Equity Agreement Statement For Property In Pima

Description

Form popularity

FAQ

The average tax rate on a home in PIMA County will be approximately 1% of market value. Or 10% of “Assessed Value”. Tucson home Assessed Value will be about 10% of the market value.

To ensure our records are accurate, please update your mailing address if you've recently moved or notice any errors. You can do this in person at our Customer Service desk located at 240 N. Stone, or by using our electronic Change of Address form.

The Senior Valuation Protection program enables qualified seniors to have their Limited Value frozen, which is the basis for all property taxes, frozen in 3 year increments to protect against the potential of an increasing real estate market.

Pima County sales tax details The minimum combined 2025 sales tax rate for Pima County, Arizona is 11.1%. This is the total of state, county, and city sales tax rates. The Arizona sales tax rate is currently 5.6%. The Pima County sales tax rate is 0.5%.

Property taxes typically are based on a property's assessed value rather than its current fair market value. In most states, tax assessments are conducted every one to five years and are not changed when a property is sold or transferred as a gift.

Qualifications. Age: At least one property owner must be the minimum qualifying age of 65 at the time of application. Residence: The property must be the owner(s) primary residence. A "primary" residence is that residence which is occupied by the property owner(s) for an aggregate of nine months of the calendar year.

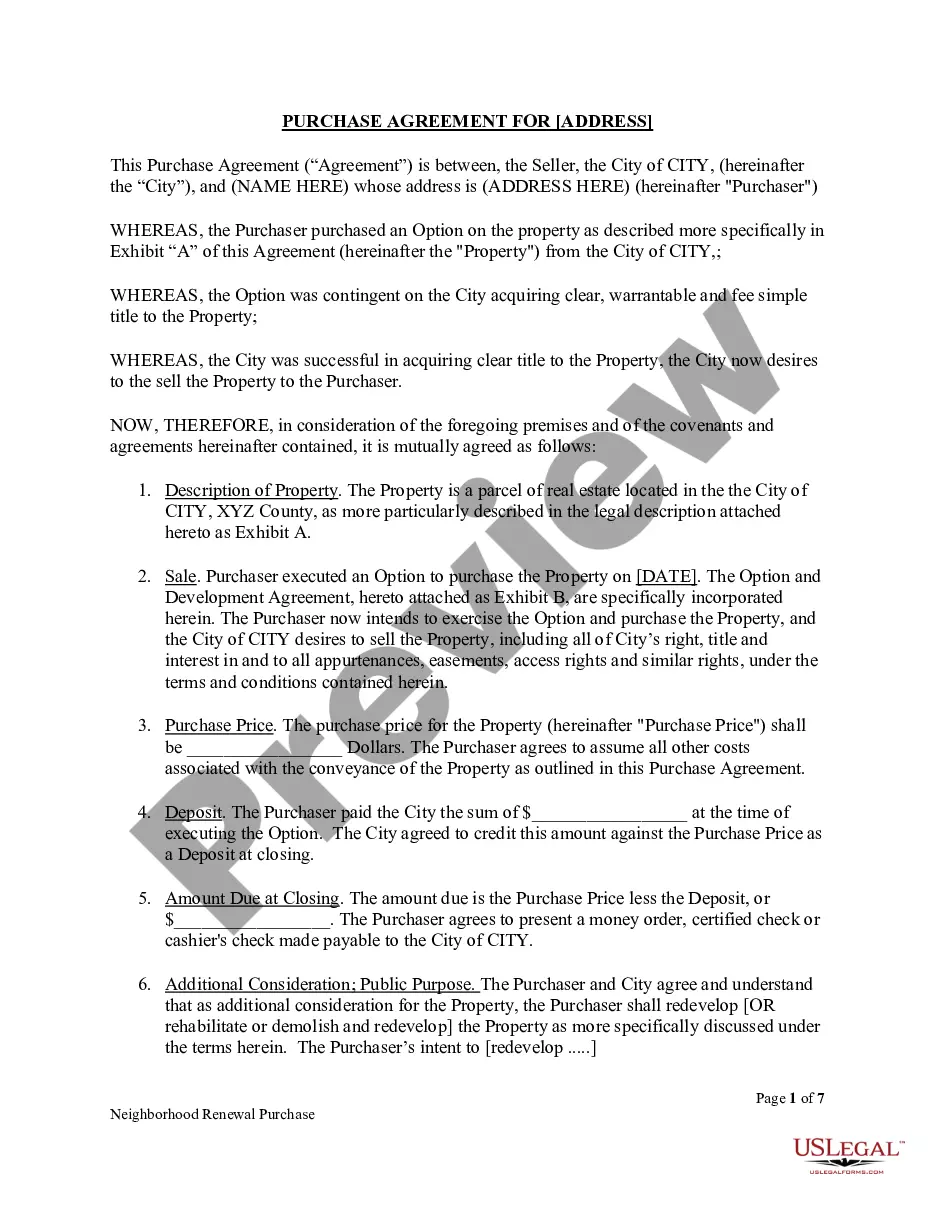

Let's say your home has an appraised value of $250,000, and you enter into a contract with one of the home equity agreement companies on the market. They agree to provide a lump sum of $25,000 in exchange for 10% of your home's appreciation. If you sell the house for $250,000, the HEA company is entitled to $25,000.

Equity agreements allow entrepreneurs to secure funding for their start-up by giving up a portion of ownership of their company to investors. In short, these arrangements typically involve investors providing capital in exchange for shares of stock which they will hold and potentially sell in the future for a profit.

Equity agreements commonly contain the following components: Equity program. This section outlines the details of the investment plan, including its purpose, conditions, and objectives. It also serves as a statement of intention to create a legal relationship between both parties.