Deed Of Trust With Future Advance Clause In Bronx

Description

Form popularity

FAQ

Deeds of trust almost always include a power-of-sale clause , which allows the trustee to conduct a non-judicial foreclosure - that is, sell the property without first getting a court order.

The lien priority of a future advance is determined by the law of the state in which the real property security is located. Lien priority under state law may depend on specific factors, such as whether: The future advance is deemed obligatory or optional. The intervening lien is a mechanic's lien.

The "Future Advances" clause in a contract specifies that the lender agrees to provide additional funds to the borrower at a later date, under predetermined conditions. It outlines the terms and conditions for these subsequent loans, ensuring they are legally tied to the original contract.

The Future Advances Endorsement insures the lender that the validity and enforceability of the mortgage will not be affected because the mortgage contains a future advances provision.

Granting Clause: The clause in the deed that lists the grantor and the grantee and states that the property is being transferred between the parties.

If the asset is a house, you must execute a new deed giving it to the trust. If the asset is a car, you must transfer the title to the trust. If the asset is a bank account, you must transfer the funds to a new bank account in the name of the trust.

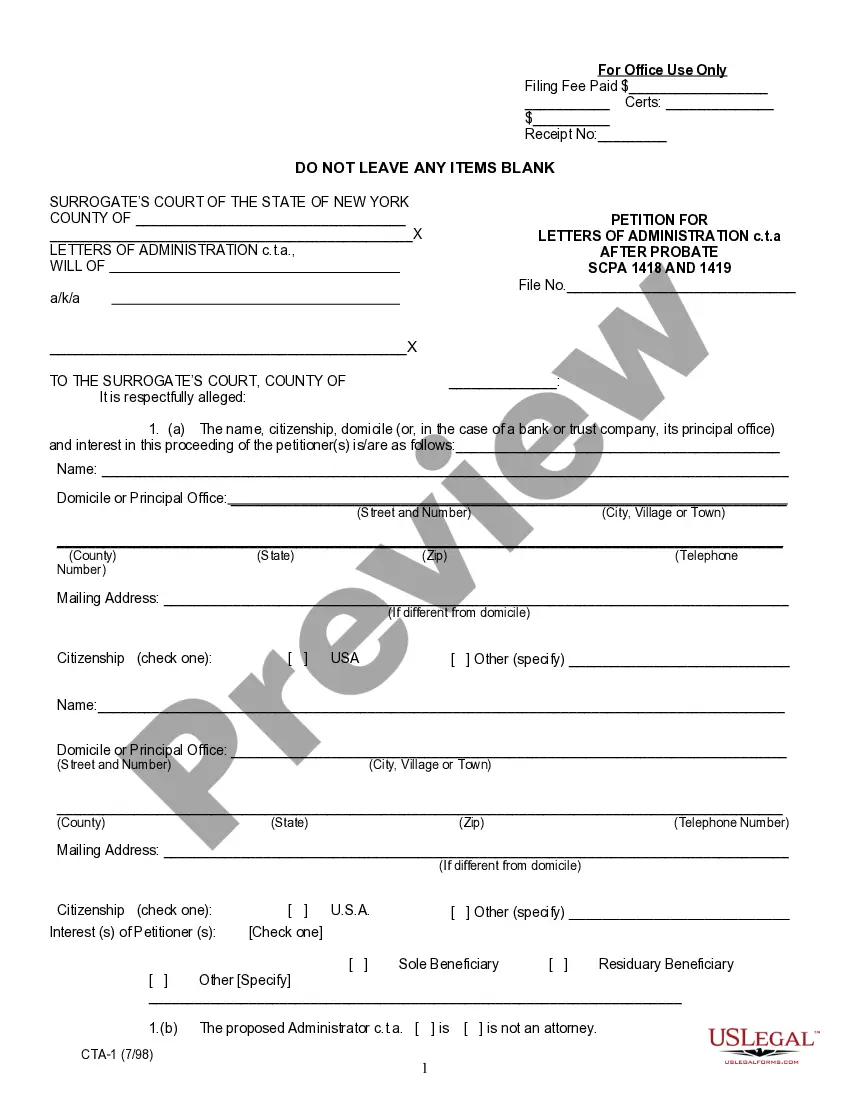

In New York, although deeds of trust are permitted by law, a mortgage is the most common instrument used to create a lien on real property.

In real estate, a grantee is the recipient of the property, and the grantor is a person who transfers ownership rights of a property to another person. However, the specifics of their transaction may vary depending on the situation.

The granting clause grants the property with its related rights and appurtenances, beginning with “grants, sells, and conveys.” The habendum clause defines the extent of property ownership conveyed to the grantee, beginning with “to have and to hold.” The warranty clause describes the warranties of title made by the ...