Mississippi Answer

About this form

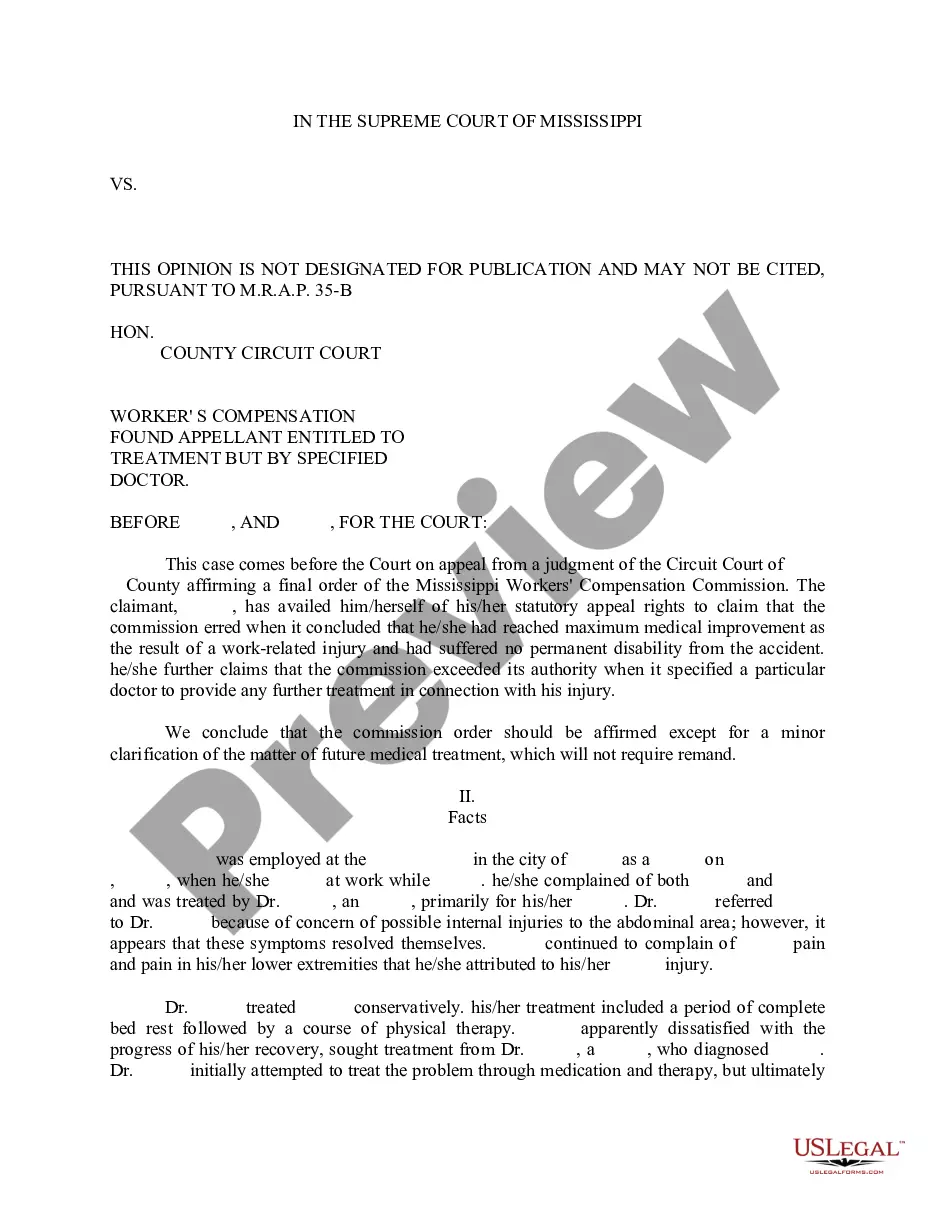

The Answer form is a legal document used in Mississippi proceedings, primarily related to workers' compensation claims. It allows an employer or insurance company to reply formally to a Claimant's Petition to Controvert. This form differs from other pleadings as it not only addresses admissions or denials regarding the claimant's injury but also provides space for affirmative defenses and special pleadings relevant to the case.

What’s included in this form

- Admission or denial of the claimant's injury or occupational disease.

- Confirmation of the employer-employee relationship at the time of the alleged incident.

- Statement regarding the claimant's loss of wage earning capacity.

- Affirmative defenses and special pleadings section.

- Details on medical reports and their submission.

Situations where this form applies

This form is needed when an employer or their insurance representative needs to formally respond to a Petition to Controvert filed by a claimant. It is often used in cases where workers seek compensation for injuries sustained on the job or for occupational diseases claimed to be caused by their work environment.

Who can use this document

This form is intended for:

- Employers responding to a workers' compensation claim.

- Insurance companies representing employers in such disputes.

- Legal representatives or attorneys handling workers' compensation cases.

How to prepare this document

- Identify the parties involved, including the claimant and employer.

- State whether the employer admits or denies the claimant's injury.

- Confirm if the employer-employee relationship existed at the time of the alleged injury.

- Provide a statement regarding the loss of wage earning capacity, clearly indicating whether it is admitted or denied.

- Include any affirmative defenses or special pleadings in the designated section.

- Attach any necessary medical reports, indicating if they have been filed.

Is notarization required?

This form usually doesn’t need to be notarized. However, local laws or specific transactions may require it. Our online notarization service, powered by Notarize, lets you complete it remotely through a secure video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to clearly admit or deny the claims in the appropriate sections.

- Omitting the submission of required medical records.

- Not providing sufficient details about affirmative defenses.

- Submitting the form past the required deadline.

Why use this form online

- Convenience of immediate access to the form for download and completion.

- Editability allows customization to suit specific case facts.

- Reliability of having a template drafted by licensed attorneys.

Quick recap

- The Answer form is essential for formal responses in workers' compensation cases.

- Clear admissions or denials help define the issues for further proceedings.

- Accurate and timely completion of the form is crucial to adhere to legal timelines.

Looking for another form?

Form popularity

FAQ

Medical. Surgical. Chiropractic. Acupuncture.

A workers' compensation rate is represented as the cost per $100 in payroll. For example: A rate of $1.68 means that a business with $100,000 in payroll would pay $1,680 annually in work comp premiums. A rate of $0.35 means that a business with $100,000 in payroll would pay $350 annually in work comp premiums.

Regarding your question: do you claim workers comp on taxes, the answer is no. You are not subject to claiming workers comp on taxes because you need not pay tax on income from a workers compensation act or statute for an occupational injury or sickness.

Compensation is 66 2/3 percent of the injured workers wage. Minimum weekly payment is $25. Maximum weekly payment is 66 2/3 percent of the Mississippi state average weekly wage, $398.93.

The net rate is calculated by using the base rate, then applying an experience rating modifier (if applicable), a schedule rating factor (if applicable) and, in some cases, a premium discount factor.

Workers injured on the job are eligible for cash disability benefits and medical care through the Mississippi Workers' Compensation Act, passed by the state legislature in 1948.Coverage includes medical services and supplies, cash payments for lost wages, and rehabilitation services.

Workers injured on the job are eligible for cash disability benefits and medical care through the Mississippi Workers' Compensation Act, passed by the state legislature in 1948.Coverage includes medical services and supplies, cash payments for lost wages, and rehabilitation services.

What is the average cost of workers' compensation insurance in Mississippi? Estimated employer costs for workers' compensation in Mississippi are $1.27 per $100 covered in payroll.