Form Assignment Accounts For Lic Policy In North Carolina

Description

Form popularity

FAQ

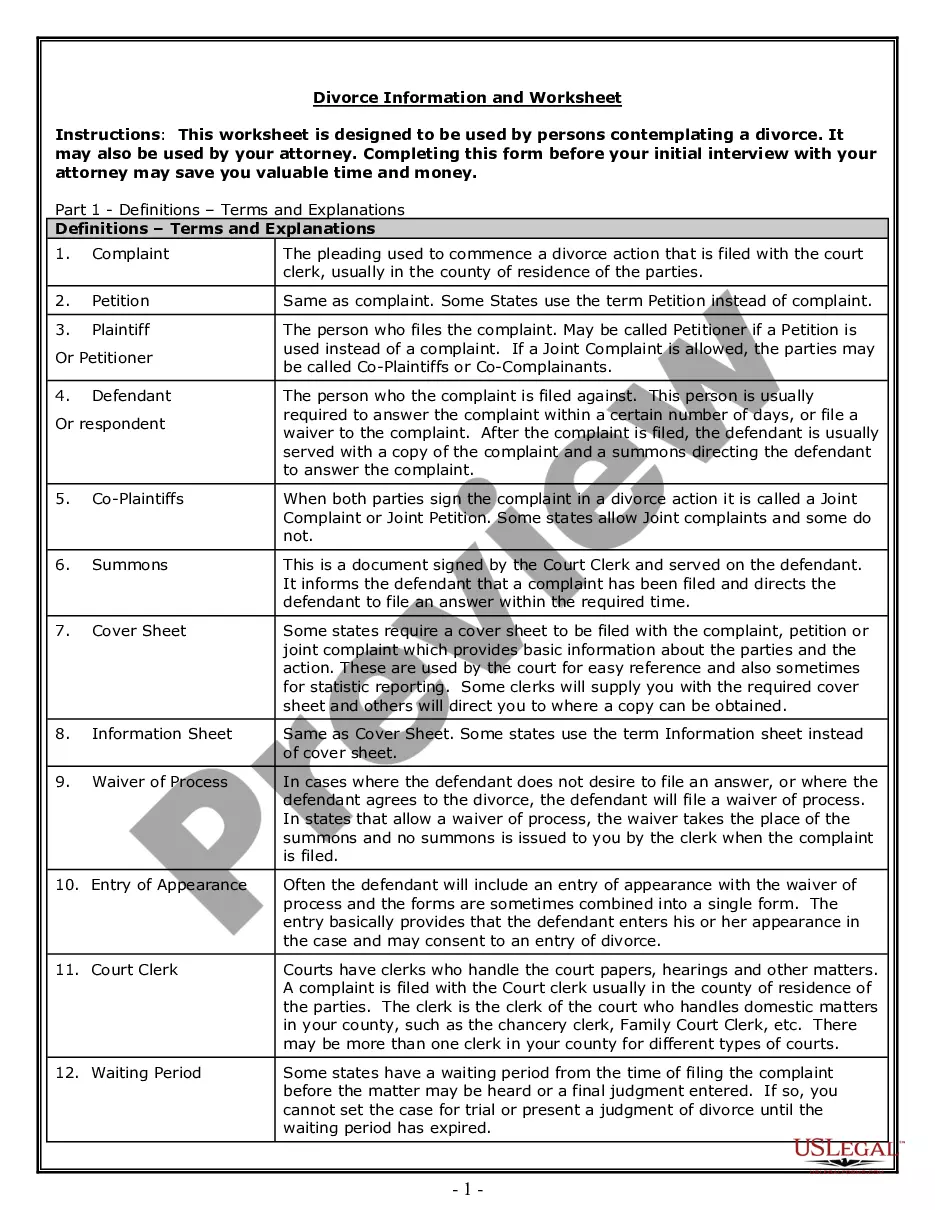

How to fill out the Assignment Questionnaire for LIC Policy Holders? Gather all required information before starting. Fill in personal details and the assignee's information. Provide information on the policy being assigned. Complete the declaration section at the end. Review all entries for accuracy before submission.

An assignment of a life insurance policy refers to the transfer of ownership rights, title, and benefits of the policy from the original policyholder (assignor) to another party (assignee).

How to fill out the Assignment Questionnaire for LIC Policy Holders? Gather all required information before starting. Fill in personal details and the assignee's information. Provide information on the policy being assigned. Complete the declaration section at the end. Review all entries for accuracy before submission.

The insured needs to either endorse the policy document or make a deed of assignment and register the same with the insurer. A form prescribed by the insurers must be filled and signed. In case of conditional assignment, your reason needs to be mentioned as well.

How to fill out the Assignment Questionnaire for LIC Policy Holders? Gather all required information before starting. Fill in personal details and the assignee's information. Provide information on the policy being assigned. Complete the declaration section at the end. Review all entries for accuracy before submission.

You can assign your policy to an individual or a financial institution, provided there is an insurable interest between you and such individual/ financial institution.

What should the endorsement contain? You (or an individual authorised by You) should sign the endorsement. It should be attested by at least one witness. It should mention that you want to assign your policy and the reason for assigning your policy. The details of the assignee. The terms on which the assignment is made.

(2) The full name, and age, of the Assignee must be stated. (3) The actual consideration for the assignment received from the assignee should be written in words, not in figures. (4) The Assignor must affix his signature to the Assignment in the presence of a witness other than the Assignee.

If you wish to change the nominee in your LIC policy, you can follow these steps alongside the name change request: Step 1: Obtain Nominee Change Form. Request the "nominee change form" from your LIC branch. Step 2: Fill Out the Form. Step 3: Attach Supporting Documents. Step 4: Submit the Form. Step 5: Confirmation.

Workers compensation and employers liability is a form of no-fault insurance provided by the employer for the employee. The employee gives up certain rights to sue in exchange for protection from injuries incurred on the job.