Personal Assets With Examples In Cuyahoga

Description

Form popularity

FAQ

Most households own a combination of physical and financial assets. Physical assets include items such as a home, a car or jewelry. Financial assets include checking and savings accounts, retirement accounts, and stocks, among others.

Capital assets are assets that are used in a company's business operations to generate revenue over the course of more than one year. They are often recorded as an asset on the balance sheet and expensed over the useful life of the asset through a process called depreciation.

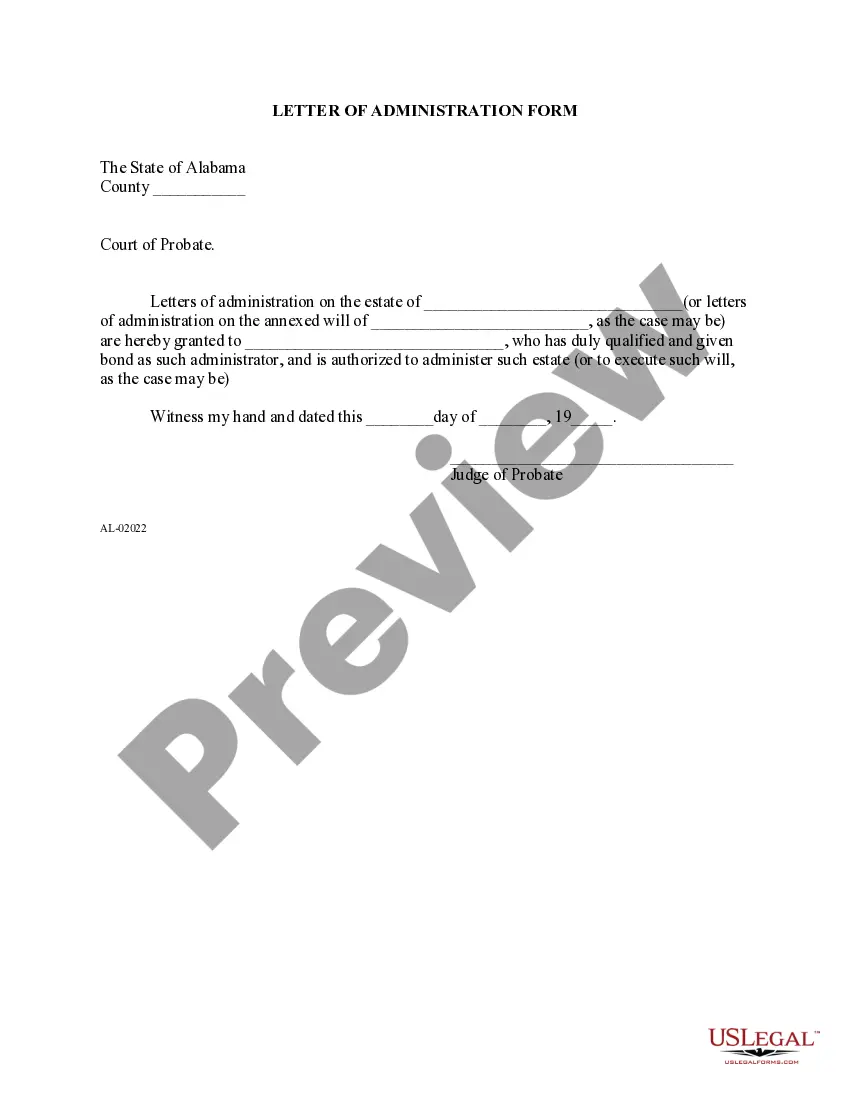

Probate is necessary when a person dies leaving property in his or her own name (such as a house titled only in the name of the decedent) or having rights to receive property.

Non-probate assets include assets held as joint tenants with rights of survivorship, assets with a beneficiary designation, and assets held in the name of a trust or with a trust named as the beneficiary.

How to create a Transfer on Death for your home Choose your recipients. You can choose one or more people to become owner of any home or land that you own. Find a copy of your deed. Complete the TOD for real estate form. Take the form to a notary. Submit the form at your County Recorder's Office.

Summary release from the administration: Avoids probate entirely if either: The estate's worth less than $40,000 and the surviving spouse is the sole heir. The estate's worth less than $5,000 and/or the decedent's final expenses total no more than $5,000.

What Qualifies As A Small Estate In Ohio? An Ohio estate qualifies as a small estate if the value of the probate estate is: $35,000 or less; OR. $100,000 or less and the entire estate goes to the decedent's surviving spouse whether under a valid will or under intestacy.

These include: Bank accounts. Retirement accounts. Stocks and bonds. Some life insurance policies. Real estate. Motor vehicles, such as cars, motorcycles, and RVs. Personal property, such as jewelry and household furnishings.

What's Included in the Inventory? Real estate, including any homes, land, or commercial properties. Bank accounts, including checking, savings, and investment accounts. Vehicles, including cars, boats, and other recreational vehicles. Stocks, bonds, and other investment assets.