Business Equity Agreement With Start In Oakland

Description

Form popularity

FAQ

Unincorporated Bay County does not require a business license; however, they do suggest that you register your business name with .sunbiz.

California doesn't necessarily require all businesses (of any structure) to obtain a license. While the state doesn't issue or require a business operating license, it regulates and requires licenses or permits for some business activities.

Oakland sales tax details The minimum combined 2025 sales tax rate for Oakland, California is 10.25%. This is the total of state, county, and city sales tax rates. The California sales tax rate is currently 6.0%.

Equity agreements are a cornerstone for startups, providing a solid foundation for their business endeavors while ensuring fairness and clarity in equity distribution. Understanding the legal aspects and best practices of equity agreements is crucial for the long-term success and stability of startups.

Can I write my own contract? Yes, you can write your own contract. However, including all necessary elements is crucial to make it legally binding.

Here are some key elements to include: Parties Involved. Clearly identify the two companies entering into the agreement. Scope Work. Define the specific scope of work or services to be provided by each party. Terms Conditions. Confidentiality Non-Disclosure. Dispute Resolution.

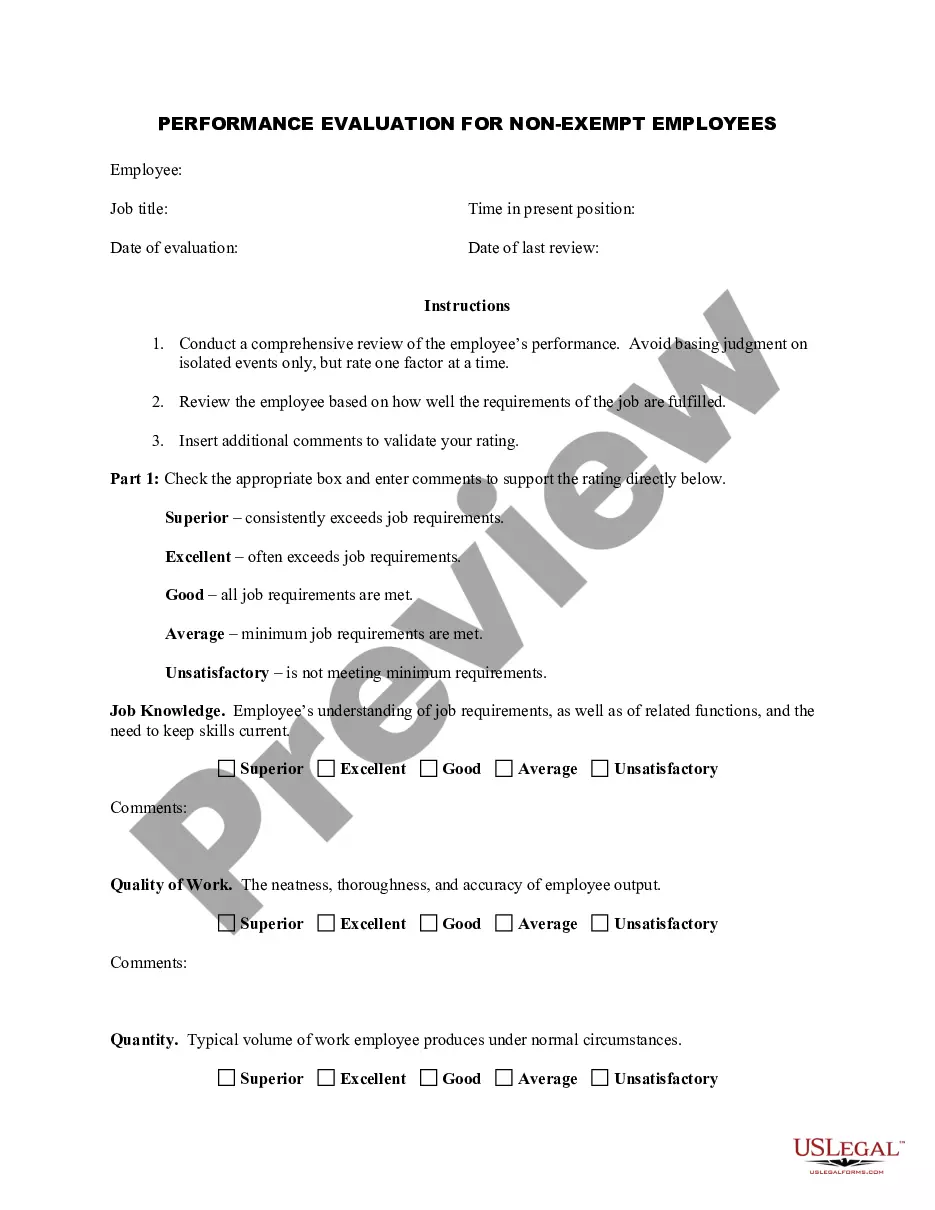

When you draft an employment contract that includes equity incentives, you need to ensure you do the following: Define the equity package. Outline the type of equity, and the number of the shares or options (if relevant). Set out the vesting conditions. Clarify rights, responsibilities, and buyout clauses.

Draft the equity agreement, detailing the company's capital structure, the number of shares to be offered, the rights of the shareholders, and other details. Consult legal and financial advisors to ensure that the equity agreement is in line with all applicable laws and regulations.

An equity agreement is like a partnership agreement between at least two people to run a venture jointly. An equity agreement binds each partner to each other and makes them personally liable for business debts.