Cancellation Form Fillable Withholding In Fairfax

Description

Form popularity

FAQ

The City of Fairfax, Virginia, is an independent city in the Commonwealth of Virginia. The six-square-mile jurisdiction in the heart of Northern Virginia was founded in 1805 as the Town of Providence. Known for its courthouse, it was for a time known as Fairfax Courthouse, then as the Town of Fairfax.

Our city is widely known for outstanding cultural amenities. Every year the city sponsors world-class events such as Fall for the Book, Spotlight on the Arts, and a fun weekend-long Chocolate Lovers Festival.

Fairfax is both a surname of English (Yorkshire and Northumberland, with a few branches later settling in Scotland) origin which means "fair hair", and a given name. Notable people with the name include: Surname: Alan Fairfax (1906–1955), Australian cricketer.

You may view your tax information online or request a copy of the bill by emailing DTARCD@fairfaxcounty or calling 703-222-8234, TTY 711.

Fairfax, a Toronto-based holding company, operates primarily through its subsidiaries in property and casualty insurance, reinsurance, and investment management.

To qualify for real estate tax deferral, you must be at least 65 years of age or permanently and totally disabled. Applicants who turn 65 or become permanently and totally disabled during the year of application may also qualify for tax deferral on a prorated basis.

You need the Virginia State's Division of Motor Vehicles website. How can I obtain information about personal property taxes? You can call the Personal Property Tax Division at (804) 501-4263 or visit the Department of Finance website .

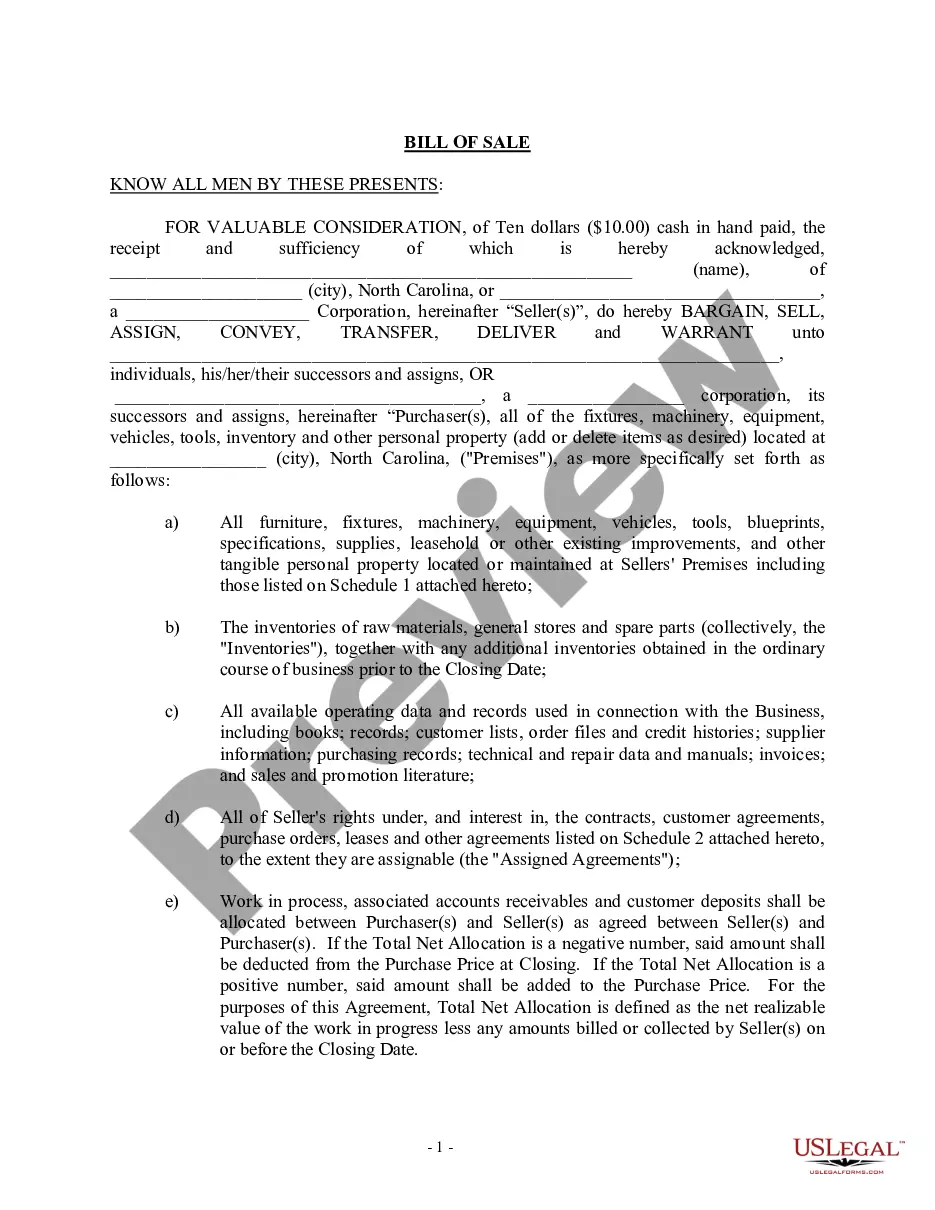

Business closures typically require documentation, which can include lease terminations, bills of sale, a copy of the business license from the new county of business, cancellation, and/or final tax returns (which must be marked as final).

If you have any questions or need assistance completing the form, please email DTAREDsurveys@fairfaxcounty.