Equity Agreement Contract With Consultant In Washington

Description

Form popularity

FAQ

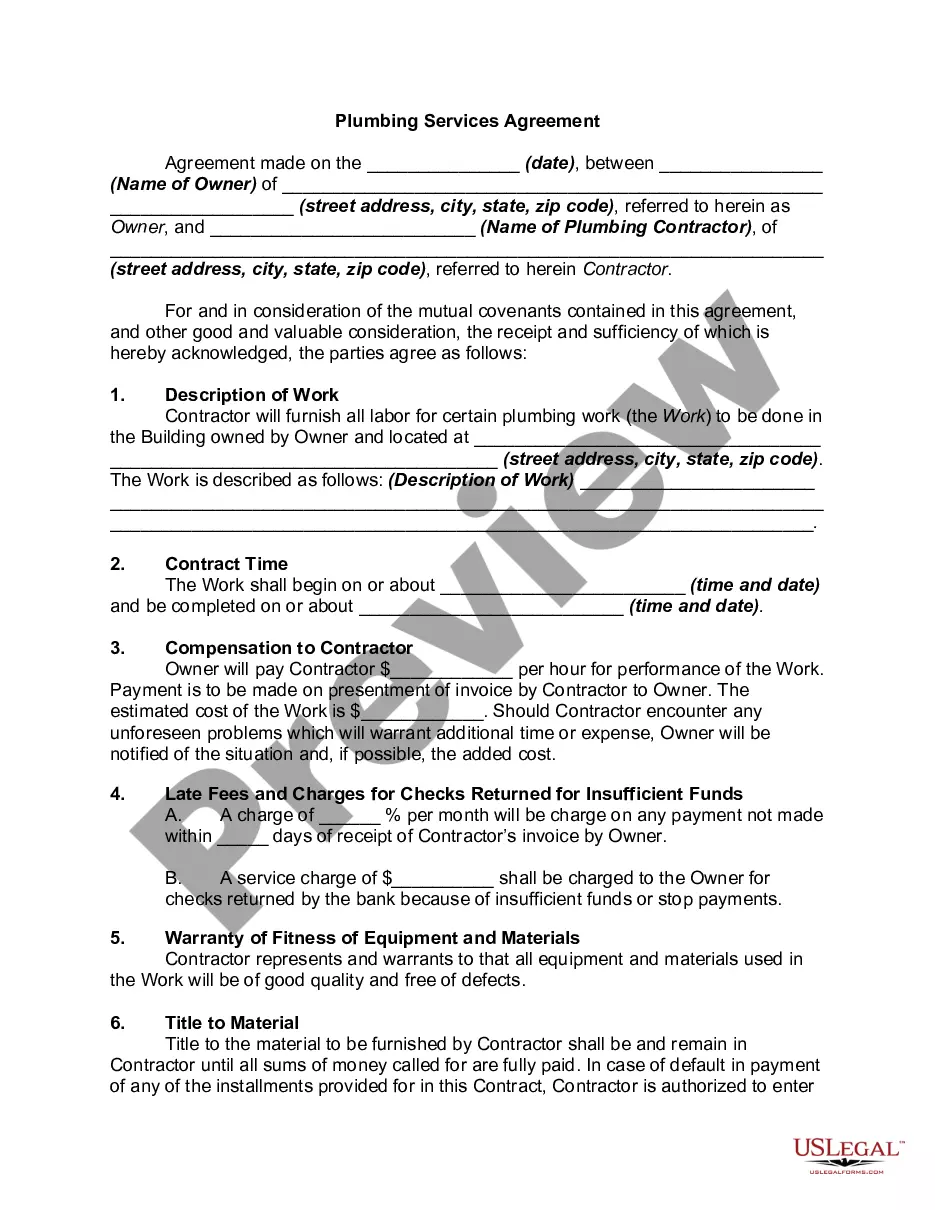

When you draft an employment contract that includes equity incentives, you need to ensure you do the following: Define the equity package. Outline the type of equity, and the number of the shares or options (if relevant). Set out the vesting conditions. Clarify rights, responsibilities, and buyout clauses.

Equity agreements commonly contain the following components: Equity program. This section outlines the details of the investment plan, including its purpose, conditions, and objectives. It also serves as a statement of intention to create a legal relationship between both parties.

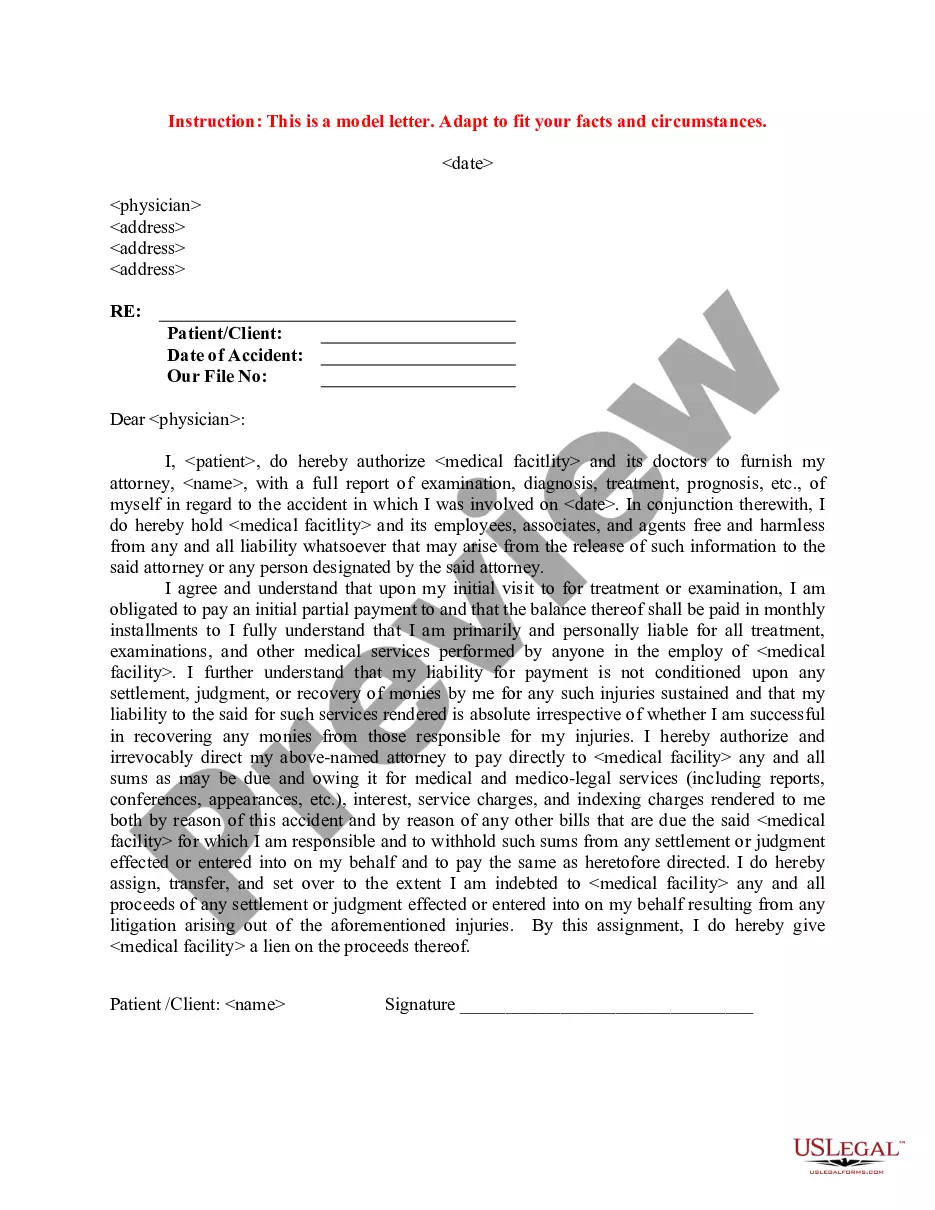

Equity agreements allow entrepreneurs to secure funding for their start-up by giving up a portion of ownership of their company to investors. In short, these arrangements typically involve investors providing capital in exchange for shares of stock which they will hold and potentially sell in the future for a profit.

Draft the equity agreement, detailing the company's capital structure, the number of shares to be offered, the rights of the shareholders, and other details. Consult legal and financial advisors to ensure that the equity agreement is in line with all applicable laws and regulations.

Many consultants choose to join an Operations Team at the Private equity level because it allows them to leverage their consulting toolkit to assess and drive operational improvement opportunities within a firm's portfolio.

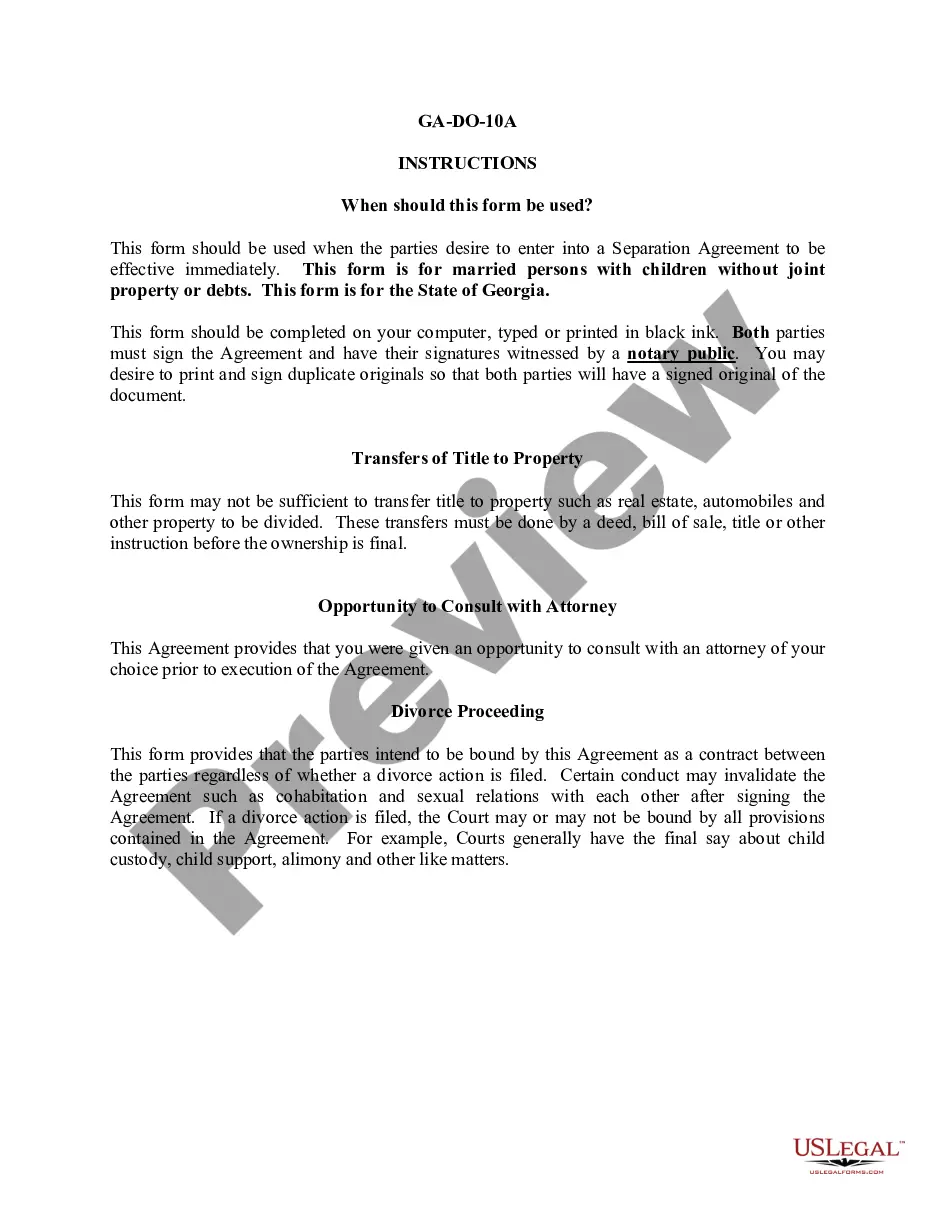

A good benchmark to consider is that your advisors should be receiving between 0.1% to 0.25% of the company because more often than not, advisors will only devote a small portion of their time to your company and may have conflicting commitments.

The short answer is yes. However, you have to ensure that your offering is compliant with all the relevant regulations in both your and your contractor's country. In some regions, for instance, your contractor may be eligible to receive non-qualifying stock options, but your contractors in other countries may not.

In summary, 1% equity can be a good offer if the startup has strong potential, your role is significant, and the overall compensation package is competitive. However, it could also be seen as low depending on the context. It's essential to assess all these factors before making a decision.

Non-qualified stock options (NSOs) can be granted to employees at all levels of a company, as well as to board members and consultants. Also known as non-statutory stock options, profits on these are considered to be ordinary income and are taxed as such.