Publication 783 With Vortex Scope In Cuyahoga

Category:

State:

Multi-State

County:

Cuyahoga

Control #:

US-00110

Format:

Word;

Rich Text

Instant download

Description

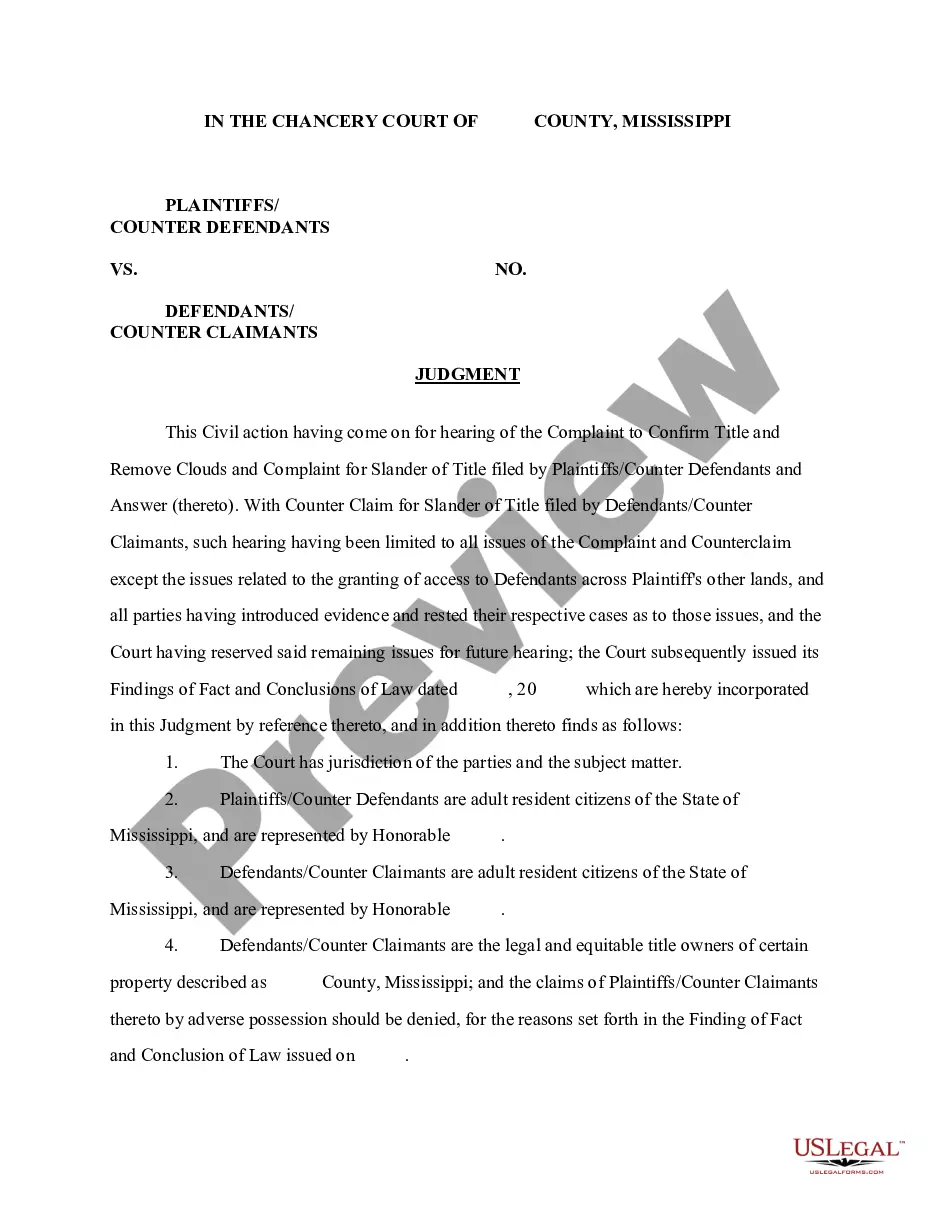

Publication 783 is an essential form used in Cuyahoga for applying for a Certificate of Discharge from a Federal Tax Lien. This document assists taxpayers and their representatives in detailing property information, tax liabilities, and any existing encumbrances. The form requires a comprehensive description of the property, instructions on the divestment of taxpayer rights, and documentation of encumbrances that hold priority over the federal lien. It also necessitates appraisals to establish property value, whether through private or public sale. Target audiences such as attorneys, partners, owners, associates, paralegals, and legal assistants can benefit from this form by helping their clients navigate the complexities of tax lien discharges. Accurate completion involves providing specific details as requested and adhering closely to the guidelines outlined in the publication. By utilizing this form, professionals can facilitate the timely resolution of liens and ensure compliance with IRS requirements.

Free preview