Shareholder Consent Form For Existing Company In Massachusetts

Description

Form popularity

FAQ

Corporations must complete a Form 966, Corporate Dissolution or Liquidation, and file it with the final corporate return. Partnerships must file the final Form 1065 and Schedule K-1s. Sole proprietors stop filing the Schedule C with the individual income tax return.

The minimum tax is $456. Taxable Period: The taxable period for corporations is either the calendar year or the corporation's fiscal year. Estimated payments are made every three months during the taxable year.

Section 156D:8.40 - Required officers (a) A corporation shall have a president, a treasurer and a secretary and such other officers described in its bylaws or appointed by the board of directors in ance with the bylaws.

Follow these five steps to start a Massachusetts LLC and elect Massachusetts S corp designation: Name Your Business. Choose a Resident Agent. File the Massachusetts Certificate of Organization. Create an Operating Agreement. File Form 2553 to Elect Massachusetts S Corp Tax Designation.

Can I set up an S corp myself? While it's possible to file articles of incorporation and go through the S corporation election process on your own, S corp requirements are strict and complex. It's recommended you consult an attorney or tax professional.

(a) A corporation shall have a president, a treasurer and a secretary and such other officers described in its bylaws or appointed by the board of directors in ance with the bylaws.

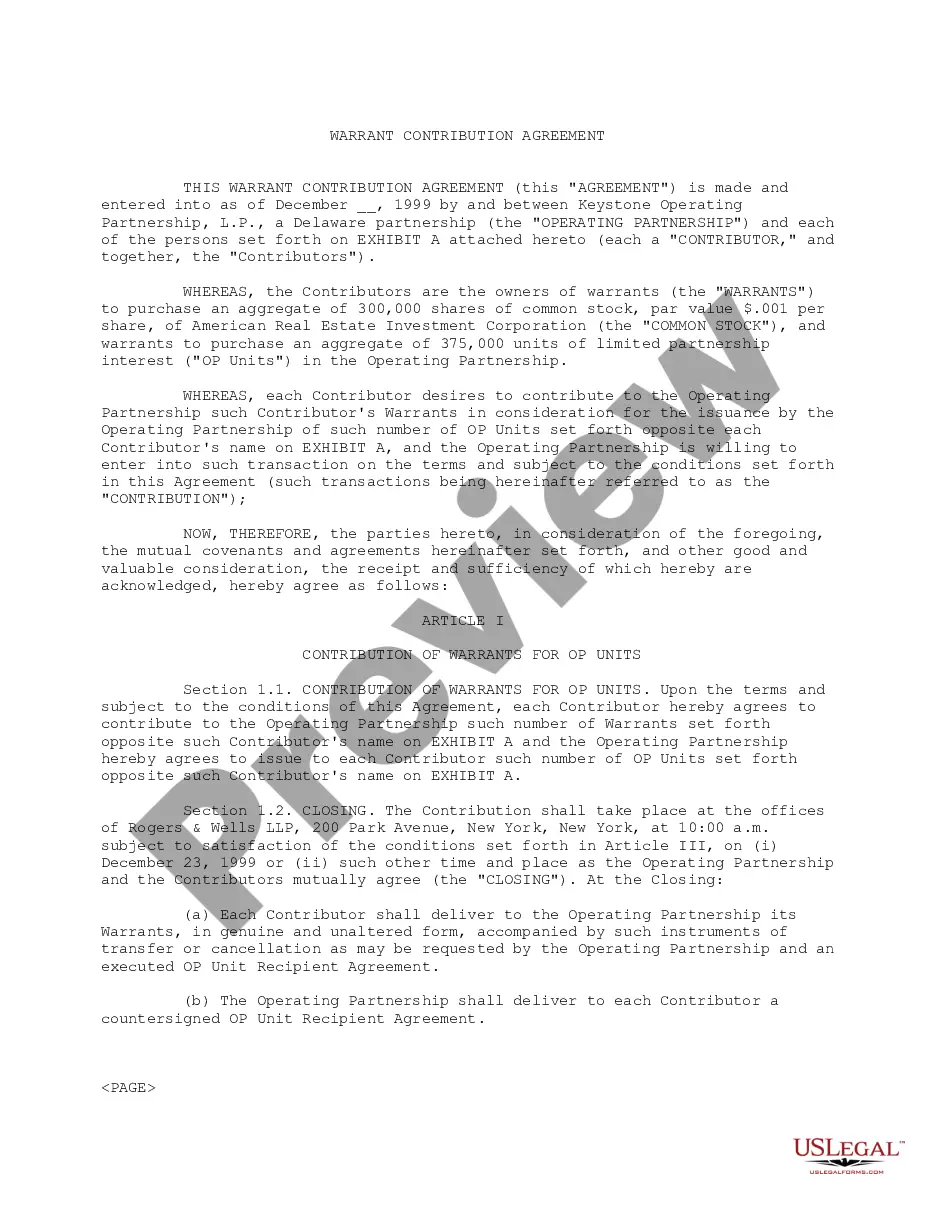

A Shareholders' Consent to Action Without Meeting, or a consent resolution, is a written statement that describes and validates a course of action taken by the shareholders of a particular corporation without a meeting having to take place between directors and/or shareholders.

Usually, the bylaws will provide for several corporate officers. The most common are the president, vice president, secretary and treasurer. The president usually makes decisions of corporate policy and operations. The vice president assumes the president's functions in his or her absence.

Every corporation authorized to transact business in the commonwealth MUST file an annual report with the Corporations Division within two and one half (2½) months after the close of the corporation's fiscal year end. M.G.L.A. c156D § 16.22; 950 CMR 113.57.