Financed House Lend Formation In Orange

Description

Form popularity

FAQ

Traditional banks and credit unions are common sources of mortgage loans. These institutions often use deposits from their customers to fund mortgages.

Applications for California's down payment assistance program for first-time homebuyers are now open.

How much is Orange Retail Finance worth? The latest valuation of Orange Retail Finance is ₹361Cr as on . What is the annual revenue of Orange Retail Finance? Annual revenue of Orange Retail Finance is ₹75.9Cr as on .

Interest Rates: In-house financing may have higher interest rates compared to traditional loans. This is because the seller or dealership is taking on more risk by providing financing directly to the buyer. Traditional loans are typically offered at lower interest rates, as they are backed by financial institutions.

Compared to traditional car loans, in-house loans are much easier to qualify for. The dealership sets its own eligibility requirements instead of following those of a bank or finance company. An in-house financing dealership might not run your credit at all.

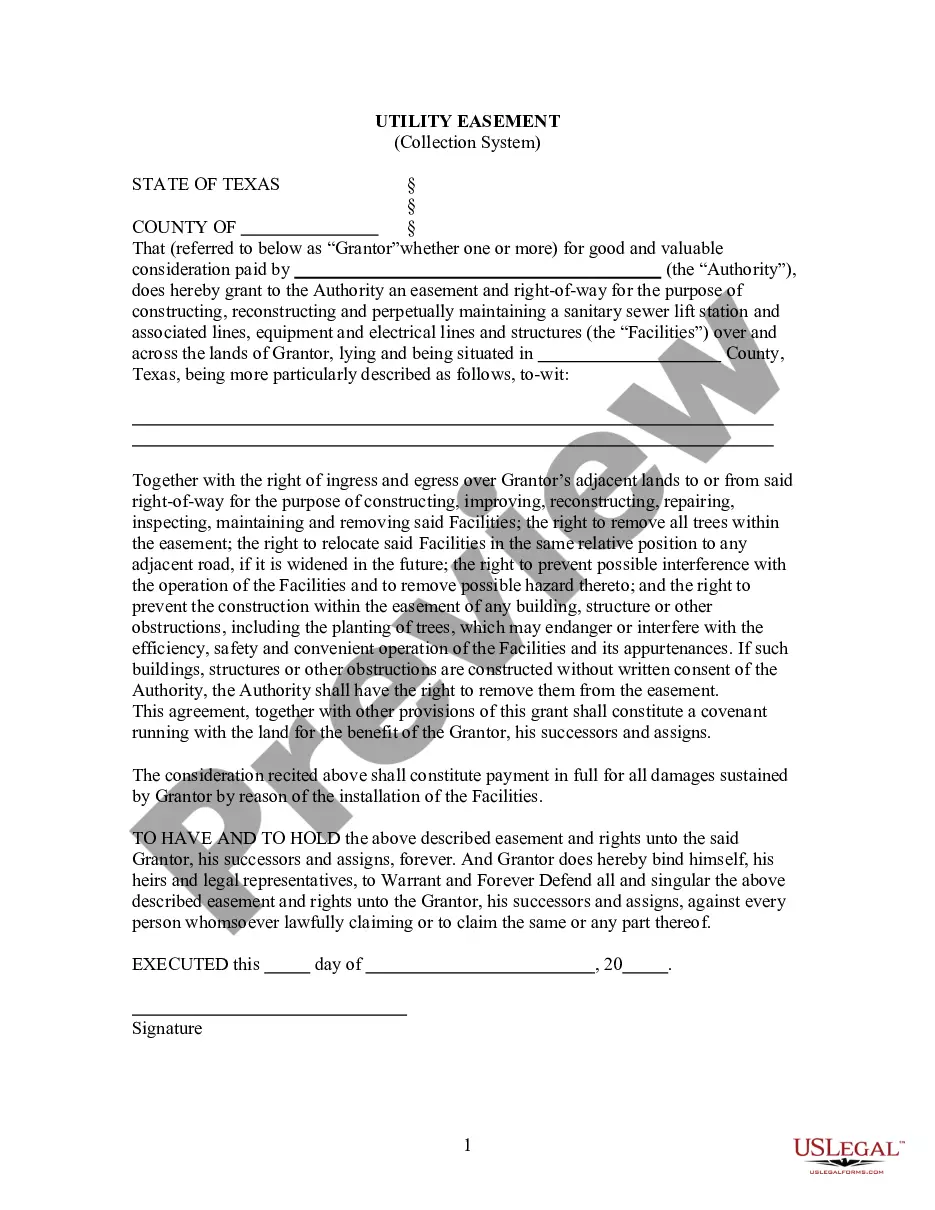

Owner financing is a method where the seller acts as the lender, allowing the buyer to make payments over time directly to them rather than going through traditional mortgage lenders. This arrangement often benefits both parties by simplifying the homeownership process and potentially speeding up sales.

Unlike improved property loans, land loans lack the security of a built structure, making them riskier investments. The following results from this: Lenders typically require higher down payments, often 20% to 50% of the land's value. Interest rates are usually higher than traditional mortgages.

Owner financed land offers a unique and often advantageous alternative to traditional financing methods. With benefits such as quick approval processes, favorable terms, and reduced paperwork, it can be an appealing option for many buyers.