Bill Sales Format Printable With Gst In Ohio

Description

Form popularity

FAQ

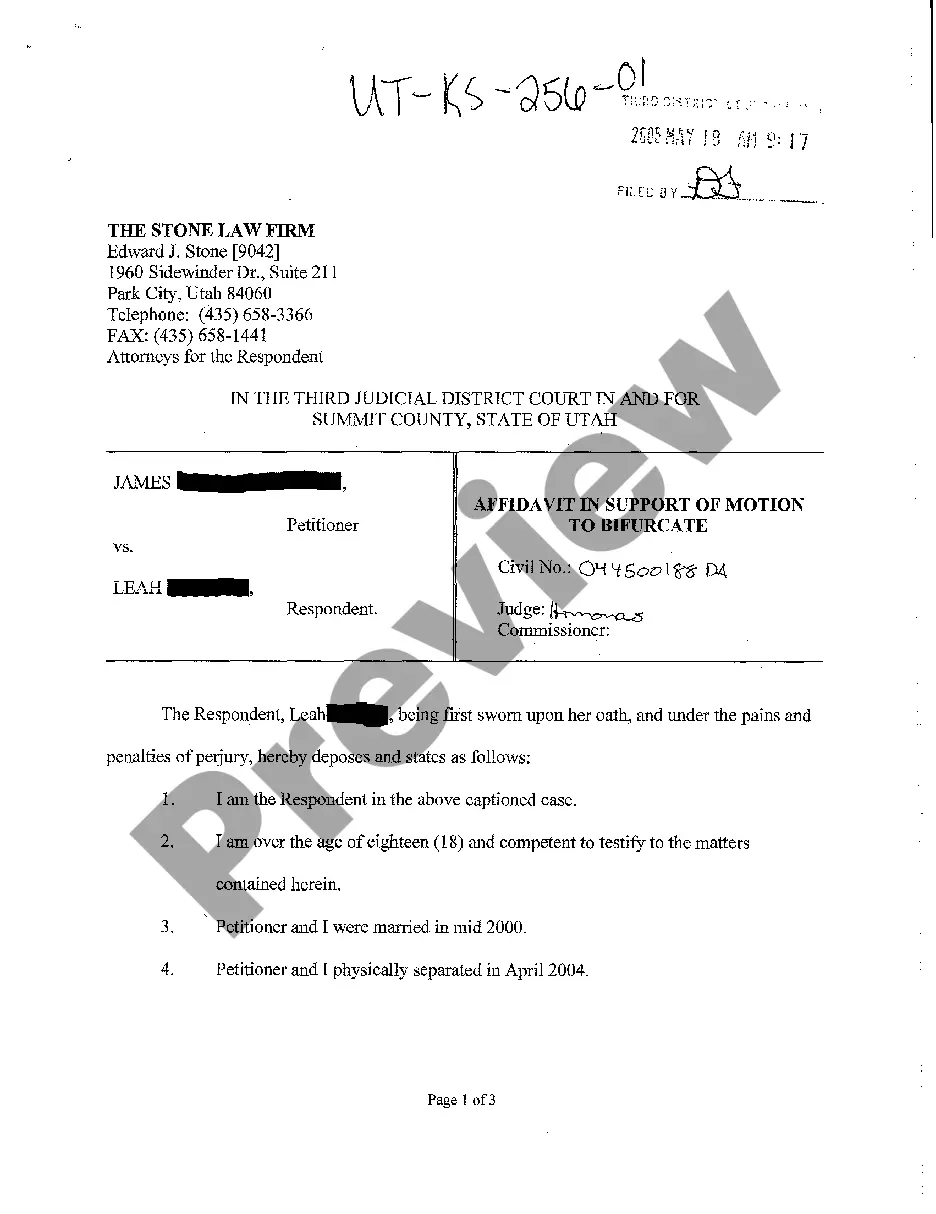

The buyer and seller must also sign a bill of sale and have it notarized. This is to protect buyers from unknowingly buying a vehicle that is unlikely to be fully insurable and may be dangerous.

Many states don't mandate notarization for bills of sale. States like California, Texas, Florida, Ohio, and New York allow transactions without a notarized document. In these states, a signed bill of sale is often sufficient for legal purposes, provided it includes all required information.

Ohio levies sales tax of 5.75% on a state level plus 0.75% to 2.25% on a county level and in some cases there is a 0.5% special sales tax. As of October 2022, the average combined sales tax rate is 7.26%.

Writing a state of Ohio bill of sale is a simple process. Start by using our easy-to-use, customizable template. Provide the legal names, addresses, and contact information of both the buyer and the seller. Describe the item being sold, including the make, model, year, color, and any unique identifiers.

If the seller withholds information from the buyer, or misrepresents the value of an item, this may render a bill of sale null and void.

Many states don't mandate notarization for bills of sale. States like California, Texas, Florida, Ohio, and New York allow transactions without a notarized document. In these states, a signed bill of sale is often sufficient for legal purposes, provided it includes all required information.

Common exemptions from Ohio sales and use tax: Groceries and food sold for off premises consumption. Prescription medicines. Housing related utilities, such as gas, electric, water and steam. Many items used in farming or manufacturing.

Start by determining whether you have a compliance obligation in a state. If so, register with your state's taxing agency before collecting any sales tax. After you've gone through the state's registration process, you are then permitted to collect sales tax on your transactions.

Ohio uses both destination and origin sourcing. Sales by an Ohio vendor to an Ohio consumer (intrastate sales) are generally sourced to the location where the order was received (which may be different from where the order is processed or shipped).

Manual Online Upload of Invoice on GSTN Step 1: Login to your GST account. GST Login. Step 2: Select the month for which you wish to upload GST invoices. Select Filing Month. Step 3: Select GSTR-1 Return and Click on Prepare Online. Step 4: Upload B2B Invoice Details. Step 5: Upload B2C Large Invoice Details.