Chattel Mortgage Form With Two Points In Middlesex

Description

Form popularity

FAQ

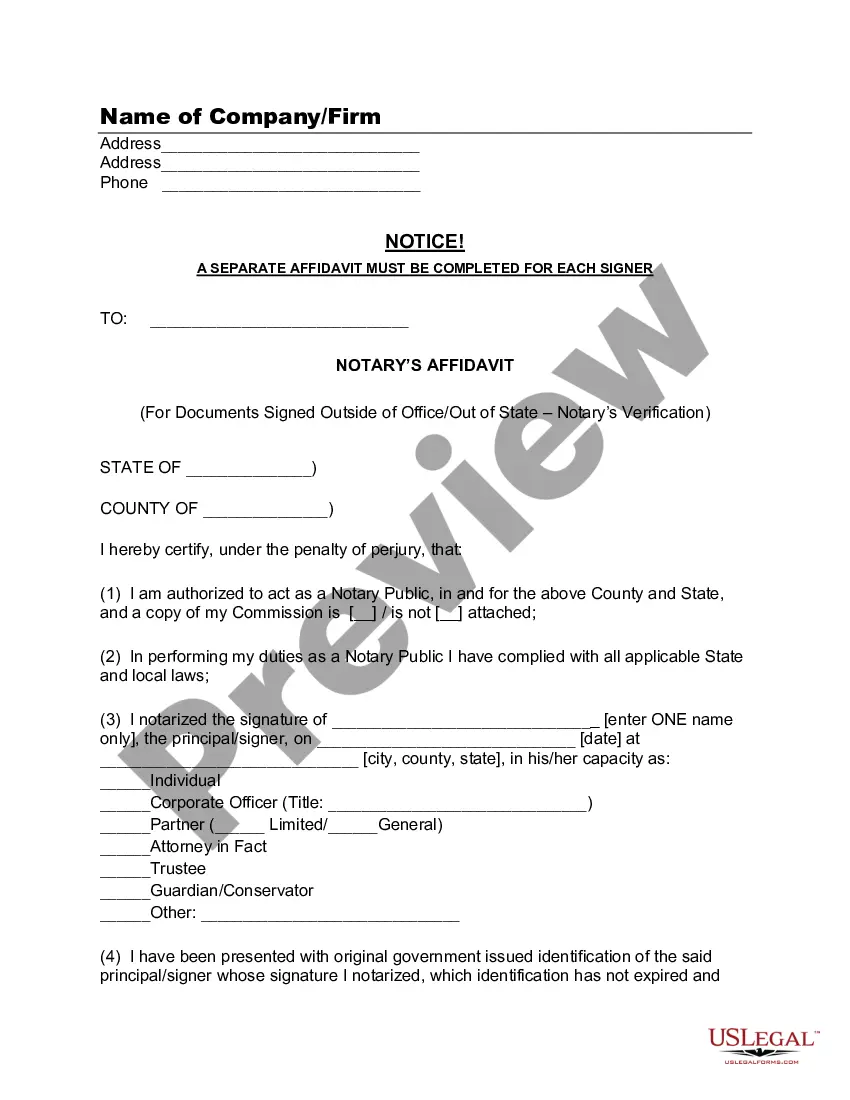

A form of security interest, typically a legal mortgage, taken over tangible movable property (known as chattels).

Chattel is any tangible personal property that is movable. Examples of chattel are furniture, livestock, bedding, picture frames, and jewelry.

The Bottom Line Chattel mortgages are a little-known but potentially good option if you're looking to finance a manufactured home or heavy equipment. These loans are smaller than conventional loans and tend to have higher rates, but they have shorter terms and quicker payoffs.

Any property owner in Massachusetts has online access to the deed to their property and the property record card used to generate their tax bill by their local assessors.

The deed is the legal document that “documents” change of ownership, i.e. the transfer of title from one owner to another. The title is not a physical object. It is more a concept which defines the person, more than one person, business or other entity who owns the property.

Applying for a second mortgage affects one's credit score through inquiries and higher debt levels. These factors can lower scores temporarily. Missed payments on a second mortgage have long-term effects on credit health. They can damage one's ability to borrow in the future.

Combining your first and second mortgage can decrease monthly payments and interest rates substantially. Accunet can calculate your current finances and help you determine how much you'll see in savings by combining both mortgages into one new mortgage.

A form of security interest, typically a legal mortgage, taken over tangible movable property (known as chattels).

Today's Mortgage Rates in Massachusetts ProductTodayLast Week 30 year fixed 6.90% 6.91% 15 year fixed 6.06% 6.08% 5/1 ARM 7.38% 7.13% 30 yr fixed mtg refi 6.84% 6.81%3 more rows