Employee Form Fillable For Pan Correction In Riverside

Description

Form popularity

FAQ

Instructions for Filling PAN Card Form No 49A Full Name: This section requires the full name of the applicant. Full Name Abbreviation to be Printed on the PAN card: Individuals are expected to provide the abbreviated/full name that they want to be printed on the document.

You can apply for PAN card online through the NSDL or the UTIITSL website. Individuals having an Aadhaar card can apply for instant e-PAN card on the Income Tax portal. The documents required for a PAN card are as follows: Individuals - Proof of identity, address and date of birth.

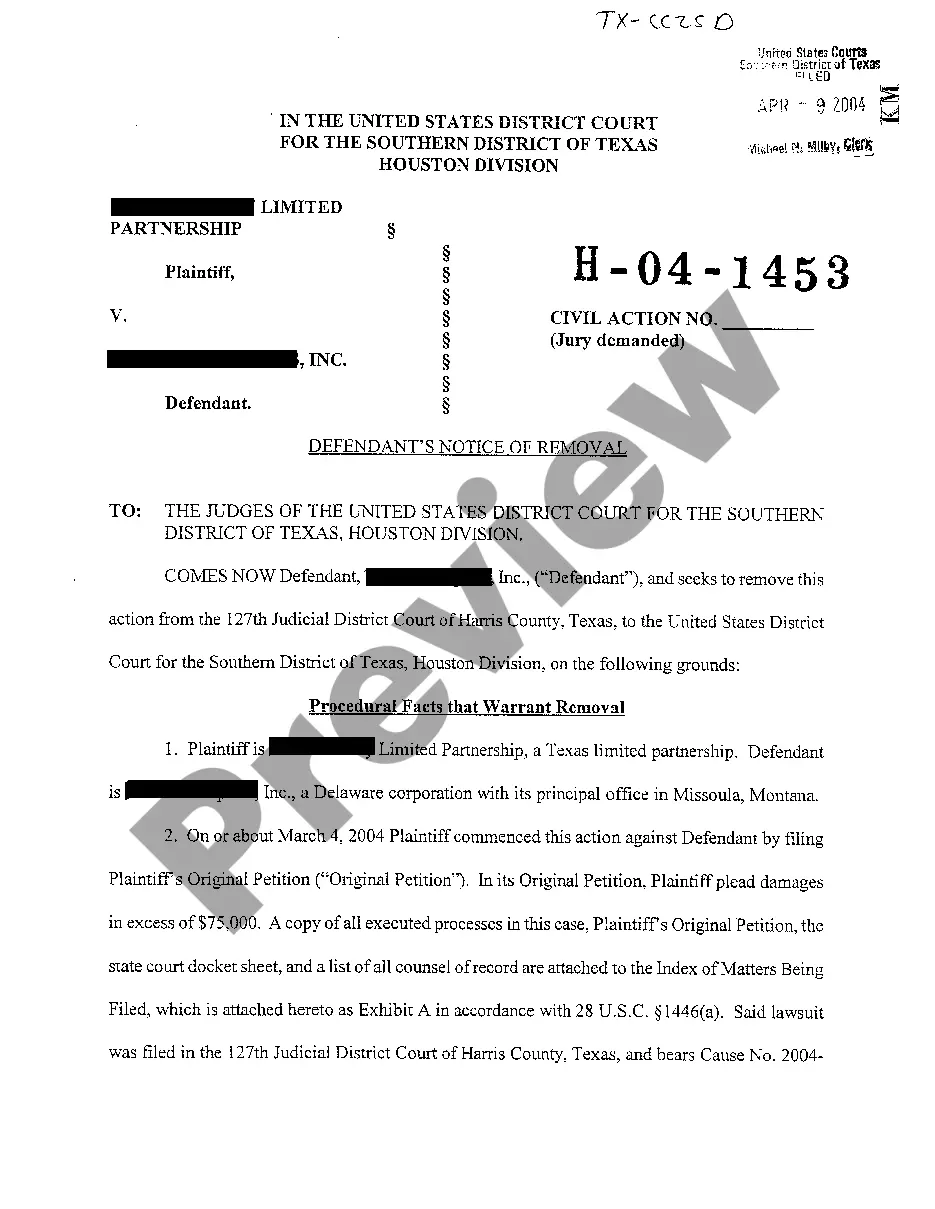

(a) Applicants may obtain the 'Request for New PAN Card or/and Changes or Correction in PAN Data' Form in the format prescribed by Income Tax Department from any IT PAN Service Centres (managed by UTIITSL) or TIN-Facilitation Centres (TIN-FCs)/PAN Centres (managed by NSDL e-Gov), or any other stationery vendor ...

Frequently Asked Questions Visit the NSDL PAN website or the UTIITSL website. Select the 'Change/Correction in PAN card details'. Enter the 'PAN Card' number, fill in the other details, and click the 'Submit' button. Enter the required details on the form. Enter the changed/updated name.

(a) Form to be filled legibly in BLOCK LETTERS and preferably in BLACK INK. Form should be filled in English only (b) Mention 10 digit PAN correctly. (c) Each box, wherever provided, should contain only one character (alphabet /number / punctuation sign) leaving a blank box after each word.

Apply for new Permanent Account Number (PAN) card, changes or corrections in PAN data through online form by Income Tax Department. Users can apply for new PAN card, changes or corrections in PAN data by selecting appropriate category of applicants such as individual, firm, company, etc.

Instructions for Filling PAN Card Form No 49A Full Name: This section requires the full name of the applicant. Full Name Abbreviation to be Printed on the PAN card: Individuals are expected to provide the abbreviated/full name that they want to be printed on the document.

It provides the proprietor's name and PAN, confirms he is the proprietor of the firm, and shares the firm's PAN. It includes a copy of the proprietor's signed PAN card with the firm's seal as an enclosure.