Virginia Installment Purchase and Security Agreement With Limited Warranties - Horse Equine Forms

About this form

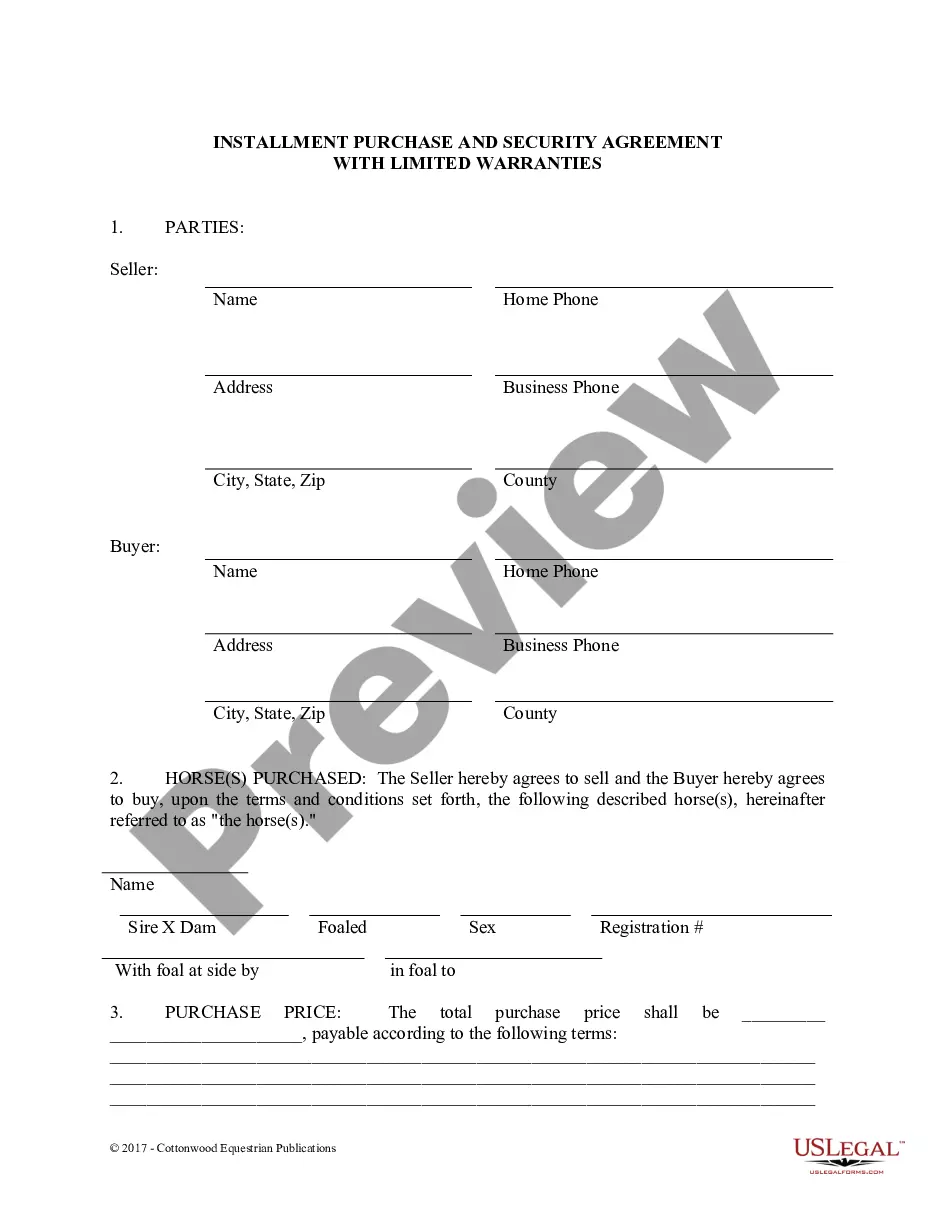

The Installment Purchase and Security Agreement With Limited Warranties is a legally binding contract used for the purchase of a horse, establishing a payment plan while securing the seller's interest in the horse until full payment is made. Unlike other purchase agreements, this form includes limited warranties specific to horse purchases and allows for joint liability among multiple buyers.

Main sections of this form

- Parties involved: Includes information about the seller and buyer.

- Description of the horse: Details about the horse being purchased, including name and pedigree.

- Purchase price and payment terms: Specifies the total price and methods of payment.

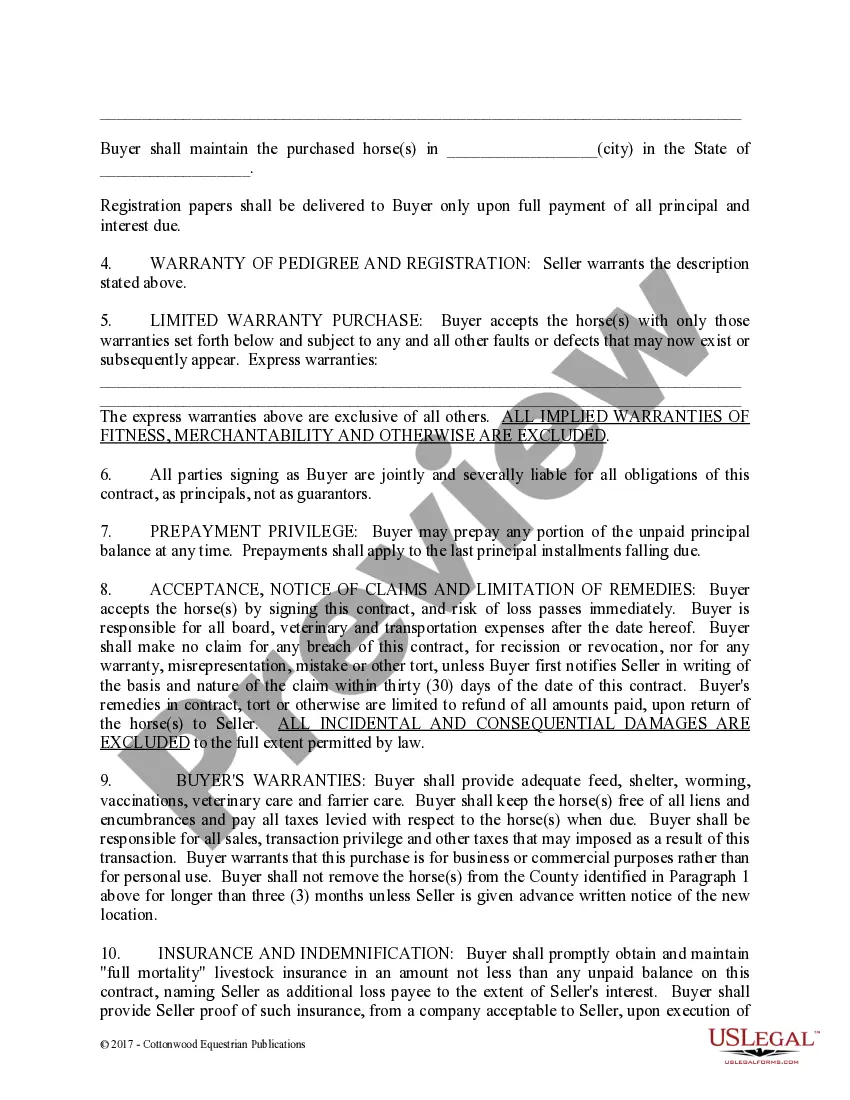

- Warranties: Outlines limited warranties regarding the horse's condition and pedigree.

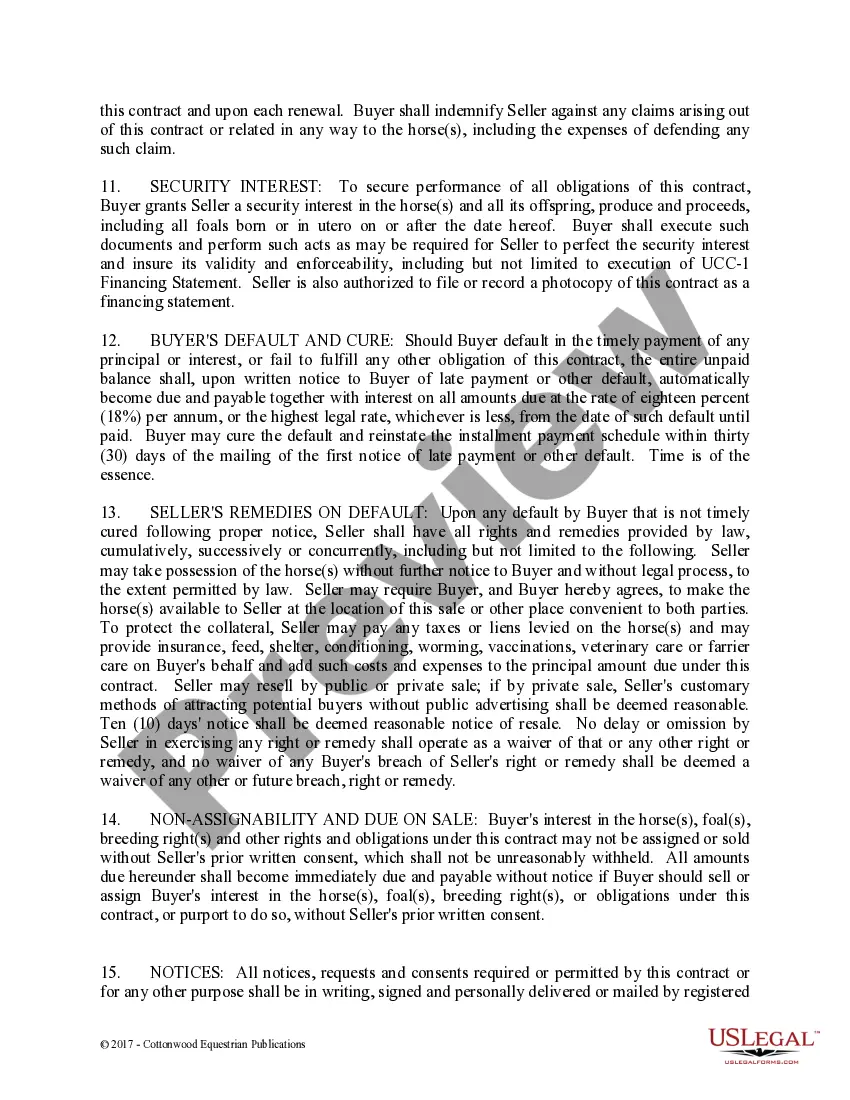

- Security interest: Grants the seller a security interest in the horse until payment is completed.

- Default provisions: Details what happens if the buyer defaults on payments.

When to use this document

This form should be used when purchasing a horse through an installment plan. It is ideal for situations where the buyer cannot pay the full purchase price upfront but wishes to secure the horse immediately. This agreement protects the seller by ensuring their financial interest in the horse while enabling the buyer to have immediate access to it.

Intended users of this form

- Buyers looking to purchase a horse but who wish to pay in installments.

- Horse sellers wanting to formalize a payment agreement while retaining a security interest in the horse.

- Individuals or businesses involved in horse breeding or sales.

- Anyone requiring legal assurance regarding warranties on the horse's condition and pedigree.

Completing this form step by step

- Identify the parties: Fill in the names and contact information for both the seller and the buyer.

- Specify the horse: Enter detailed information about the horse being purchased, including name, pedigree, and registration details.

- Enter the purchase price: Clearly outline the total amount to be paid and the payment terms.

- Describe warranties: Note any specific warranties related to the horse's pedigree or condition.

- Sign and date: All parties must review and sign the form, making sure to date it correctly.

Is notarization required?

In most cases, this form does not require notarization. However, some jurisdictions or signing circumstances might. US Legal Forms offers online notarization powered by Notarize, accessible 24/7 for a quick, remote process.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Not fully understanding the warranty section and risks involved.

- Failing to complete all contact details for the parties involved.

- Ignoring state-specific regulations that may affect the contract.

- Not keeping a copy of the signed agreement for personal records.

Why use this form online

- Convenience of instant download and printing from your home or office.

- Editability allows customization to fit specific needs and details.

- Access to legally drafted documents ensures compliance with current laws.

- Time-saving, as it eliminates the need for in-person legal consultations.

Looking for another form?

Form popularity

FAQ

What is an installment plan? Instead of paying the full price up front when you buy a new smartphone, you can choose to pay on an installment plan. An installment plan takes the full price of your new device and spreads it across low monthly payments. Plus, you won't pay any finance fees or interest.

Common examples of installment loans include mortgage loans, home equity loans and car loans. A student loan is also an example of an installment account. Except for student and personal loans, installment loans are often secured with some collateral, such as a house or car, explains credit card issuer, Discover.

An Installment Agreement in the United States is an Internal Revenue Service (IRS) program which allows individuals to pay tax debt in monthly payments. The total amount paid can be the full amount of what is owed, or it can be a partial amount.

(Entry 1 of 2) 1 : one of the parts into which a debt is divided when payment is made at intervals. 2a : one of several parts (as of a publication) presented at intervals.

Individual installment agreement A streamlined installment plan gives you 72 months (about six years) to pay. To calculate your minimum monthly payment, the IRS divides your balance by the 72-month period.

An installment plan is a way of buying products gradually. You make regular payments to the seller until, after some time, you have paid the full price.

Individuals can complete Form 9465, Installment Agreement Request. If you prefer to apply by phone, call 800-829-1040 (individual) or 800-829-4933 (business), or the phone number on your bill or notice.

Installment plans allow you to finance a purchase by paying for it over a set period of time generally anywhere from a few weeks to a year. They're basically a modern version of the layaway, with the big difference being that you get the product after your first installment.

If you already have an installment agreement and you also expect to owe taxes for the current year, you must act quickly to request a change to your existing installment agreement.You can request an amendment to the installment agreement by: Calling the IRS at 1-800-829-7650. Visiting a local IRS office.