Personal Property Statement With Example In Florida

Description

Form popularity

FAQ

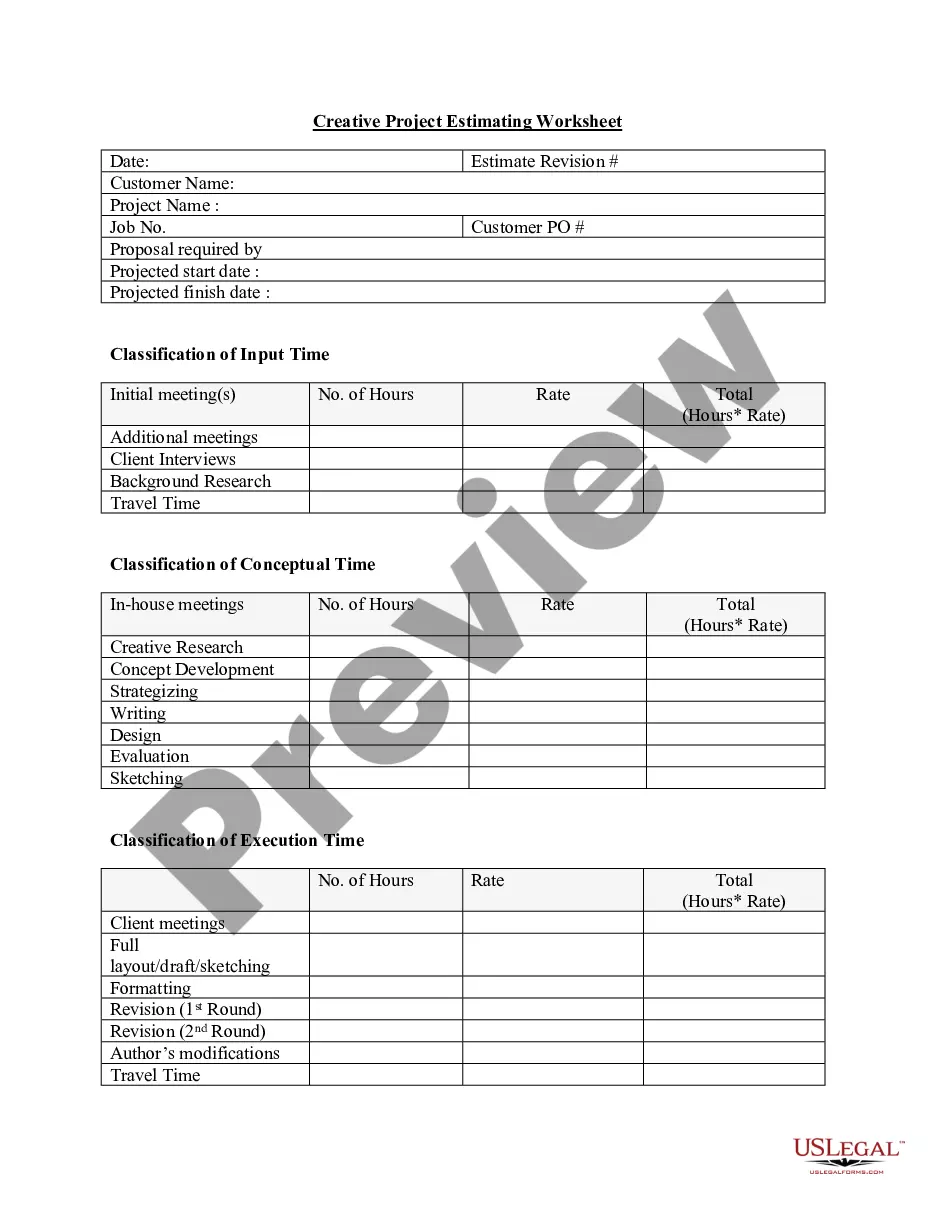

5 steps to fill out a business personal property rendition quickly and accurately Review your property tax accounts. Take stock of your assets. Select the appropriate business personal property rendition forms. Prepare the personal property renditions. File your business personal property rendition packages.

Why must I file a return? Florida Statute 193.052 requires that all tangible personal property be reported each year to the Property Appraiser's Office. If you receive a return, it is because our office has determined that you may have property to report.

Types of Exemptions Government Agency Loans, Industrial Loans, and Aircraft Liens: Certain types of mortgage transactions are exempt from the intangible tax. This includes loans provided by government agencies, mortgages associated with industrial purposes, and those secured by a lien on aircraft.

Every new business owning tangible personal property on January 1 must file an initial tax return. In any year the assessed value of your tangible personal property exceeds $25,000, you are required to file a return. Taxpayers who lease, lend or rent property must also file a return.

Tangible personal property can be subject to ad valorem taxes, meaning the amount of tax payable depends on each item's fair market value. In most states, a business that owned tangible property on January 1 must file a tax return form with the property appraisal office no later than April 1 in the same year.

You can't deduct capital losses on the sale of personal use property. A personal use asset that is sold at a loss generally isn't reported on your tax return unless it was reported to you on a 1099-K and you can't get a corrected version from the issuer of the form.

(19) “Tangible personal property” means and includes personal property which may be seen, weighed, measured, or touched or is in any manner perceptible to the senses, including electric power or energy, boats, motor vehicles and mobile homes as defined in s.

Each TPP tax return is eligible for an exemption up to $25,000 of assessed value. If the property appraiser has determined that the property has separate and distinct owners and each files a return, each may receive a $25,000 exemption.

6016. "Tangible personal property." "Tangible personal property" means personal property which may be seen, weighed, measured, felt, or touched, or which is in any other manner perceptible to the senses.

Tangible personal property, or TPP as it is often called, is personal property that can be felt or touched and physically relocated. That covers a lot of stuff, including equipment, livestock, and jewelry. In many states, these items are subject to ad valorem taxes.