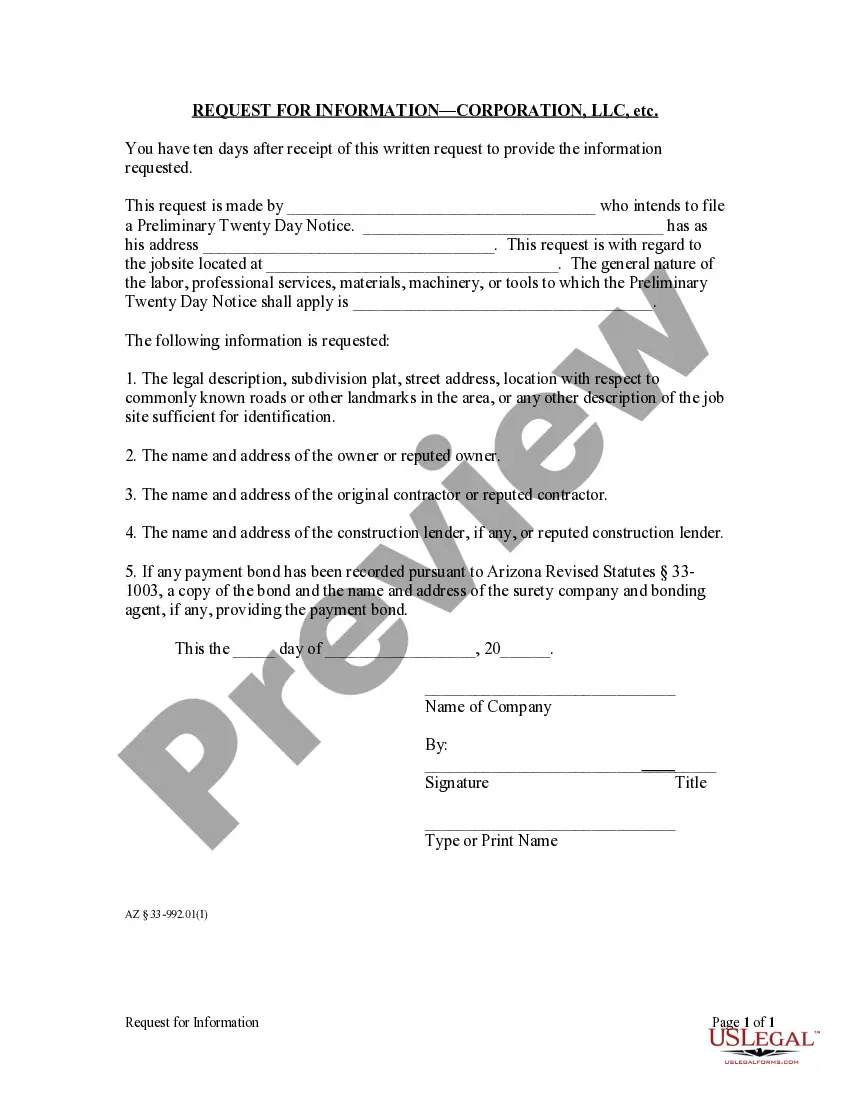

This form is an Application for Certificate of Discharge of IRS Lien. Use to obtain certificate of release when lien has been removed or satisfied. Check for compliance with your specific circumstances.

Publication 783 With Scope For Sale In Texas

Description

Form popularity

FAQ

The rifle comes with the scope already mounted. In our opinion, the simple cardboard box does not offer an above-average protection, nevertheless we did not find any inconvenience, which attests to the robustness of the rifle and the optics mounting system, based on Picatinny rails and aluminum rings.

Issuance of a Certificate of Discharge of Property from Federal Tax Lien (IRS Publication 783). In this case, the IRS agrees to release the lien as it applies to specified property only, and the lien will remain valid against all other property owned by the taxpayer.

Issuance of a Certificate of Discharge of Property from Federal Tax Lien (IRS Publication 783). In this case, the IRS agrees to release the lien as it applies to specified property only, and the lien will remain valid against all other property owned by the taxpayer.

A "discharge" removes the lien from specific property.

If there is a federal tax lien on your home, you must satisfy the lien before you can sell or refinance your home. There are a number of options to satisfy the tax lien.

Proper handling of the notice of lien is extremely important. Generally the IRS can pursue collection of a tax liability up to 10 years from the date it was assessed. A Notice of Federal Tax Lien may be filed any time within that 10-year period.

If there is a federal tax lien on your home, you must satisfy the lien before you can sell or refinance your home.

For a copy of the recorded certificate, you must contact the recording office where the Certificate of Release of Federal Tax Lien was filed. If the federal tax lien has not been released within 30 days of satisfying your tax liability, you can request a Certificate of Release of Federal Tax Lien.

IRS & State Tax Attorney Resolving Tax Debt… You're absolutely able to sell property that is subject to an IRS lien.