must promptly modify or delete the information or permanently block the reporting of that information.