Factoring Agreement Draft Withdrawal In Clark

Description

Form popularity

FAQ

A letter of release is a legal document provided to customers that releases the factoring company's Notice of Assignment (NOA) and assigns account receivables back to the carrier.

Invoice factoring is an agreement to assign your accounts receivable (A/R) to a factoring company. So the letter communicates that a third party (factoring company) is managing and collecting your A/R.

You need to consider the fees associated with switching before committing to the change. Once you've decided to leave your current factor, you will need to give notice. All factoring companies require written notice to terminate the contract. The expectation is usually 30 – 60 days prior to the renewal date.

Export factoring is the process where a lender or a factor buys a company's receivables at a discount. It includes services like keeping track of accounts receivable from other countries, collecting and financing export working capital, and providing credit insurance.

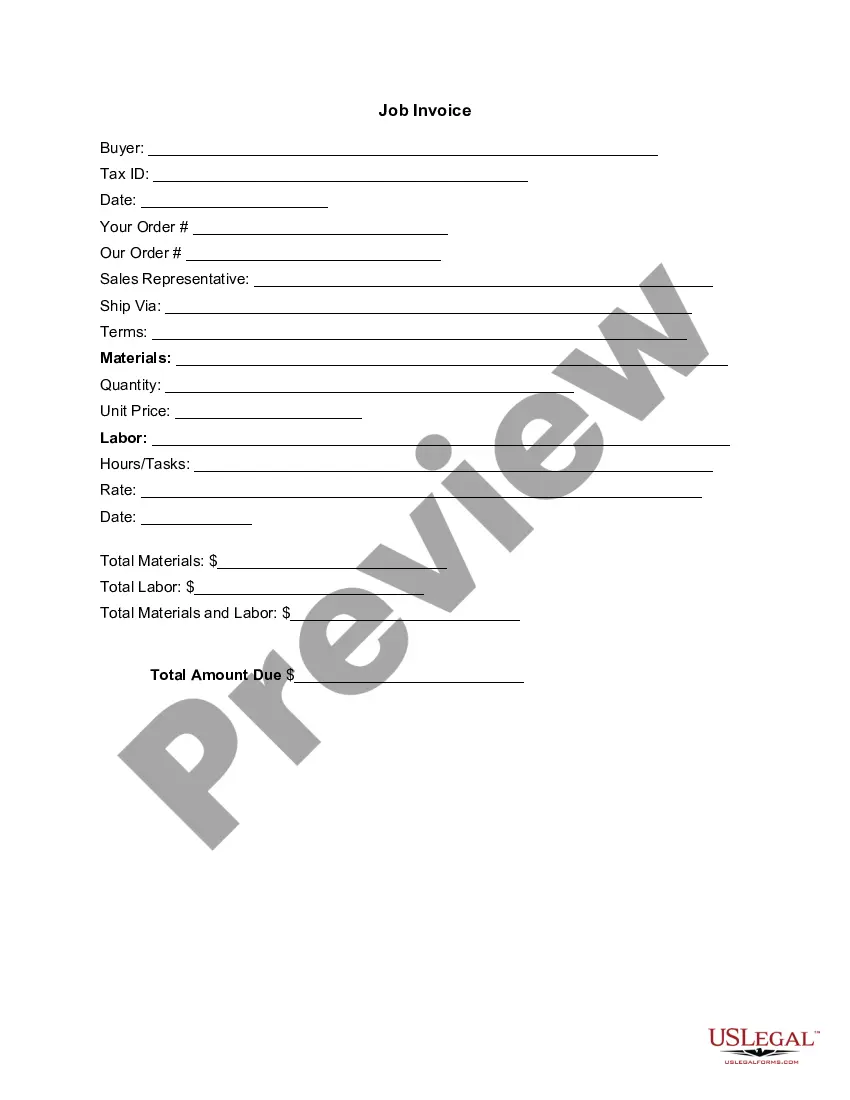

The factor will have the right to terminate the factoring agreement at any time (i.e., not just at the end of the initial or renewal term) by giving usually 30 to 60 days prior written notice to your company. In addition, the factor will have the right to terminate the factoring agreement immediately upon any default.

Factor expressions, also known as factoring, mean rewriting the expression as the product of factors. For example, 3x + 12y can be factored into a simple expression of 3 (x + 4y). In this way, the calculations become easier. The terms 3 and (x + 4y) are known as factors.

Overall, the Factoring Master Agreement provides a legal framework for the factoring relationship, ensuring that both parties understand their rights and obligations and helping to minimize the risk of disputes or misunderstandings.

It sets the general terms, while contracts focus on the specific details and scope of each individual project. Master agreements streamline the negotiation process by eliminating the need to renegotiate common terms for every contract, saving time and effort.

Often used by financial service institutions, master transaction agreements highlight specific terms such as credit limits, margin requirements and types of transaction that are to be covered. Most master transaction agreements are standardised and bilateral.