Arrendamiento Bienes Without In Minnesota

Description

Form popularity

FAQ

Homeowner's Homestead Credit Refund Type of refundRegular Requirements to claim the refund You owned and lived in your home on January 2, 2025 Your household income for 2024 was less than $139,320

You're considered a nonresident of Minnesota if both of these apply: You are a permanent resident of another state or country. You spent less than 183 days in Minnesota.

Requirements to claim the refund You owned and lived in the same home on January 2, 2024, and on January 2, 2025. Your home's net property tax increased by more than 12% from 2024 to 2025. The net property tax increase was at least $100. The increase was not because of improvements you made to the property.

Homeowners should receive their refund by the end of September if they filed by July 1, or 90 days after they file, whichever is later. Renters should receive their refund by mid-August if they filed by May 15. You may receive your refund earlier if you did all of the following: Electronically filed your return.

If you are waiting for a refund and want to know its status: Use our Where's My Refund? system. Call our automated phone system (available 24/7) at 651-296-4444 or 1-800-657-3676.

You may file up to one year after the due date. New Filing Method for Renters!

What are the maximums? For refund claims filed in 2024, based on property taxes payable in 2024 and 2023 household income, the maximum refund is $3,310. Homeowners whose income exceeds $135,410 are not eligible for a refund.

Statute of Limitations To claim a refund from aYou must file by Property Tax Refund 1 year from the due date Commissioner Filed Return (CFR) replacement 3 1/2 years from the original due date or 1 year from the date we notify you the CFR is filed, whichever is later. You must file your own return to replace the CFR.1 more row

Claimants can check the status of their refund by calling DOR at 651-296-4444 or online at .revenue.state.mn. Minnesota House Research Department provides nonpartisan legislative, legal, and information services to the Minnesota House of Representatives. This document can be made available in alternative formats.

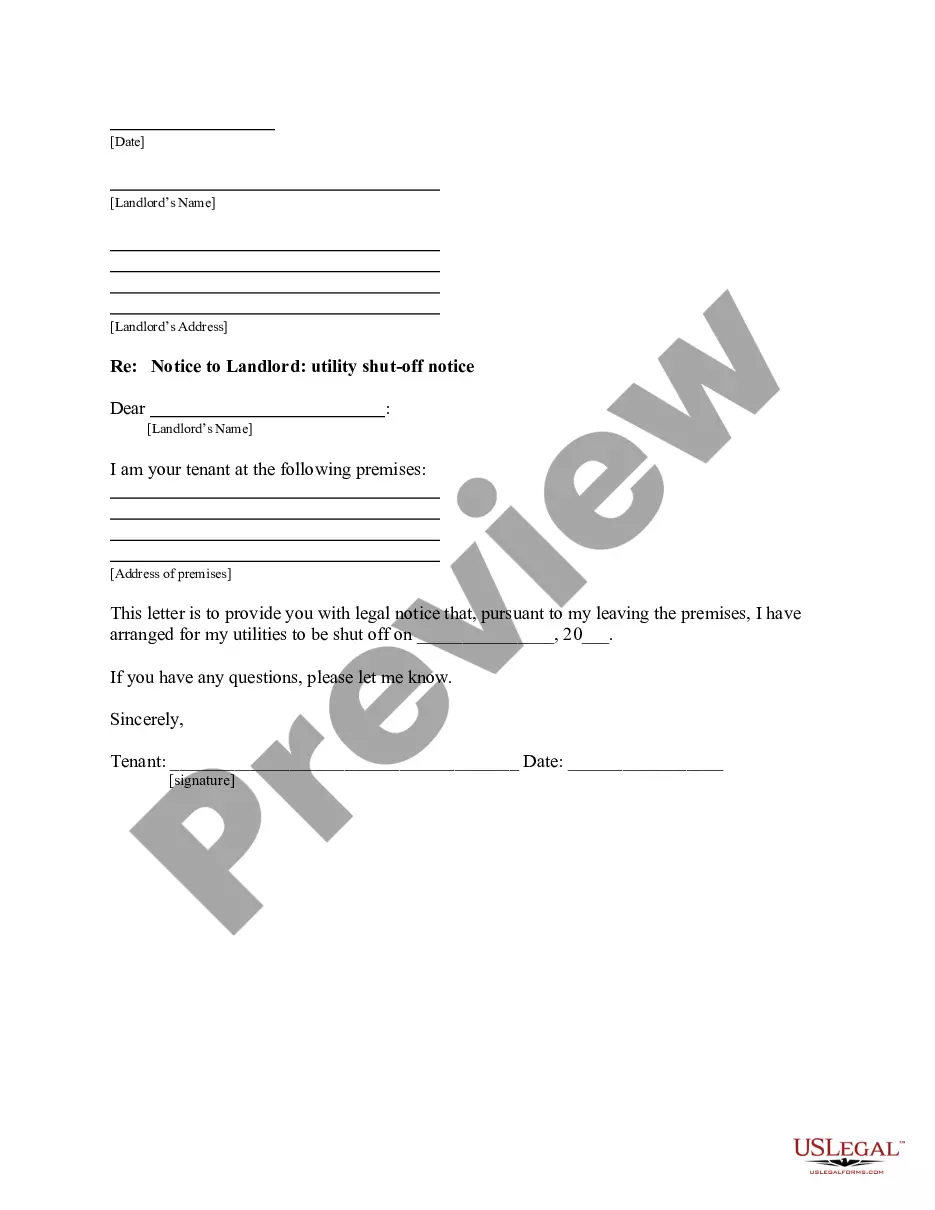

A Minnesota month-to-month rental agreement is for tenancy-at-will arrangements where the landlord and tenant can terminate at any time with one month's notice. The agreement will renew each month until the landlord or tenant sends notice.