Meeting Minutes Corporate Withholding In Bronx

Description

Form popularity

FAQ

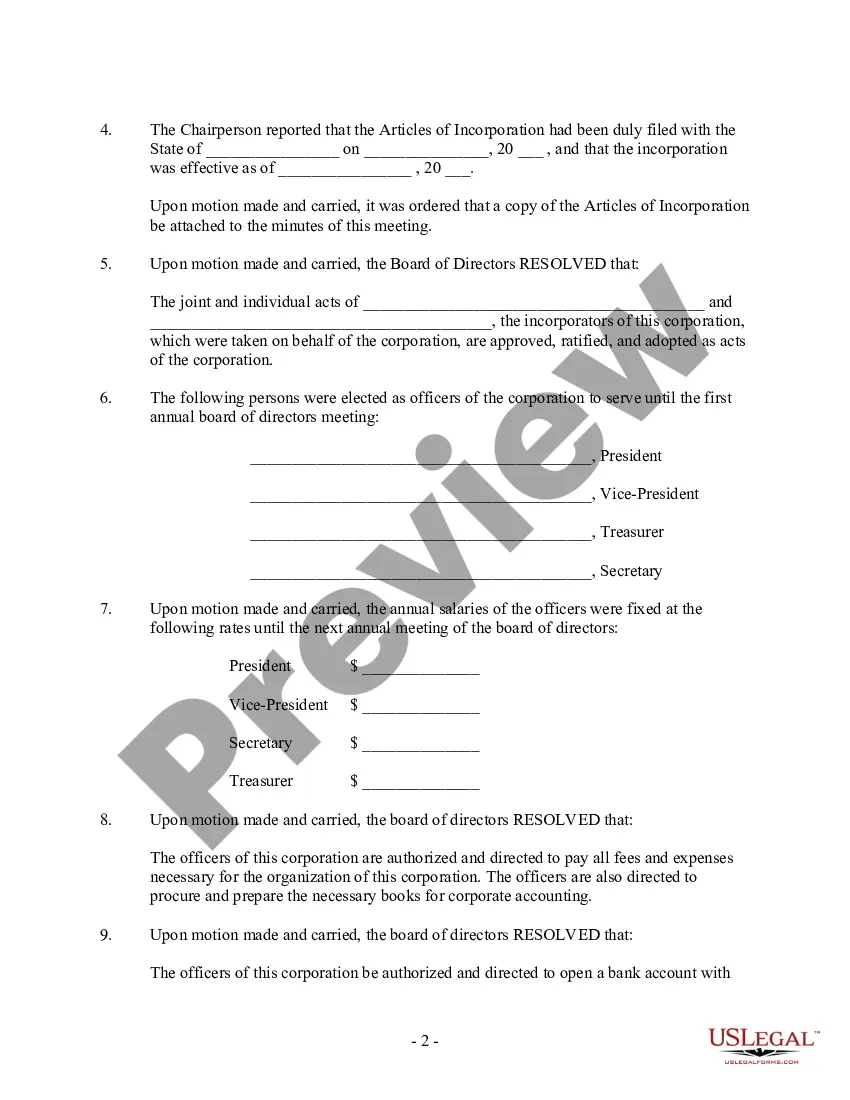

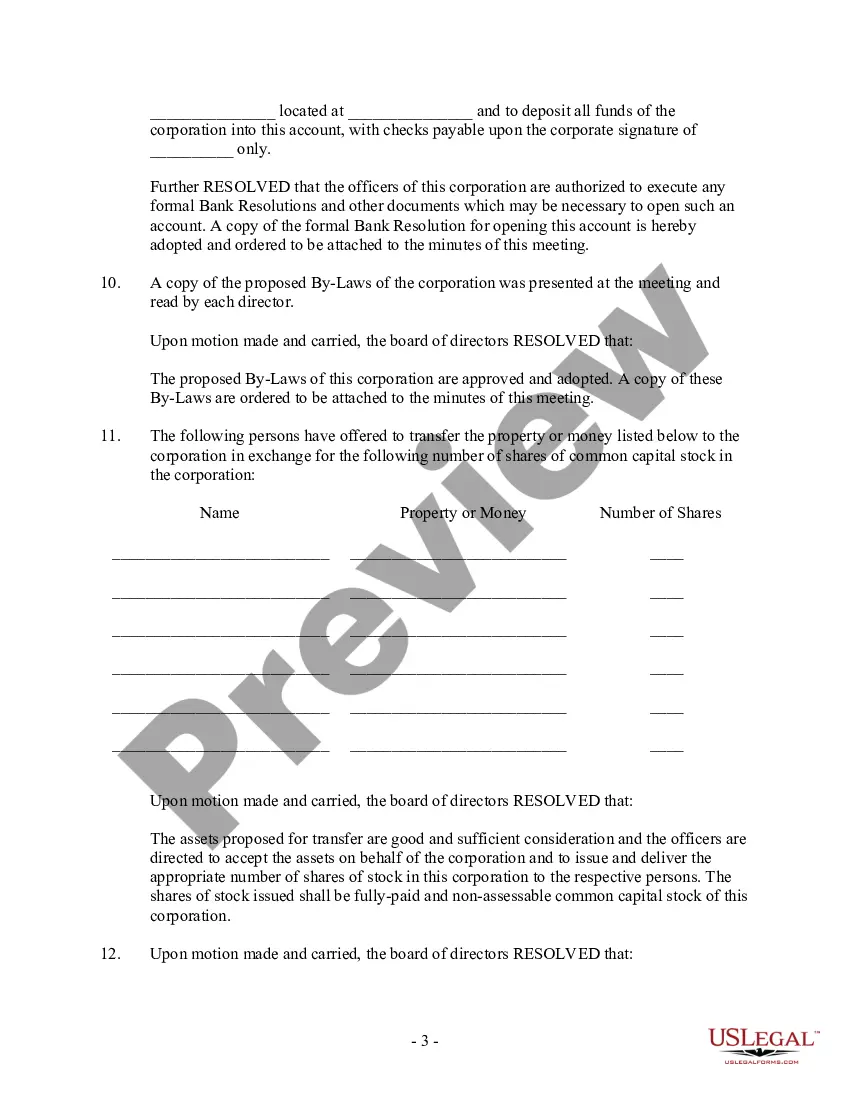

Corporate meeting minutes typically include: The meeting's date, time and location. A list of attendees and absentees, including any present board members or officers. Agenda items. Summaries of all discussion points. Details of all activities completed or agreed upon. Results of any votes or motions.

As the lone attendee you must document the date, time and location of the meeting. You must also list the discussion items, summarize the key points and document the decisions made. You must note all the positions in attendance, even if you occupy all of them.

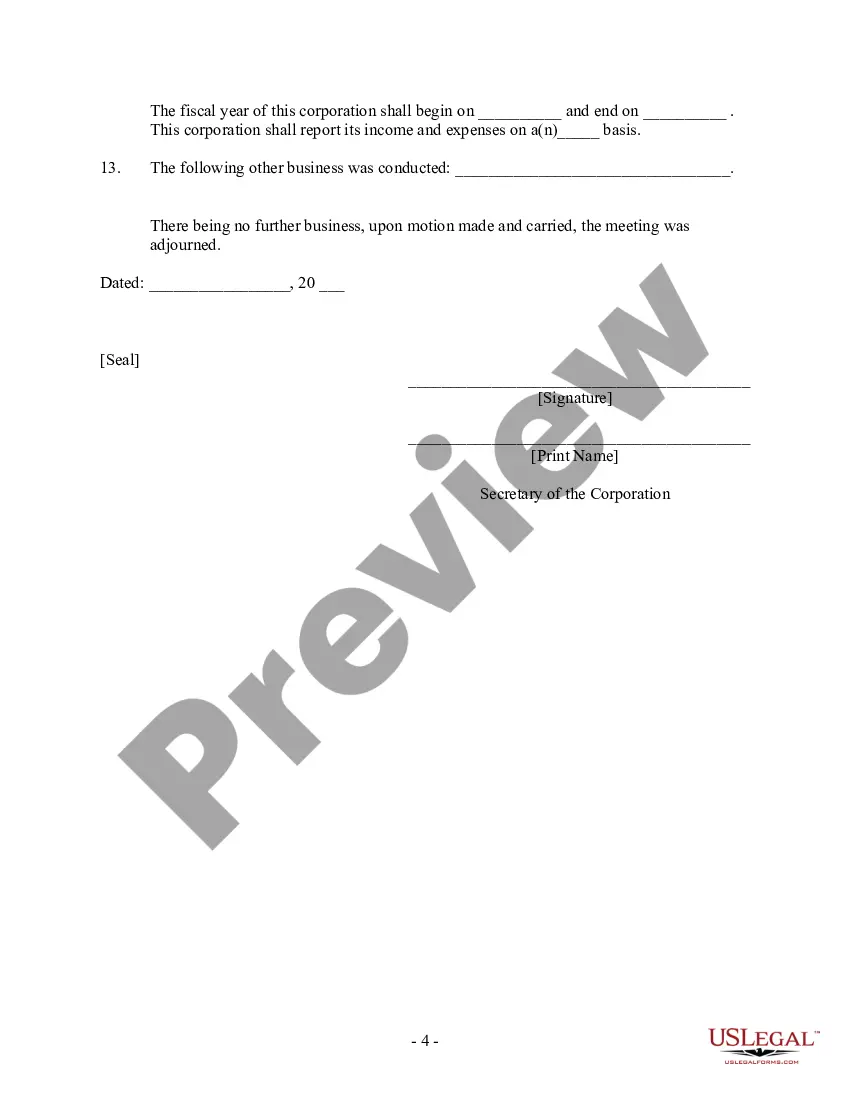

This document needs to be signed by: or another person who is authorized to take minutes and/or record official corporate action. There is no requirement that the signature be witnessed or notarized.

What happens if a minute book is not maintained? If evidence is uncovered that a corporate entity's actions are not documented in historic or active record keeping, the shareholders, members, and management could lose personal liability protection – a situation referred to as “piercing the corporate veil.”

At their core, meeting minutes should include several key elements: Details of the Meeting: Start with the basics - the date, time, and location of the meeting, as well as the type of meeting (regular, special, annual, etc.). This sets the stage for what follows. Attendees: List everyone present and note any absences.

Meeting minutes are the written record of what was discussed and decided during a meeting. They typically include the date and time of the meeting, a list of attendees, a summary of the topics discussed, decisions made, action items assigned, and the time of adjournment.

To receive your New York Withholding Identification Number, you must file the New York State Employer Registration for Unemployment Insurance, Withholding and Wage Reporting Form (Form NYS-100N) if you haven't already done so. The form can be filed online through New York Business Express.

Register for withholding income tax and unemployment tax Go to the New York Department of Labor website to register for both income withholding and unemployment tax. Non-profits: Complete a NYS-100N form instead.

To receive a New York sales tax ID, your business must register for a sales tax Certificate of Authority with the New York Department of Tax and Finance or via the state's Business Express portal - a process also known as “sales tax vendor registration”.

Withholding tax payments There are two ways to register. To register online, apply with the Department of Labor on their website. To register by phone, call the Department of Labor at 888-899-8810 or 518-457-4179.