Factoring Agreement Draft Formula In Hillsborough

Category:

State:

Multi-State

County:

Hillsborough

Control #:

US-00037DR

Format:

Word;

Rich Text

Instant download

Description

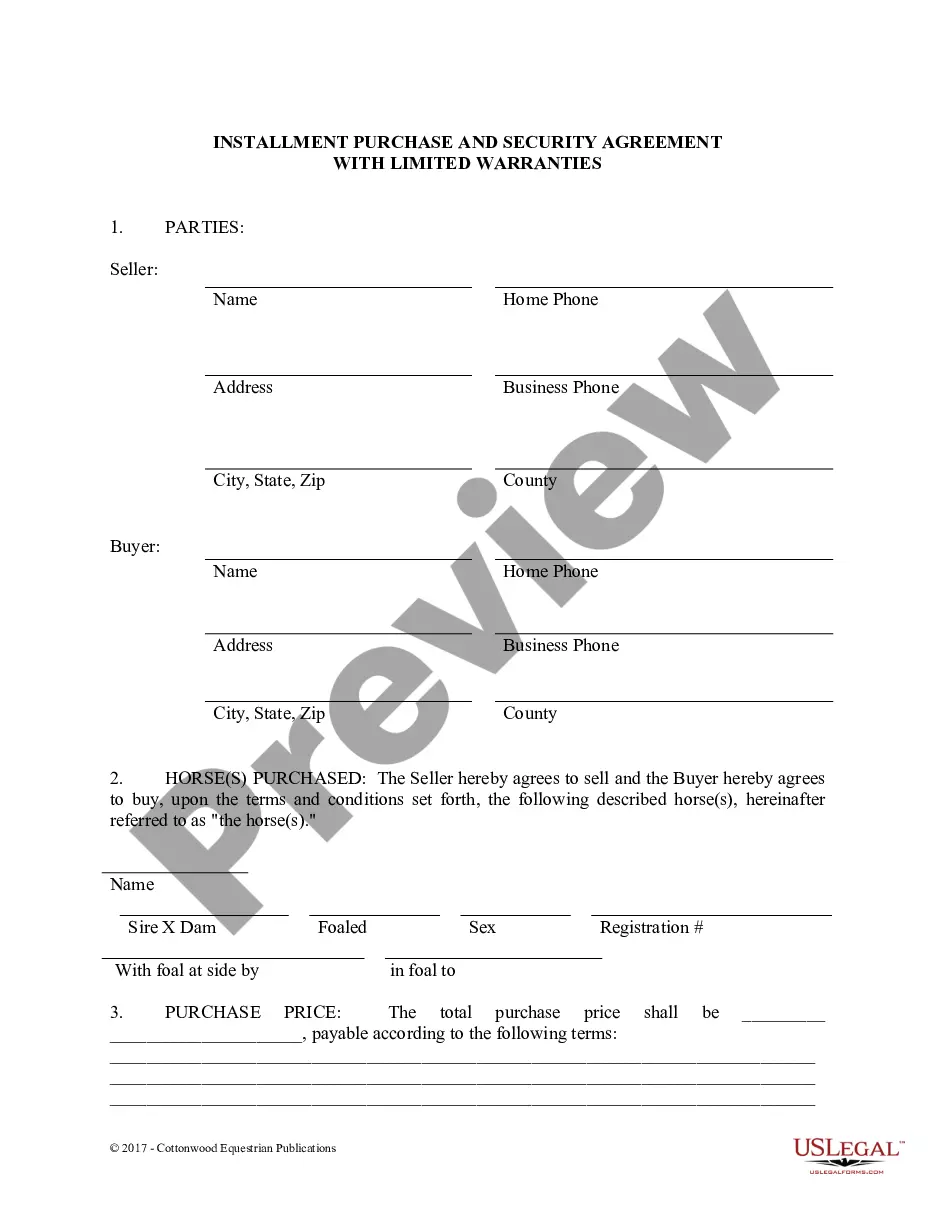

The Factoring Agreement Draft Formula in Hillsborough is designed for businesses seeking financial solutions by converting accounts receivable into immediate cash. This comprehensive document outlines the relationship between the Factor and the Client, detailing key features such as the assignment of accounts receivable, credit approvals, and terms of payment. Notably, the Factor assumes credit risks for approved receivables, reinforcing financial security for the Client. The form requires the Client to maintain clear records and promptly communicate any issues regarding merchandise or payments. It is particularly useful for Attorneys, Partners, Owners, Associates, Paralegals, and Legal Assistants in ensuring compliance with legal requirements while facilitating business transactions. Clear guidelines are provided for filling and editing the document, such as specifying dates, names, percentages, and other critical information. Furthermore, the form addresses contingencies such as the handling of customer disputes and merchandise returns, providing a well-rounded toolkit for managing financial arrangements efficiently.

Free preview

Form popularity

FAQ

The factoring company assesses the creditworthiness of the customers and the overall financial stability of the business. Typically, the factoring rates range from 1% to 5% of the invoice value, but they can be higher or lower depending on the specific circumstances.

Documents you will have to provide: Factoring application. Articles of Association or registered Amendments to the Articles of Association of your company. Annual report for the previous financial year. Financial report (balance sheet andf profit/loss statement) for the current year (for 3, 6 or 9 months, respectively)

Average factoring costs fall between 1% and 5% depending on the factors above. Volume plays a huge part in calculating factoring rates.