Personal Property Business Form Forsyth County In Broward

Description

Form popularity

FAQ

Property Tax Bills Across Forsyth County, Georgia In Forsyth County, GA, property tax bills are calculated based on the assessed value of a home, which is typically a percentage of its market value. The assessed value is then multiplied by the local tax rate to determine the tax bill.

In Forsyth County, GA, property tax bills are calculated based on the assessed value of a home, which is typically a percentage of its market value. The assessed value is then multiplied by the local tax rate to determine the tax bill.

Property taxes in Forsyth County are calculated based on the tax assessed value, which generally falls below the actual market value due to various property tax exemptions like the primary residence and agricultural exemptions.

All property in Georgia is taxed at an assessment rate of 40% of its full market value. Exemptions, such as a homestead exemption, reduce the taxable value of your property. Let's say this homeowner has a standard homestead exemption of $2,000. The taxable value is then multiplied by the millage rate.

Each TPP tax return is eligible for an exemption up to $25,000 of assessed value. If the property appraiser has determined that the property has separate and distinct owners and each files a return, each may receive a $25,000 exemption.

Include on your return: Goods, chattels, and other articles of value (except certain vehicles) that can be manually possessed and whose chief value is intrinsic to the article itself. 2. Inventory held for lease. Examples: equipment, furniture, or fixtures after their first lease or rental.

Property taxes typically are based on a property's assessed value rather than its current fair market value. In most states, tax assessments are conducted every one to five years and are not changed when a property is sold or transferred as a gift.

Scheduled personal property is a supplemental insurance policy that extends coverage beyond the standard protection provided in a homeowners' insurance policy. By purchasing a scheduled personal property policy, owners can ensure full coverage of expensive items, such as jewelry, in the event of a claim.

Include on your return: Goods, chattels, and other articles of value (except certain vehicles) that can be manually possessed and whose chief value is intrinsic to the article itself. 2. Inventory held for lease. Examples: equipment, furniture, or fixtures after their first lease or rental.

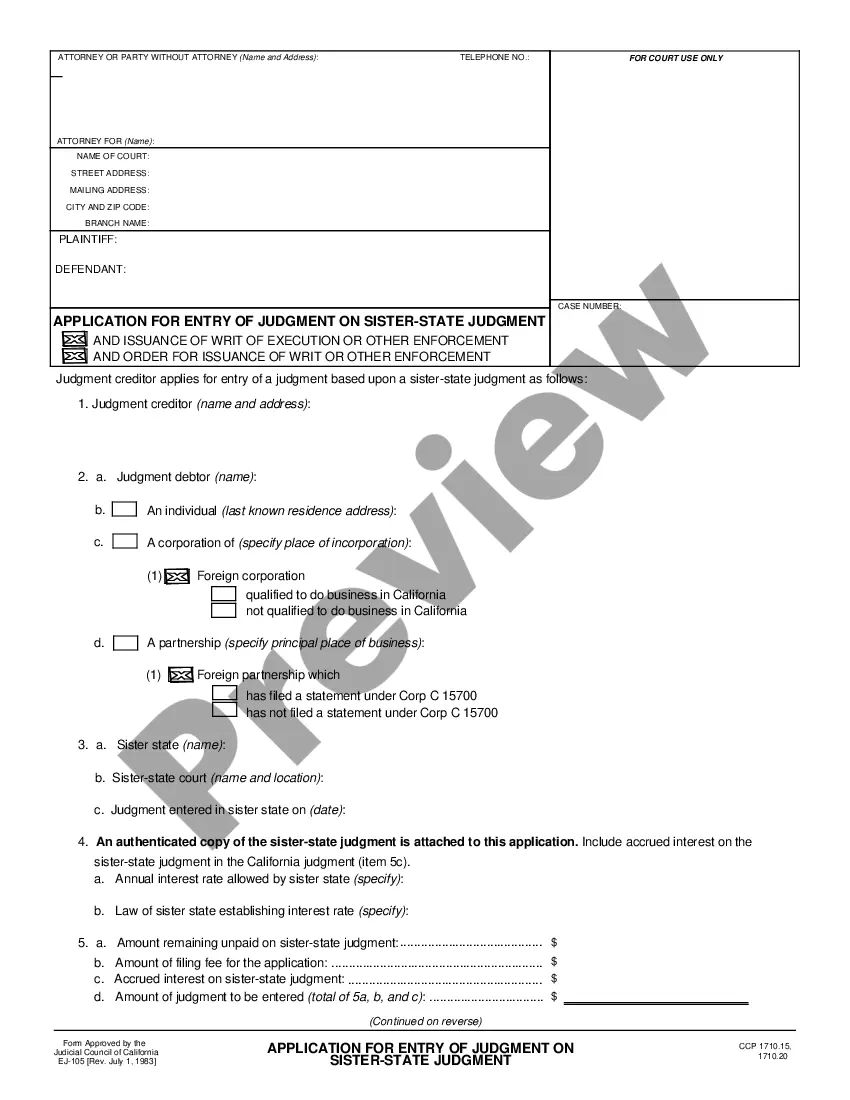

The DR-405 (Tangible Personal Property Tax Return) must be completed to accurately reflect the assets utilized by the business. If a paper form is being filed, the original form must be signed by the owner or authorized agent for the business and delivered to the Property Appraiser's office.