Hawaii Living Trust for Husband and Wife with No Children

Description

How to fill out Hawaii Living Trust For Husband And Wife With No Children?

Access one of the most comprehensive collections of legal documents.

US Legal Forms is truly a platform where you can discover any state-specific file in moments, including Hawaii Living Trust for Husband and Wife with No Children examples.

There’s no need to squander several hours searching for a court-acceptable document.

After selecting a pricing option, establish an account. Pay using your credit card or PayPal. Download the sample to your device by clicking Download. That’s all! You should complete the Hawaii Living Trust for Husband and Wife with No Children form and check it out. To ensure everything is correct, consult your local legal advisor for assistance. Sign up and conveniently access over 85,000 useful forms.

- To utilize the document library, select a subscription and set up your account.

- If you have already set it up, simply Log In and then click Download.

- The Hawaii Living Trust for Husband and Wife with No Children template will be automatically saved in the My documents section (a section for all forms you've downloaded on US Legal Forms).

- To create a new account, follow the brief instructions listed below.

- If you need to use a state-specific document, ensure you select the correct state.

- If possible, read the description to understand all the details of the document.

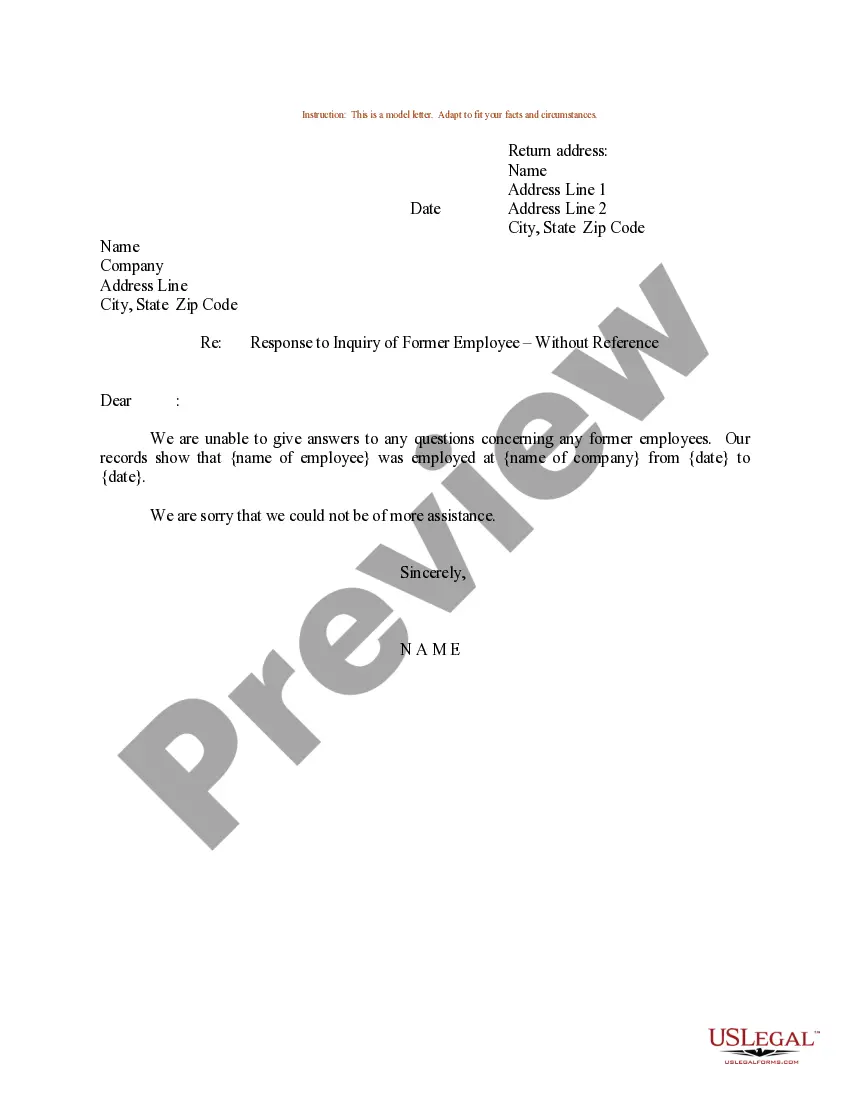

- Make use of the Preview option if available to review the document's contents.

- If everything is accurate, click on Buy Now.

Form popularity

FAQ

Yes, a married couple should consider implementing a Hawaii Living Trust for Husband and Wife with No Children to streamline their estate planning. A living trust can help manage assets during life and provide clear instructions for distribution after death. By avoiding the public probate process, couples can maintain privacy and efficiency in handling their estate. It is wise to consult with legal experts to tailor a trust that meets your unique situation.

Whether or not a husband and wife should have separate living trusts depends on their financial circumstances and estate planning needs. A Hawaii Living Trust for Husband and Wife with No Children can offer flexibility, allowing each spouse to address specific wishes regarding their assets. However, a joint trust may simplify management and reduce paperwork, making it a viable option for some couples. Evaluating both routes can yield the best outcome.

Husbands and wives might choose to establish separate trusts for several reasons, including managing unique financial situations or personal preferences. By creating a Hawaii Living Trust for Husband and Wife with No Children, each partner can designate specific assets and beneficiaries. This approach may also provide better protection against creditors, or allow for more tailored estate planning that meets both partners' individual goals.

Suze Orman emphasizes the importance of living trusts, including the Hawaii Living Trust for Husband and Wife with No Children, as a valuable estate planning tool. She believes these trusts help protect your assets and ensure a smoother transition for your loved ones after your passing. Orman highlights that living trusts can be a smart choice to avoid long probate processes and maintain privacy regarding your estate.

To set up a Hawaii Living Trust for Husband and Wife with No Children, begin by determining the assets you want to include. Next, draft the trust document, which outlines your wishes and specifications. After establishing the trust, transfer ownership of your assets into the trust to ensure they are managed according to your intentions. You may consider using legal services like US Legal Forms to streamline this process and ensure compliance with Hawaii laws.

While a Hawaii Living Trust for Husband and Wife with No Children primarily targets couples, single individuals without children can benefit from creating a trust. A trust can help manage your assets effectively, ensuring that they are distributed according to your wishes. It also provides protection against probate, which can simplify the process for your heirs. Utilizing a legal service like UsLegalForms can guide you in establishing a trust that suits your unique needs.

As of 2019, attorney fees can range from $1,000 to $2,500 to set up a trust, depending upon the complexity of the document and where you live. You can also hire an online service provider to set up your trust. As of 2019, you can expect to pay about $300 for an online trust.

Assuming you decide you want a revocable living trust, how much should you expect to pay? If you are willing to do it yourself, it will cost you about $30 for a book, or $70 for living trust software. If you hire a lawyer to do the job for you, get ready to pay between $1,200 and $2,000.

No, you don't need a lawyer to set up a trust, but it might be a good idea to seek legal advice to ensure the trust is set up correctly and that you have considered all long-term financial and estate planning aspects of the trust.Some living trusts are revocable, which means the trust can be changed at any time.